Research

World Wrap

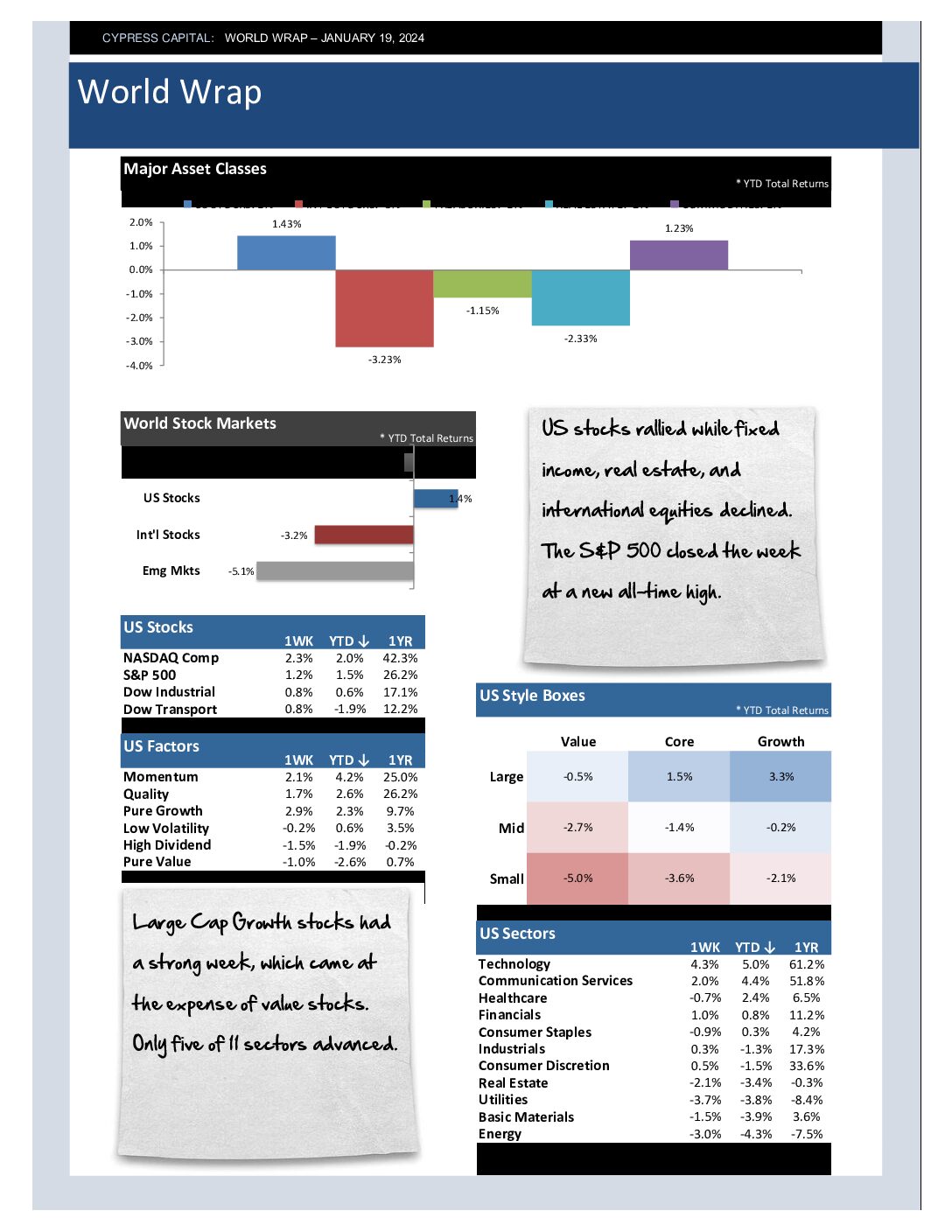

– US stocks rallied while fixed income, real estate, and international equities declined. The S&P 500 closed the week at a new all time high.

– Large Cap Growth stocks had a strong week, which came at the expense of value stocks. Only five of 11 sectors advanced.

