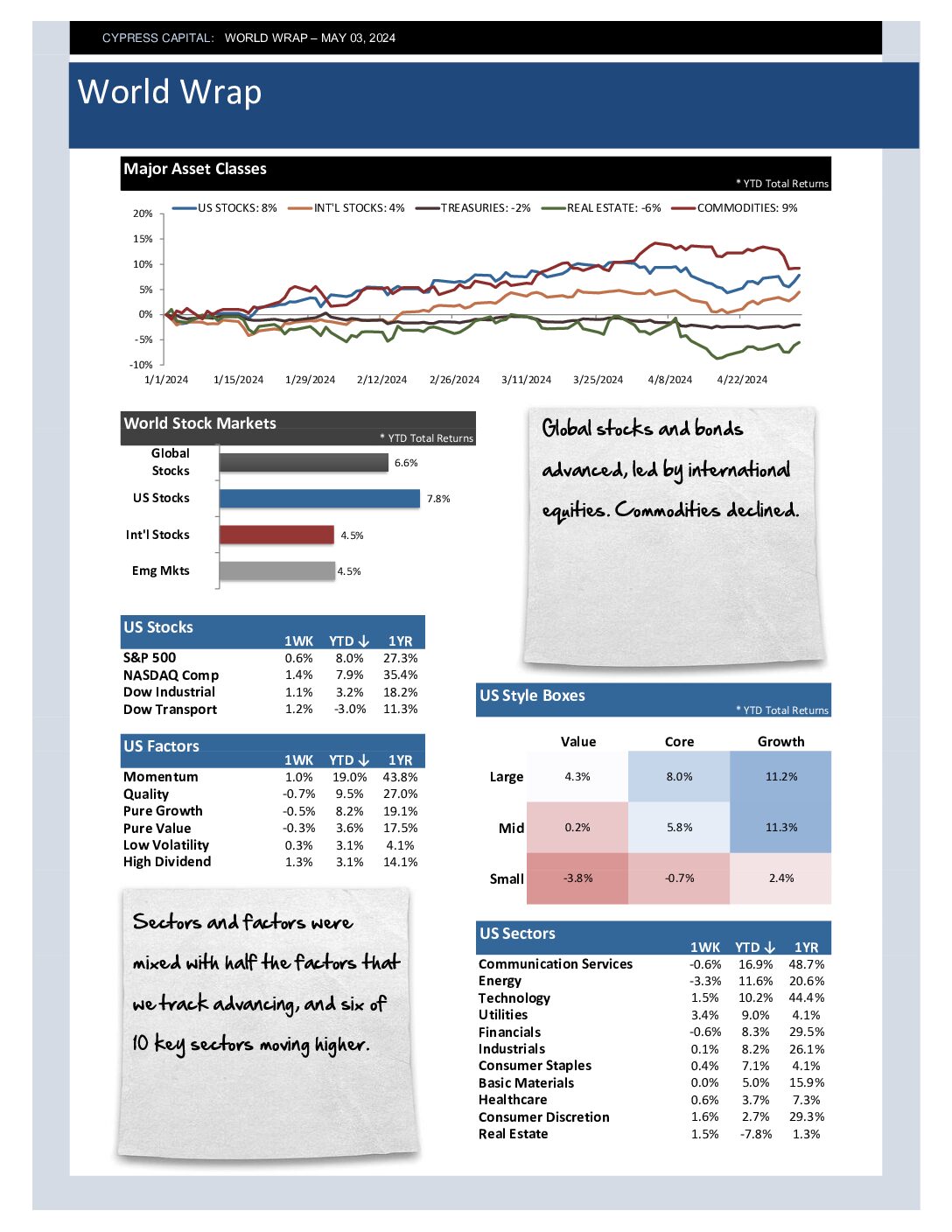

– Global stocks and bonds advanced, led by international equities. Commodities declined.

