Research

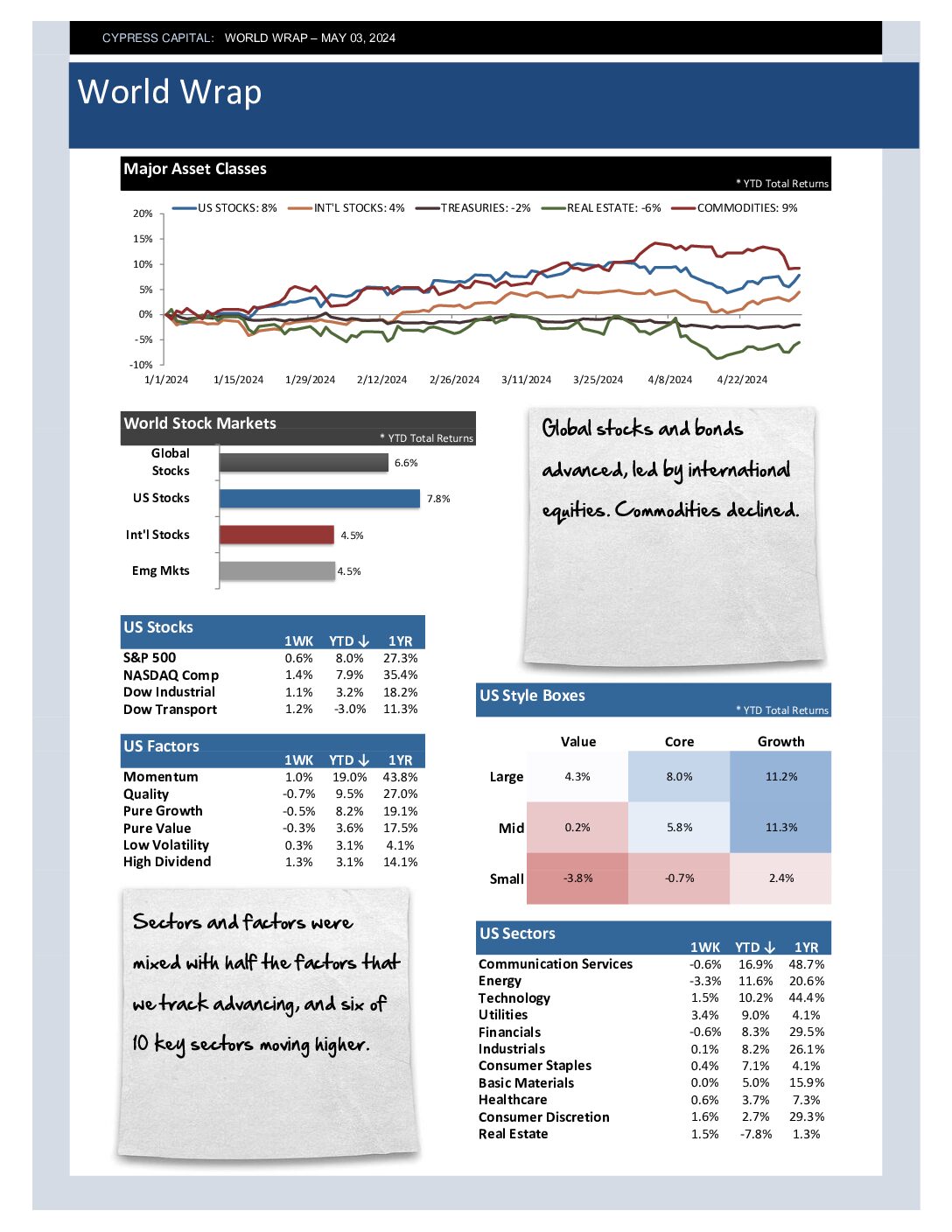

World Wrap

– Global stocks and bonds advanced, led by international equities. Commodities declined.

– Sectors and factors were mixed with half the factors that we track advancing, and six of 10 key sectors moving higher.

– Emerging Markets outperformed on the back of another robust weekly performance from Asian stocks.

