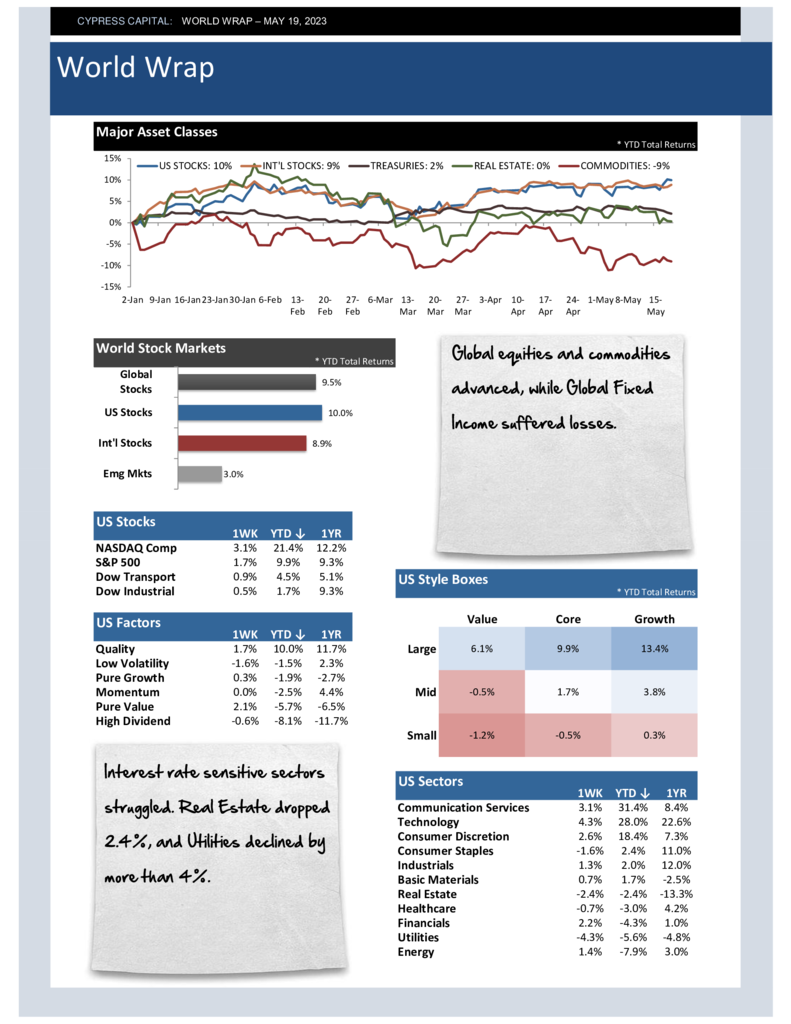

– Global equities and commodities advanced, while Global Fixed Income suffered losses.

– Interest rate sensitive sectors struggled. Real Estate dropped 2.4%, and Utilities declined by more than 4%.

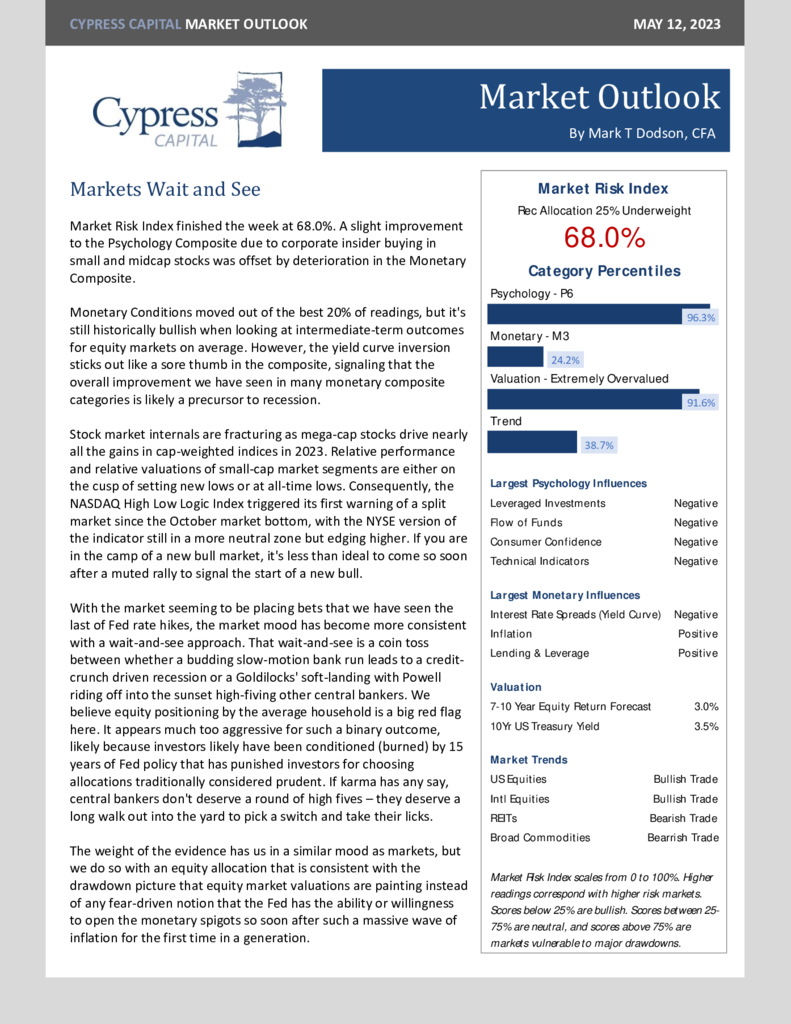

– Fed’s Bullard sees two more rate hikes needed in 2023, while Fed’s Kashkari says a rate hike in June is a close call.

– Yields on the 30Yr Treasury approached 4%, the highest level since March.