Research

World Wrap

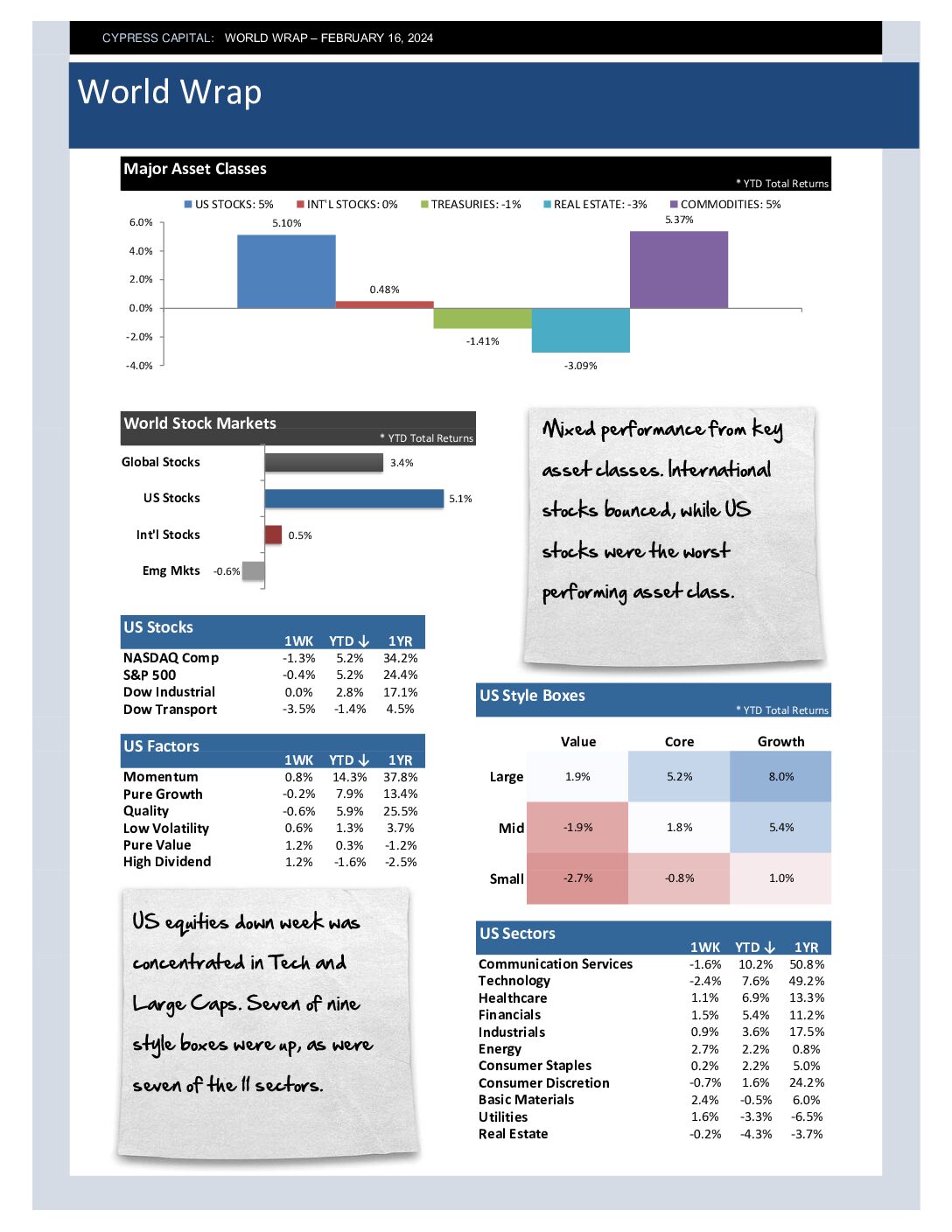

– Mixed performance from key asset classes. International stocks bounced, while US stocks were the worst performing asset class.

– US equities down week was concentrated in Tech and Large Caps. Seven of nine style boxes were up, as were seven of the 11 sectors.

