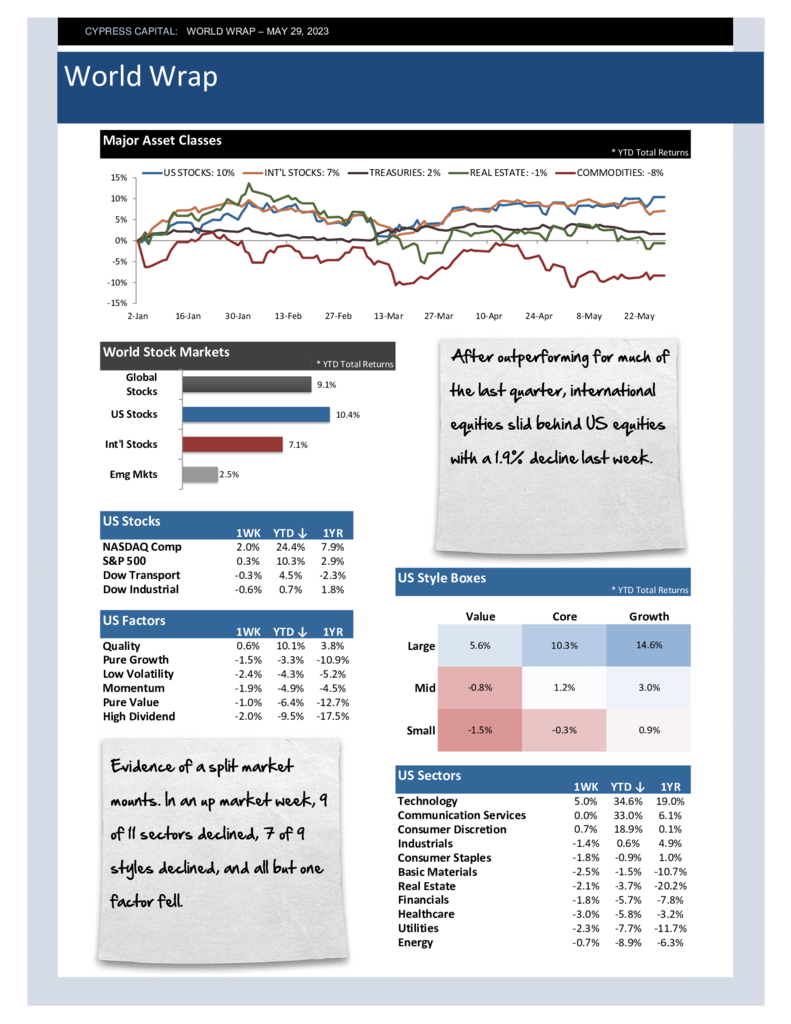

– Global financial assets rallied across the board last week. Commodities were flat on a drop in oil prices.

– All sectors, styles and factors advanced. The most beaten up areas snapped back sharply.

– European stocks underperformed for the second week in a row, hindering relative gains on international indices.

– Treasury Bill yields climbed above 5.5%, the highest level since January 2001. Fed Funds are pricing in a 25bp increase for June.