Research

World Wrap

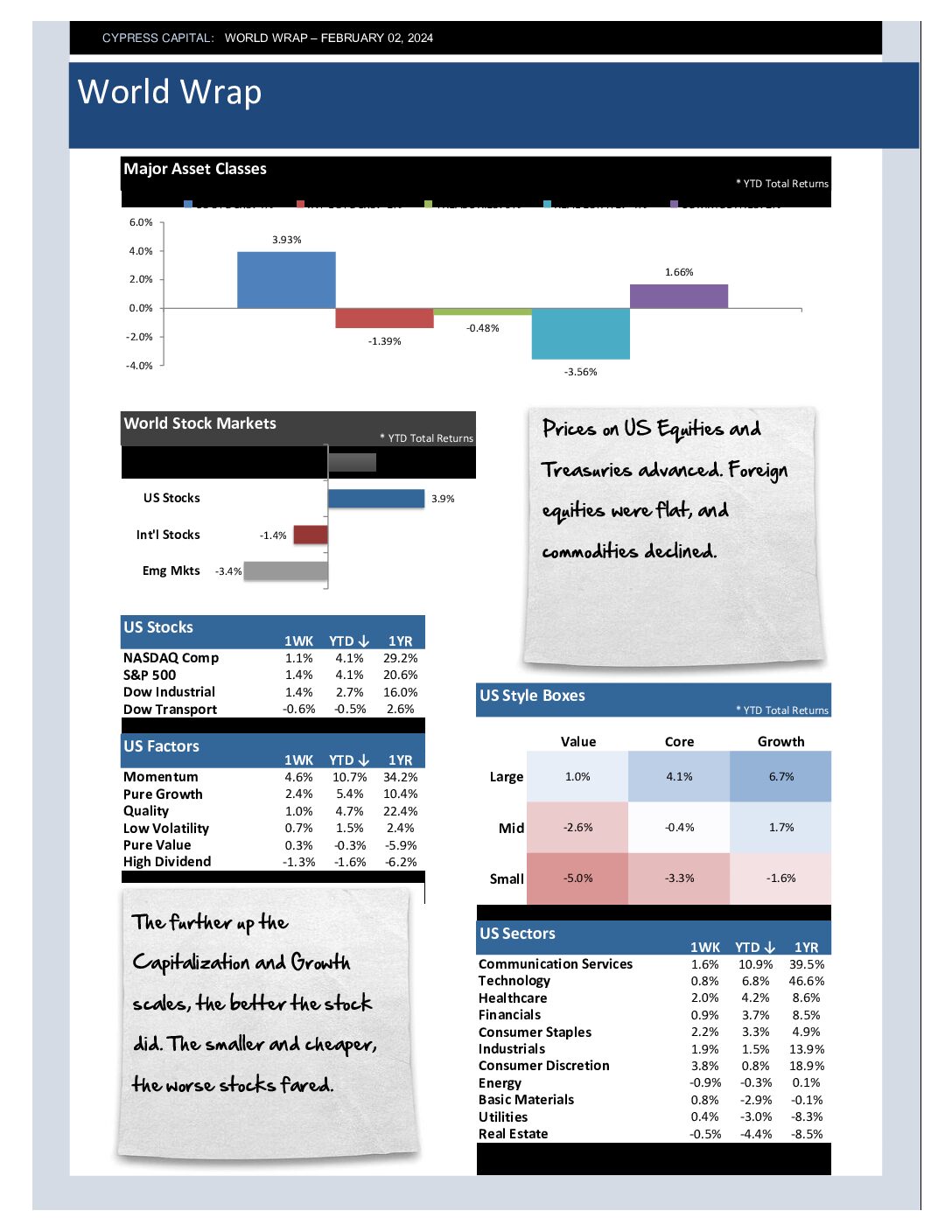

– Prices on US Equities and Treasuries advanced. Foreign equities were flat, and commodities declined.

– The further up the Capitalization and Growth scales, the better the stock did. The smaller and cheaper, the worse stocks fared.

– China declined nearly 4%. China’s stock market is roughly half the value it was nearly 17 years ago, when the globalization era peaked.