– Broad advance in international markets with 80% of countries advancing. China rallied 3.7%.

– Stronger than expected inflation sent prices on US Treasuries lower. The yield on the 2Yr Treasury has climbed 50 basis points in the last month to 4.6%.

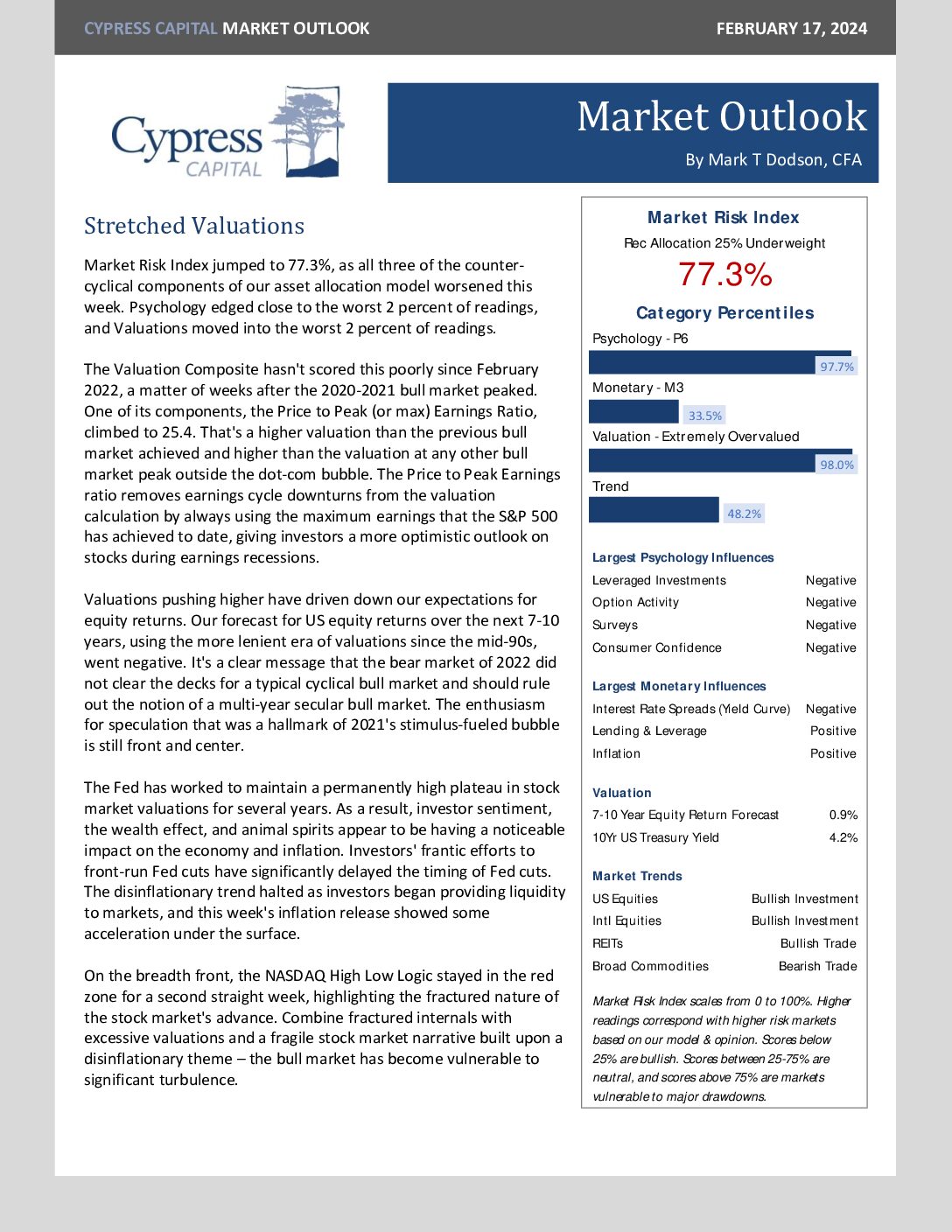