– All broad commodity sectors slid with Energy prices faring worst. Crude oil futures fell nearly seven percent.

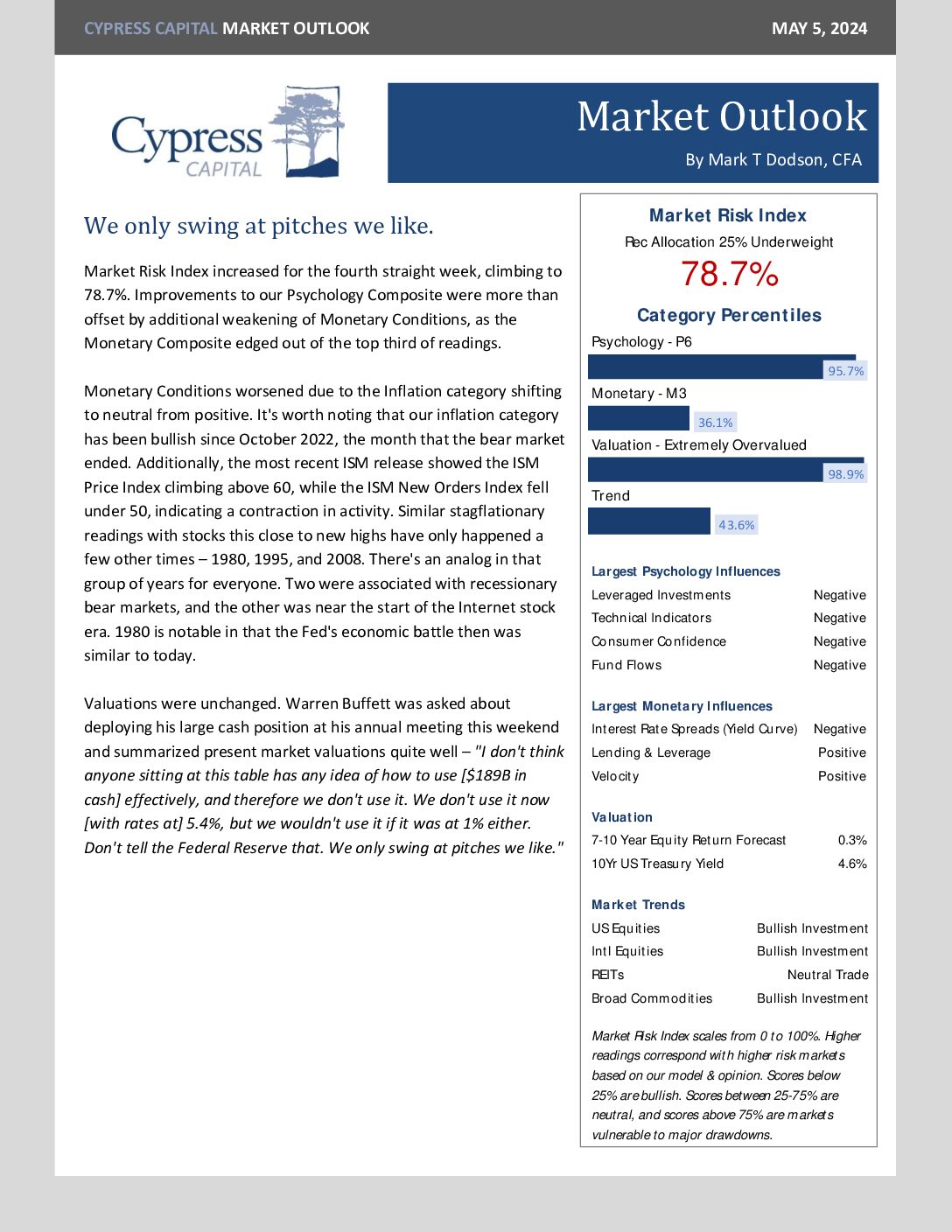

Market Outlook – We only swing at pitches we like.

