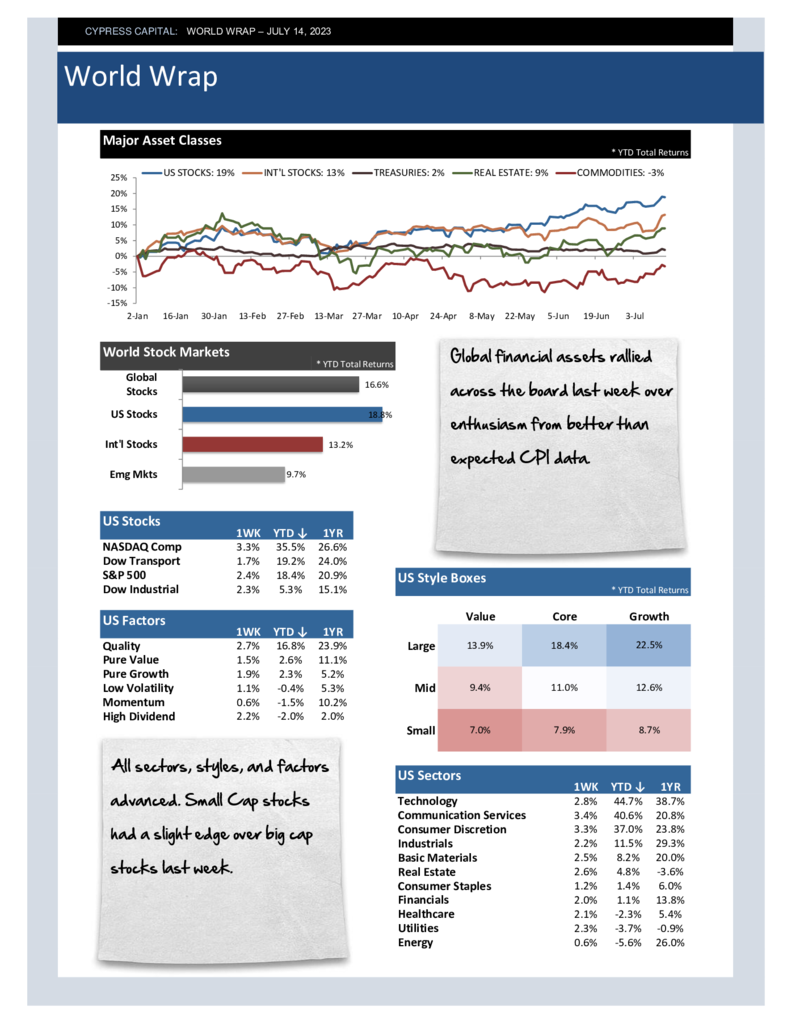

– Global financial assets rallied across the board last week over enthusiasm from better than expected CPI data.

– All sectors, styles, and factors advanced. Small Cap stocks had a slight edge over big cap stocks last week.

– International equities outperformed with 42 of 44 countries moving higher.

– The US Dollar fell sharply setting a new 52 week low, and commodity prices climbed.