Market Outlook – Stretched Valuations

World Wrap

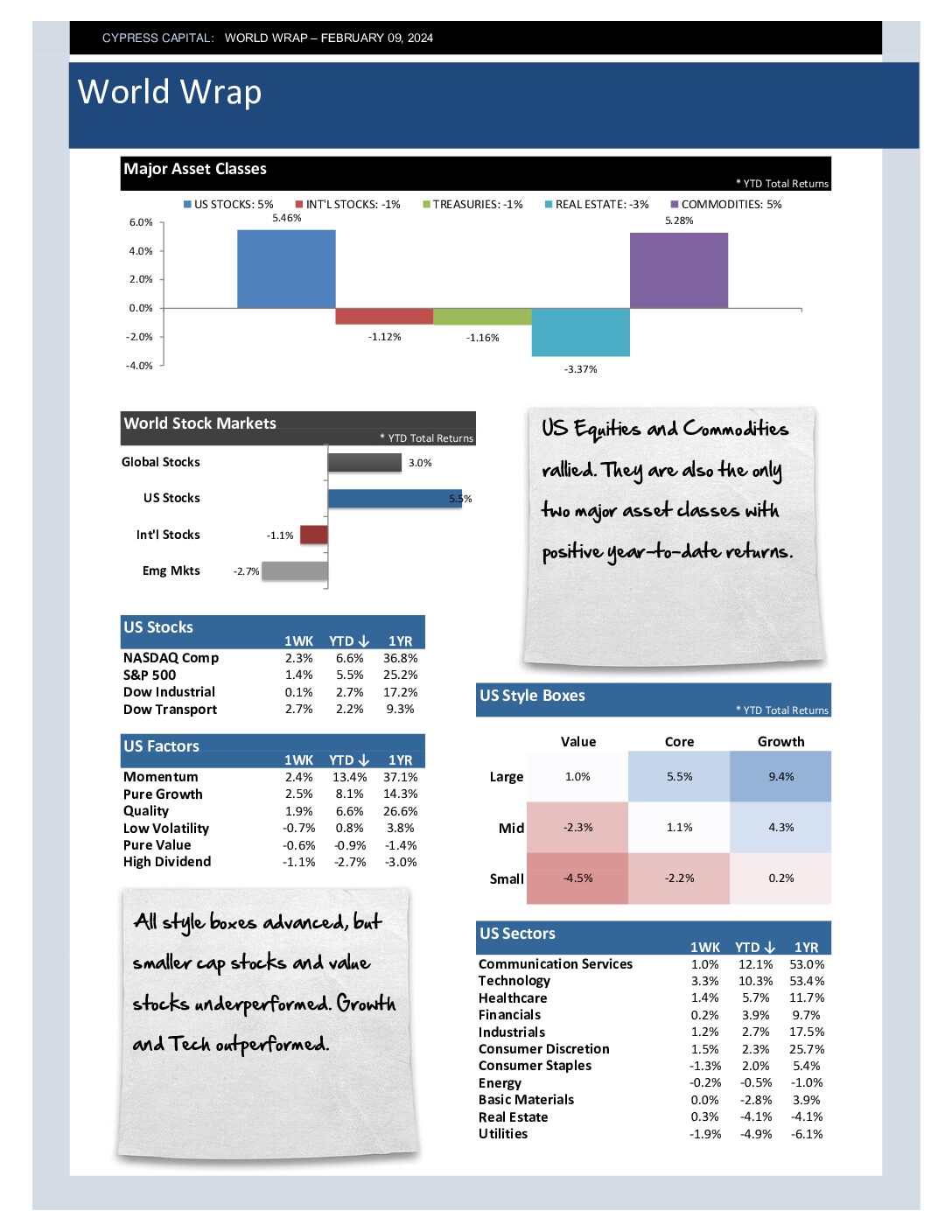

– US Equities and Commodities rallied. They are also the only two major asset classes with positive year-to-date returns.

– All style boxes advanced, but smaller cap stocks and value stocks underperformed. Growth and Tech outperformed.