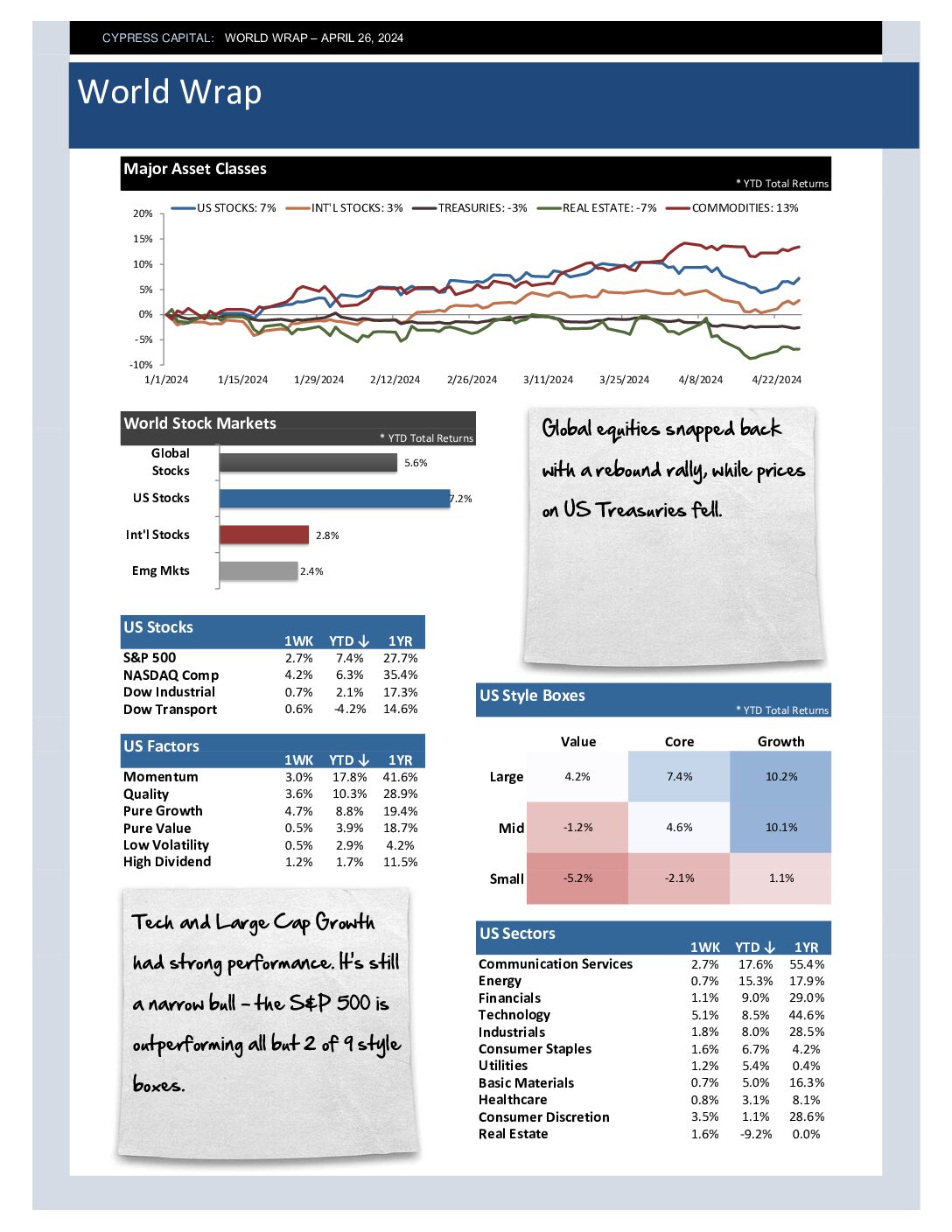

World Wrap

– Global equities snapped back with a rebound rally, while prices on US Treasuries fell.

– Tech and Large Cap Growth had strong performance. It’s still a narrow bull – the S&P 500 is outperforming all but 2 of 9 style boxes.

– Impressive move out of Asia – China and Hong Kong were up 8.2 and 9.5% for the week.

