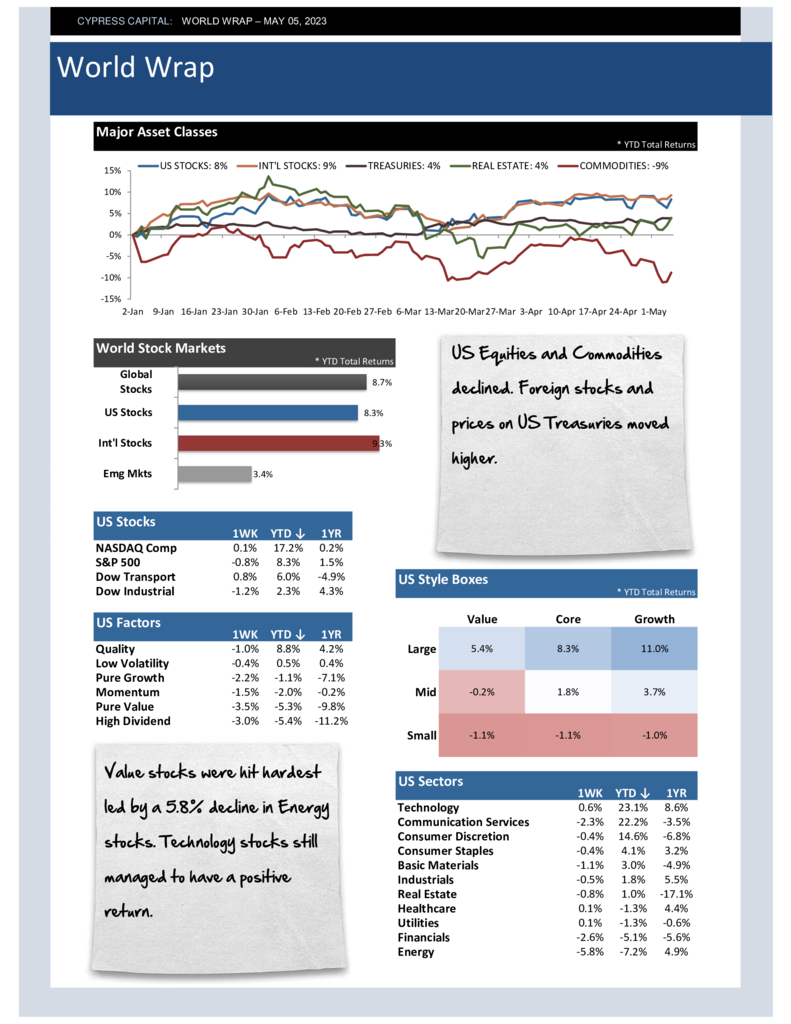

– US Equities and Commodities declined. Foreign stocks and prices on US Treasuries moved higher.

– Value stocks were hit hardest led by a 5.8% decline in Energy stocks. Technology stocks still managed to have a positive return.

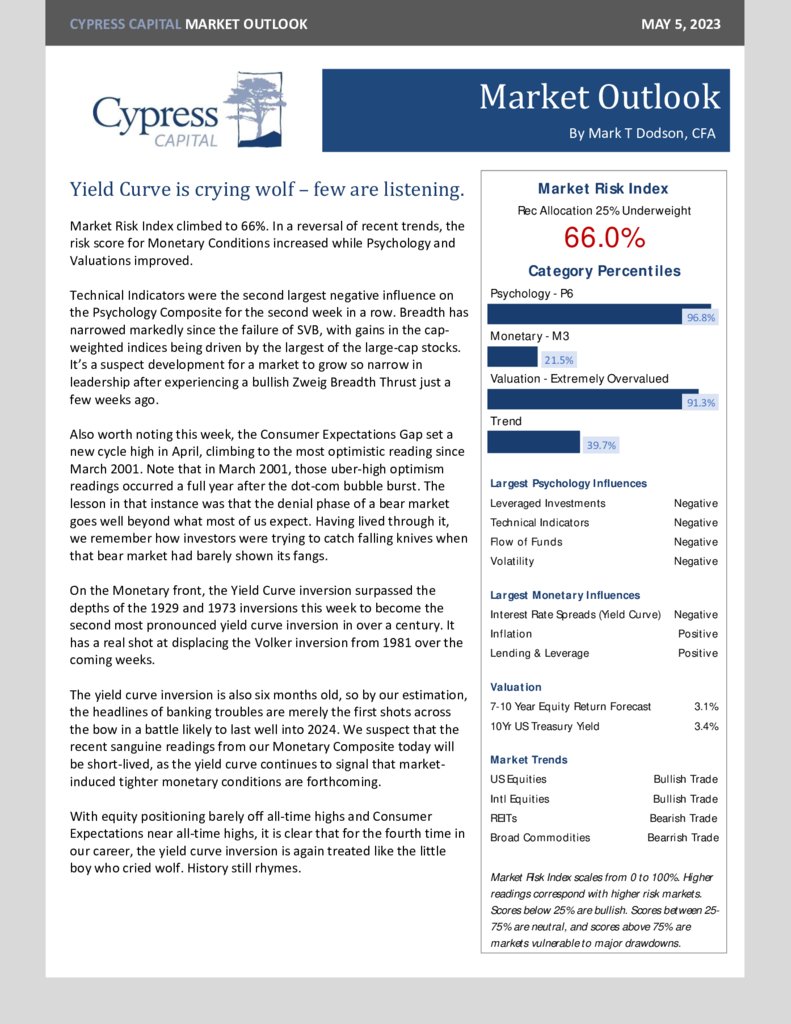

– The Fed increased rates by 0.25 percent last week, it’s the 10th increase in the rate by the Fed in a little over a year.

– Yield Curve inversion worsened, becoming the second most severe inversion in over a century.