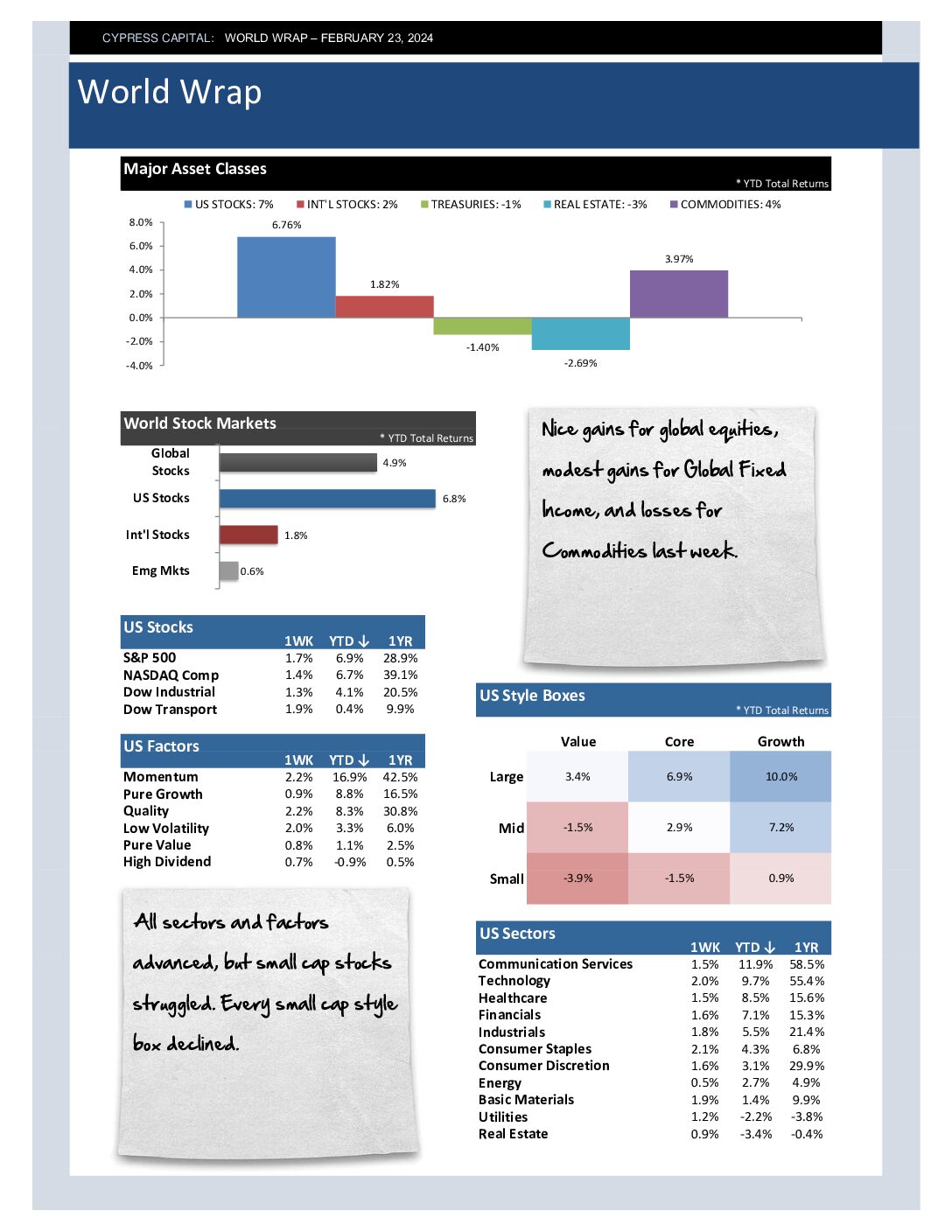

– All major asset classes saw higher prices, but commodities were the biggest winner.

– Classic risk-on week when it came to sectors – with Healthcare, Staples, and Utlities declining while all other sectors advanced.

– Developed markets kept international equity indices in the green, as more than 60% of countries declined during the week.

– A barrel of Crude Oil crossed back above $80 for the first time since November. Oil prices are up more than 12% ytd.