– Sectors and factors were mixed with half the factors that we track advancing, and six of 10 key sectors moving higher.

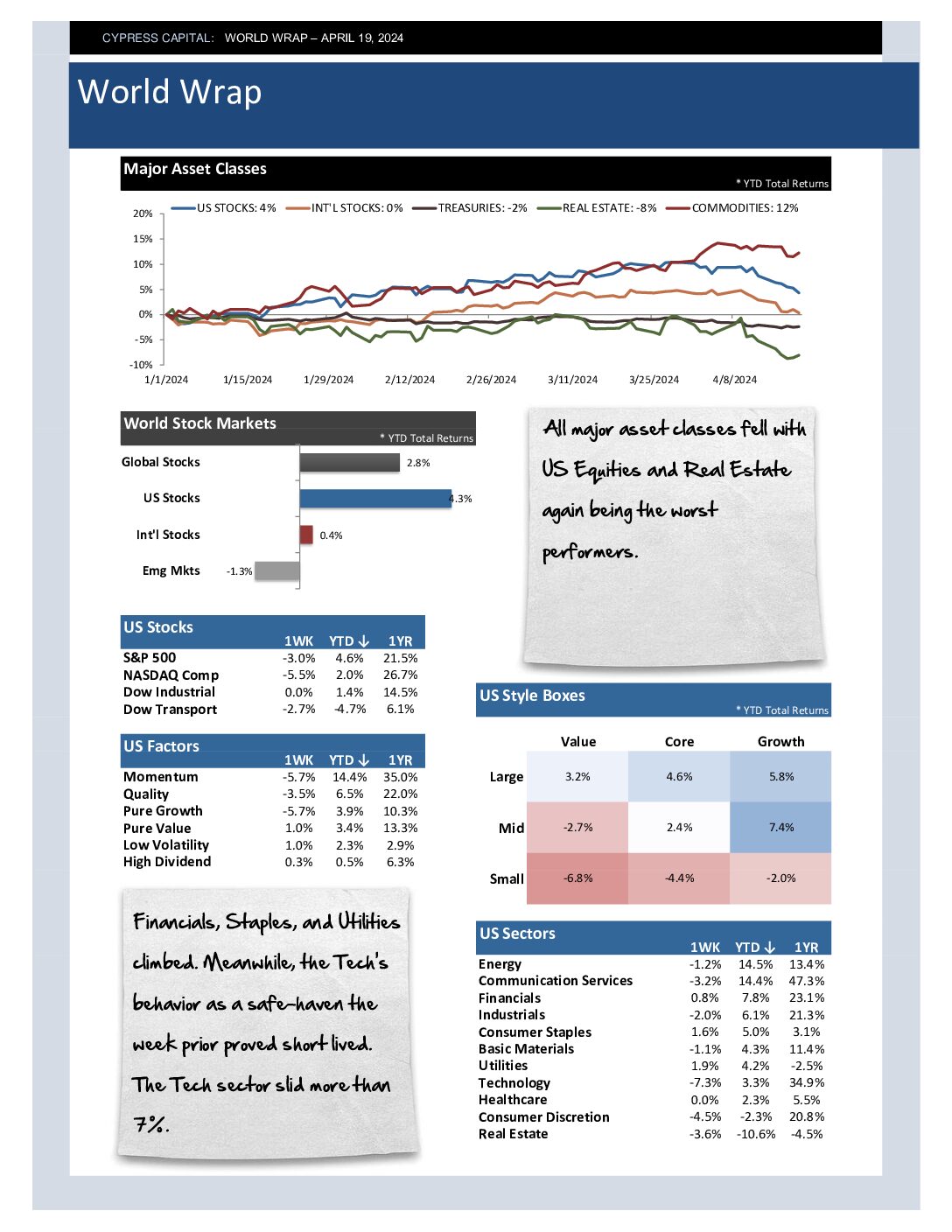

– Emerging Markets outperformed on the back of another robust weekly performance from Asian stocks.

