– Global equities declined, and Treasuries were flat for the week.

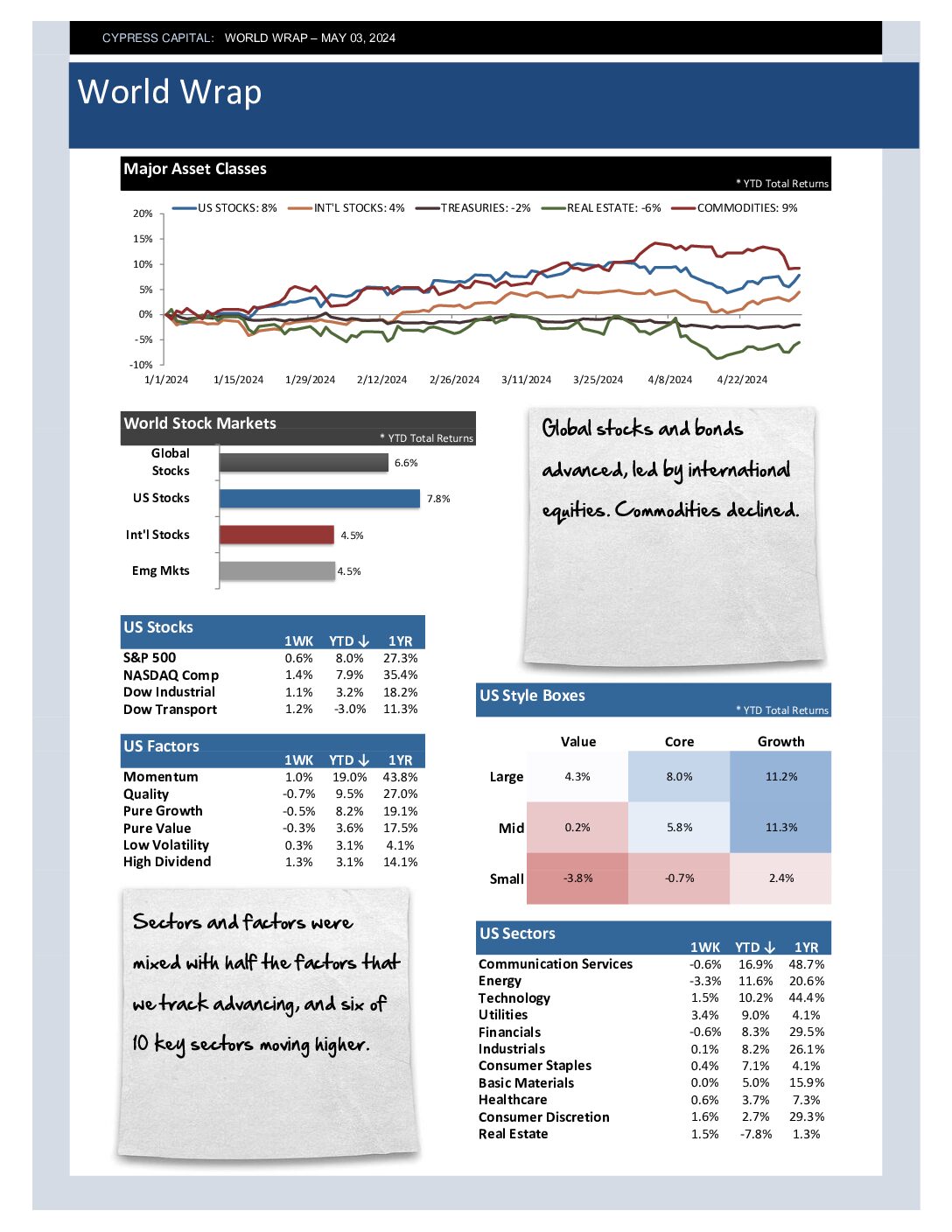

– While cap-weighted US Equities declined on Large Cap Growth weakness, 6 of 9 style boxes and 6 of 11 sectors advanced.

– Emerging markets were off more than 3% for the worst one week slide since April.

– Broad declines in commodities across every major commodity sector last week.