– Sharp weekly drop in crude oil prices hurt Commodity indices. US Treasuries and the Dollar rallied.

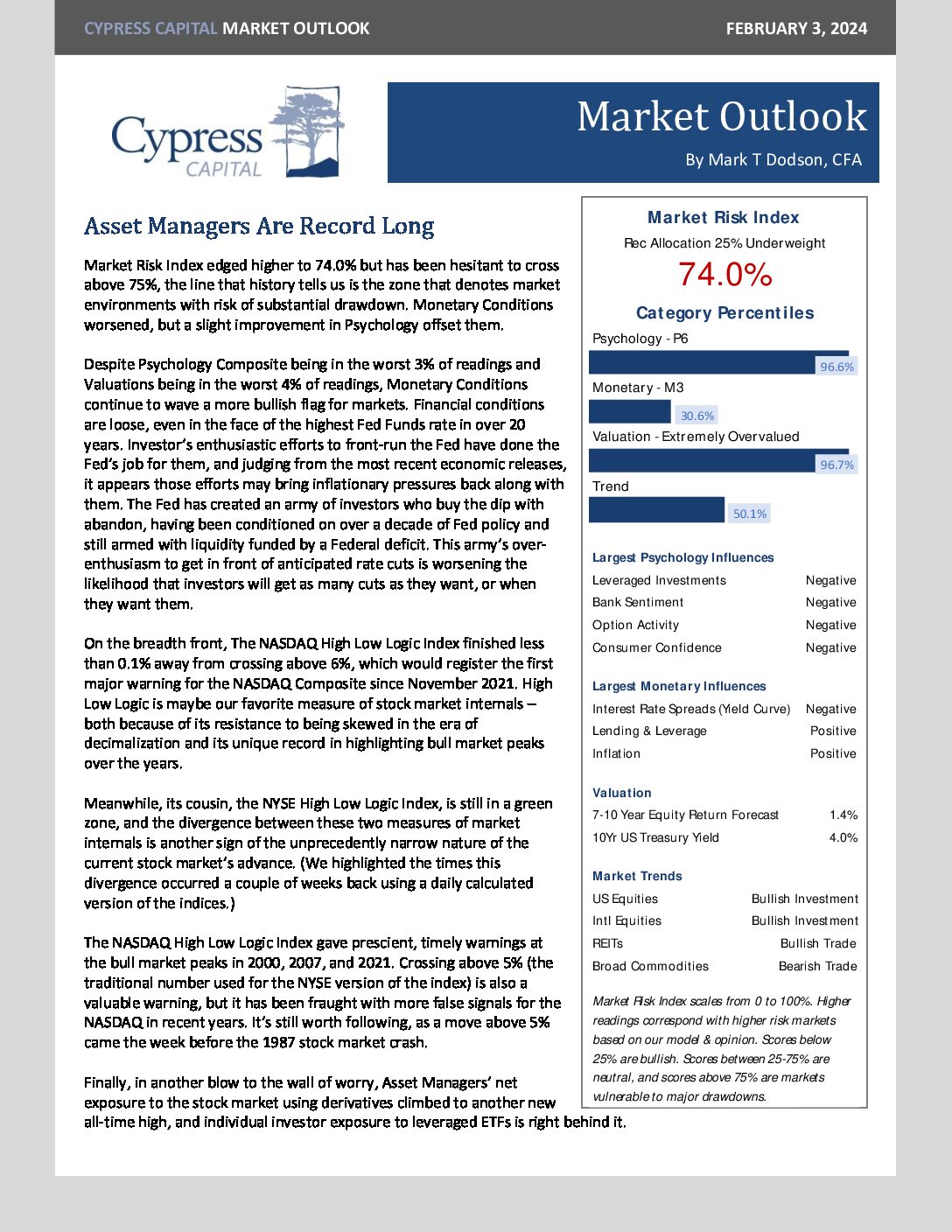

Market Outlook – Asset Managers Are Record Long

World Wrap

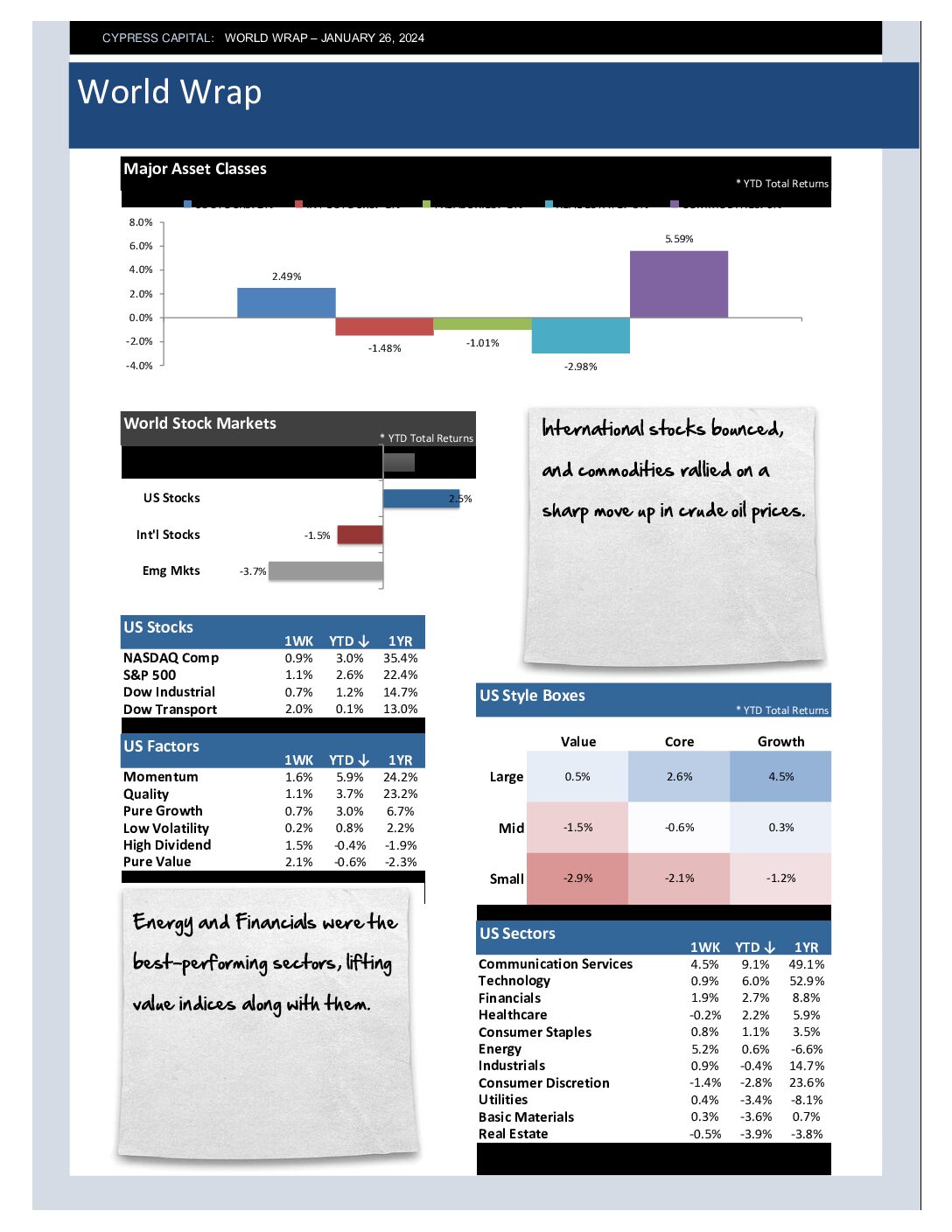

– International stocks bounced, and commodities rallied on a sharp move up in crude oil prices.

– Energy and Financials were the best-performing sectors, lifting value indices along with them.

– France, Germany, and the UK rallied strongly, helping developed markets outperform.

– Commodities had a good week – spot prices in crude oil popped by more than 5% over the week.

Market Outlook – Is it time to bail on the yield curve?

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%