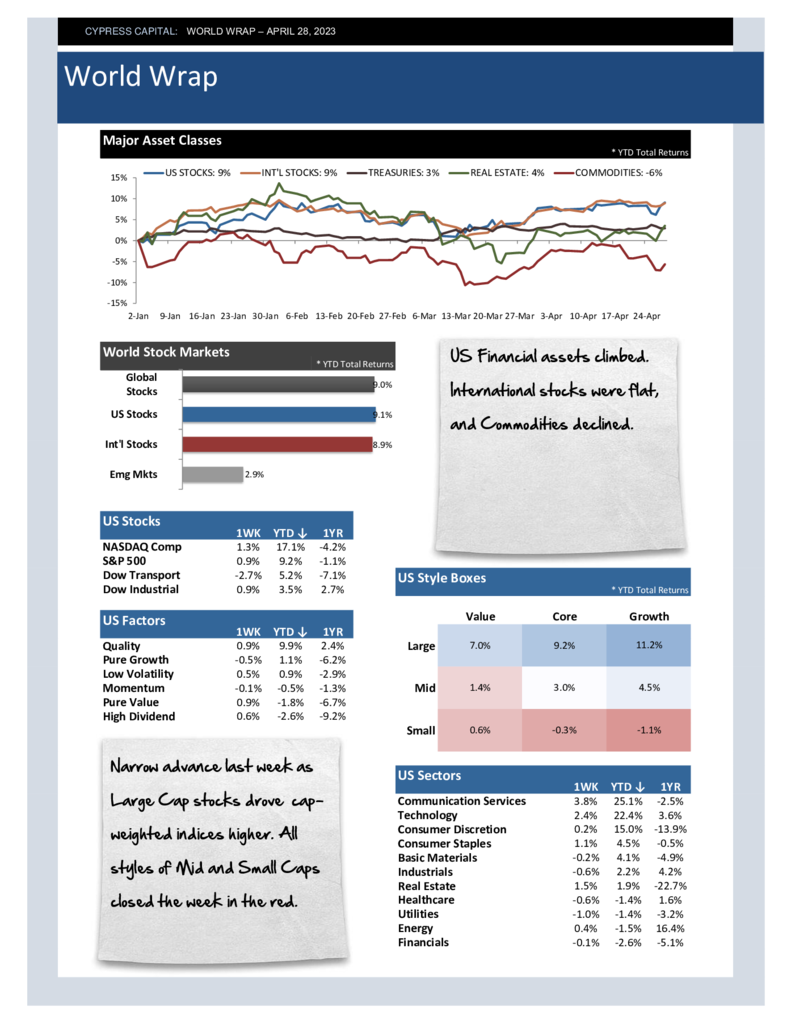

– US Financial assets climbed. International stocks were flat, and Commodities declined.

– Narrow advance last week as Large Cap stocks drove cap-weighted indices higher. All styles of Mid and Small Caps closed the week in the red.