– International equities were flat, with slightly more than half of countries advancing. More than 60% of countries are down year-to-date.

– US Treasuries declined, and breakevens on US TIPS are starting to signal a rebound in the rate of inflation.

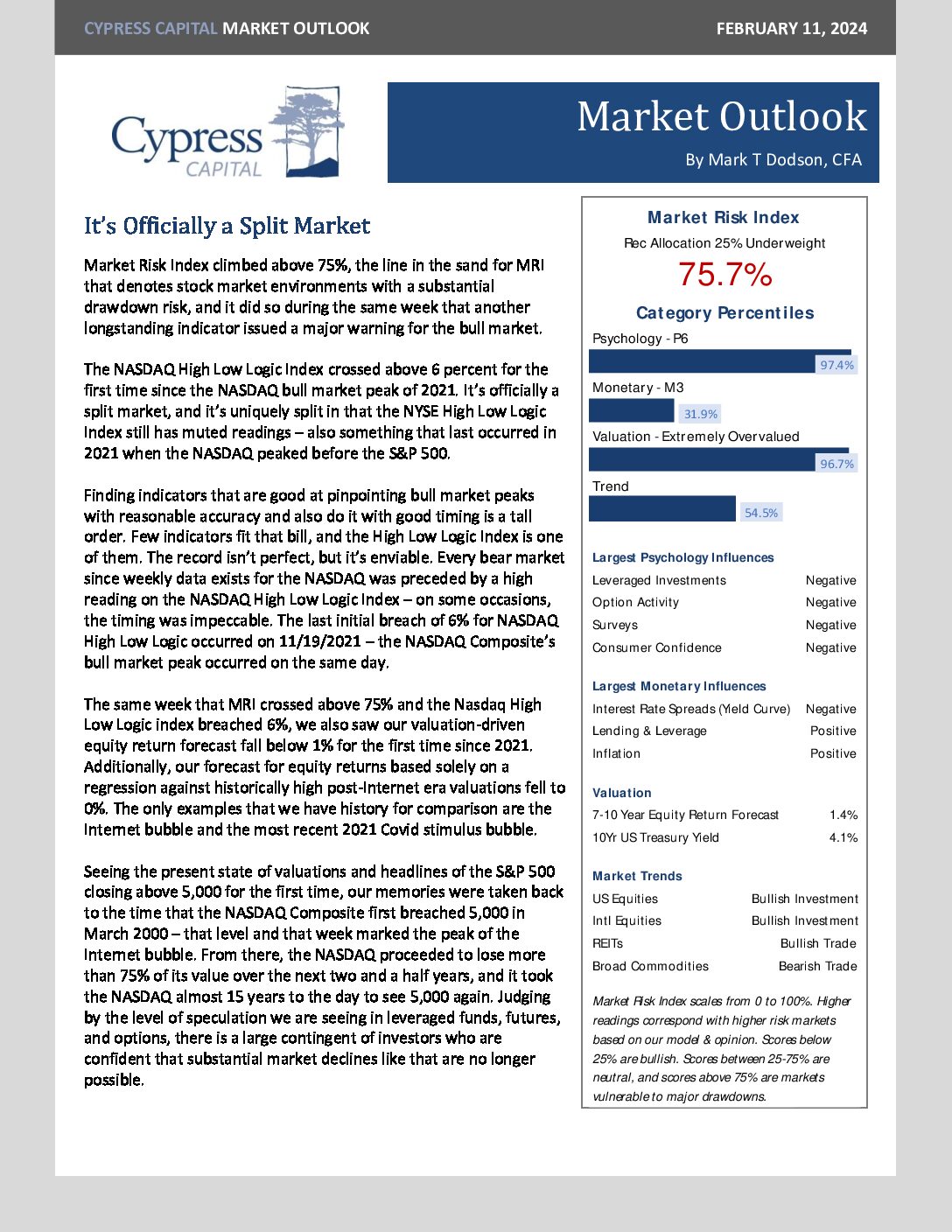

Market Outlook – It’s Officially a Split Market

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%