– Yields on the US 10Yr Treasury climbed as high as 4.7%, levels not seen since last November.

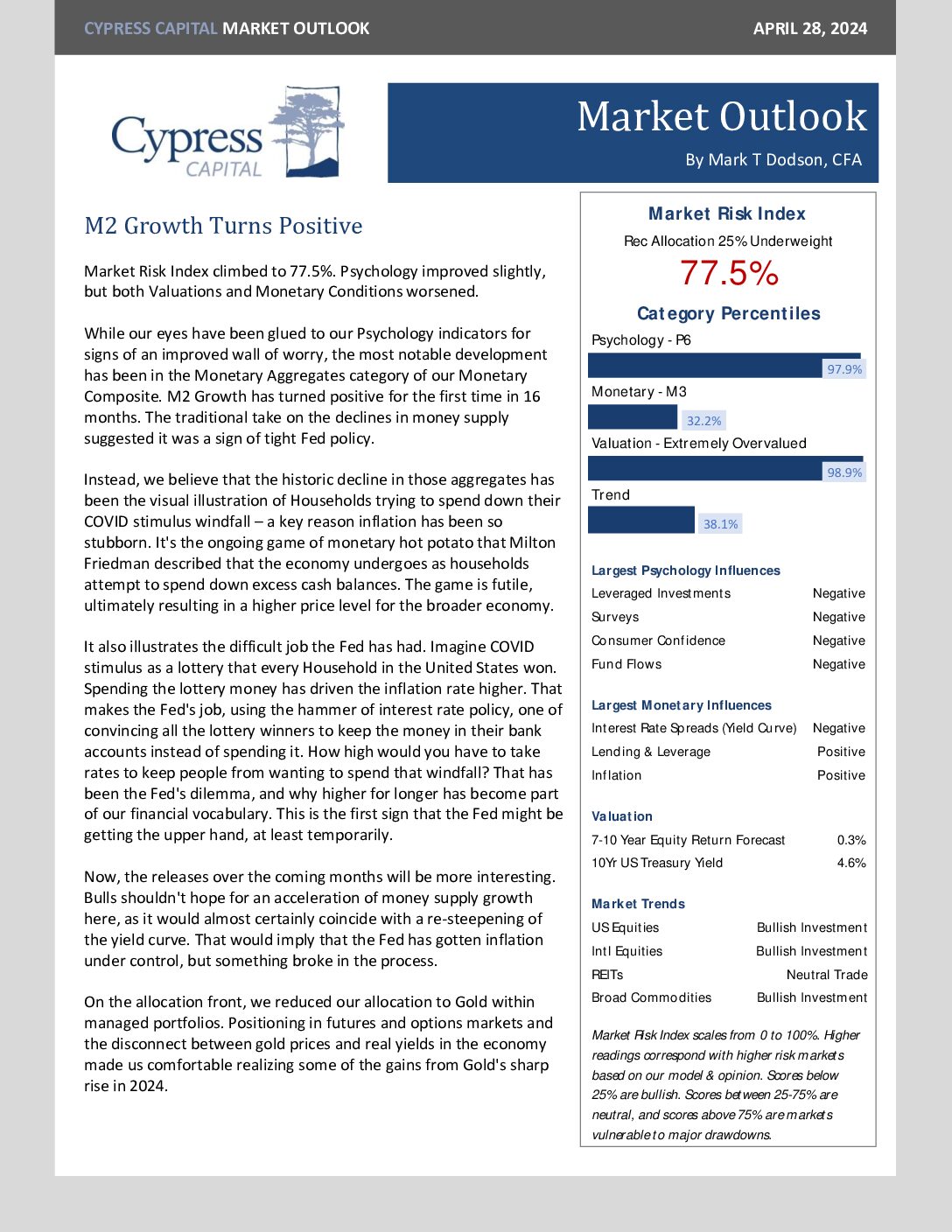

Market Outlook – M2 Growth Turns Positive

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 95.7%

- Monetary 36.1%

- Valuation 98.9%

- Trend 43.6%