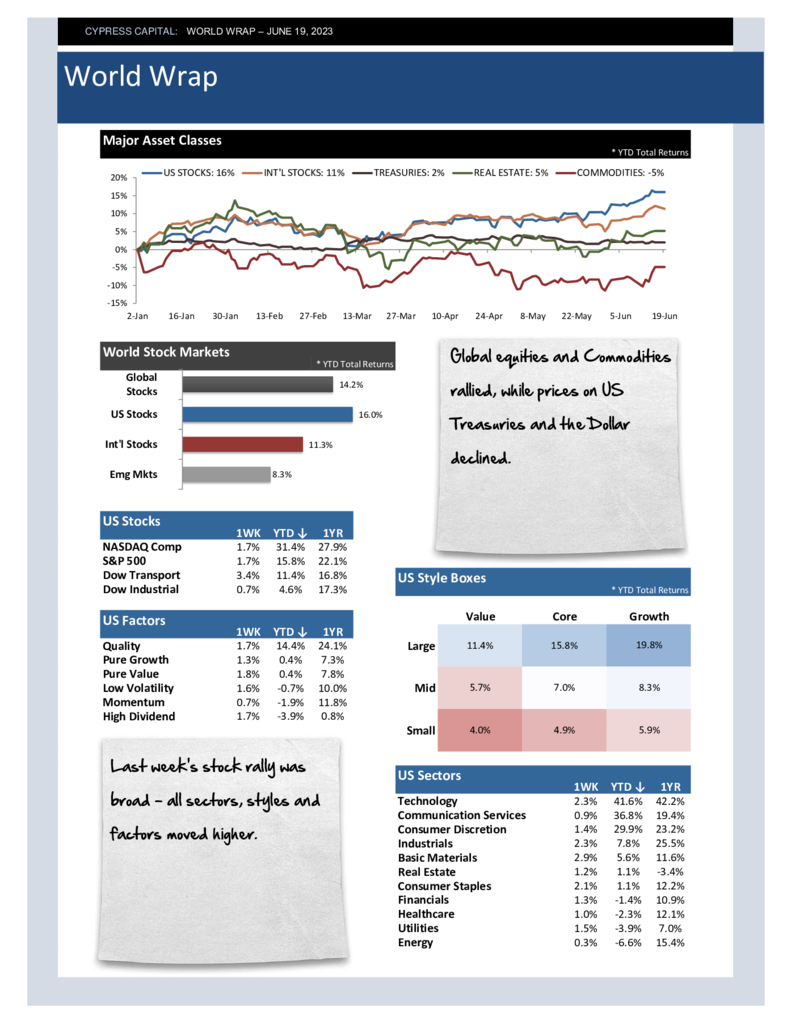

– Global equities and Commodities rallied, while prices on US Treasuries and the Dollar declined.

– Last week’s stock rally was broad – all sectors, styles and factors moved higher.

– China’s re-opening narrative has been a dud, but their stock market managed to cross into positive return territory for 2023 after a one week increase of 3.6%.

– Crude oil futures advanced by 7% in a week where all key commodities climbed.