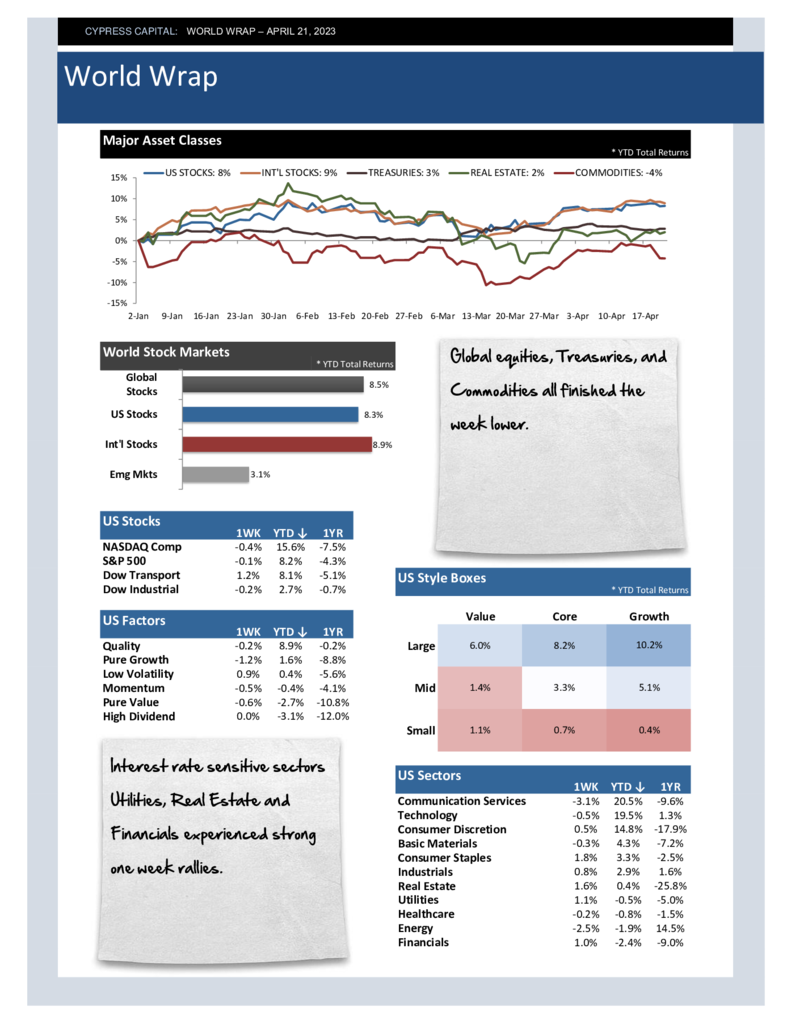

– European stocks, both developed and emergin, are dominating global equity markets thus far in 2023, closing higher again last week.

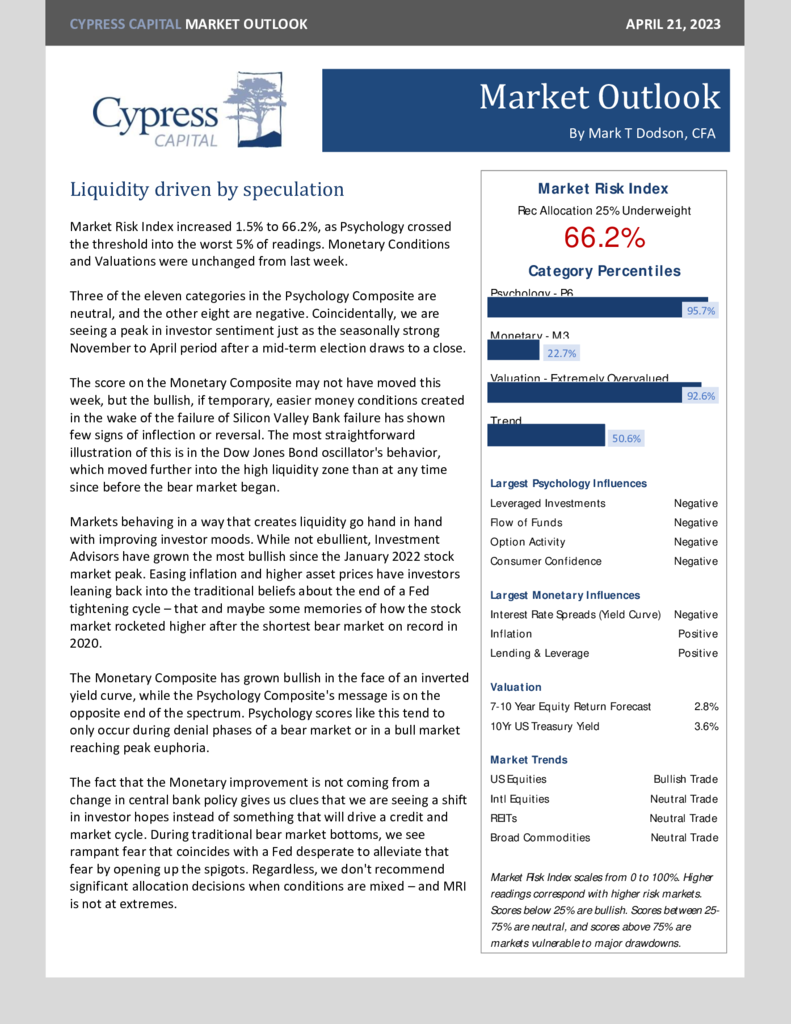

– Long duration Treasuries rallied, and the yield curve inversion hit new lows. 2023’s inversion is close to taking the title for the 2nd largest inversion in over 100 years.