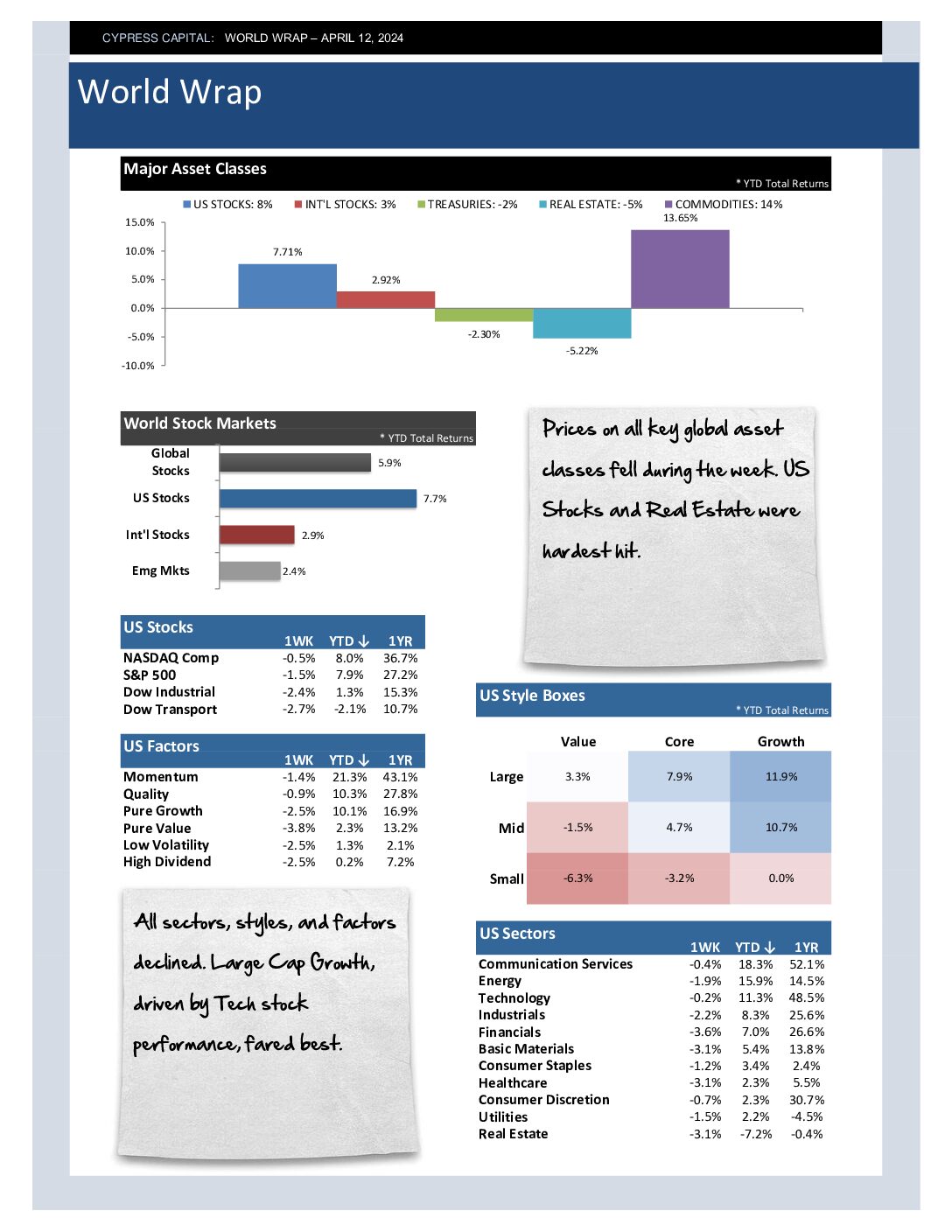

– All broad commodity sectors slid with Energy prices faring worst. Crude oil futures fell nearly seven percent.