– China declined almost 6% on the week, putting it less than 5% away from taking out its 2022 bear market low.

– US Treasuries sold off, and the 10 Year yield has climbed back above 4%. As yields have risen, so has the value of the US Dollar.

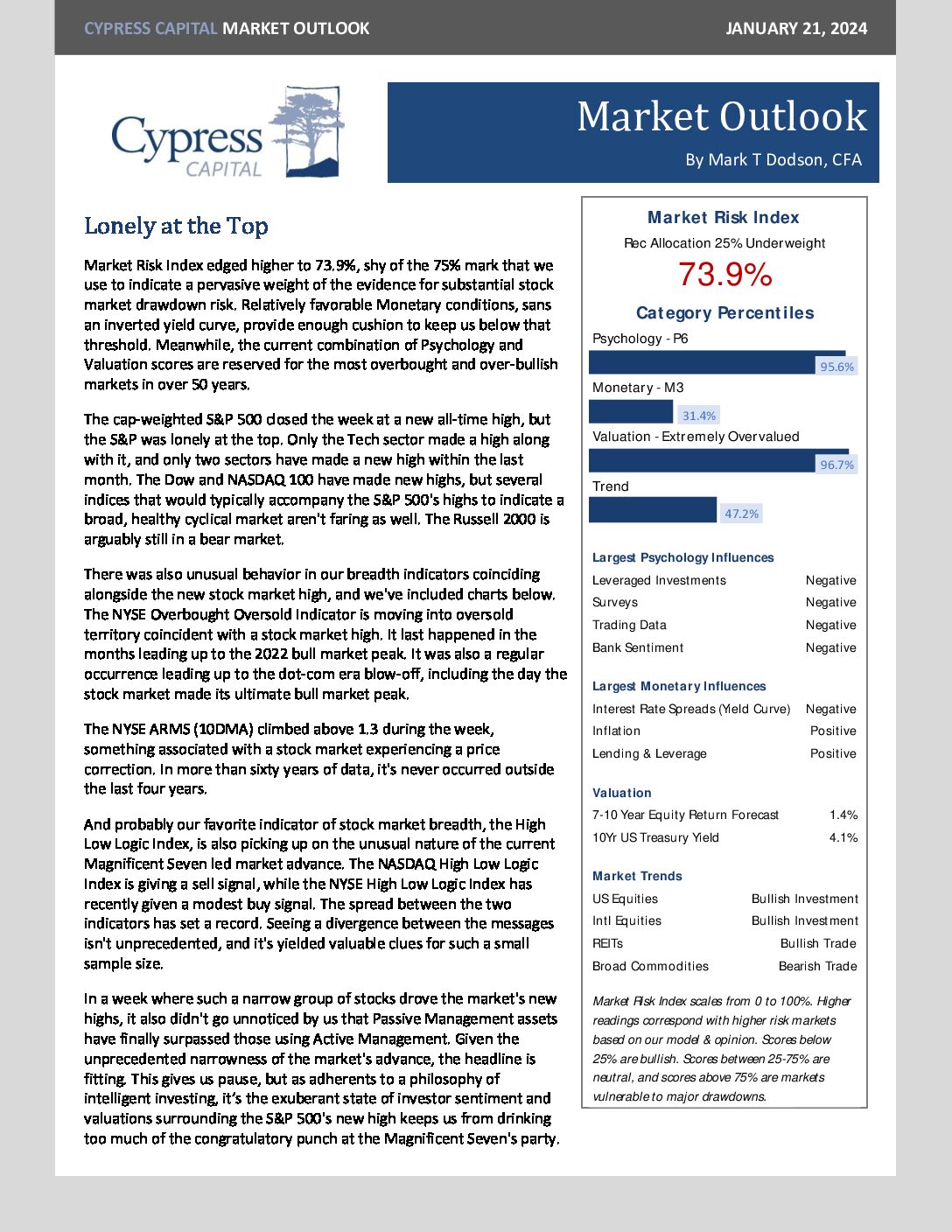

Market Outlook – Lonely at the Top

World Wrap

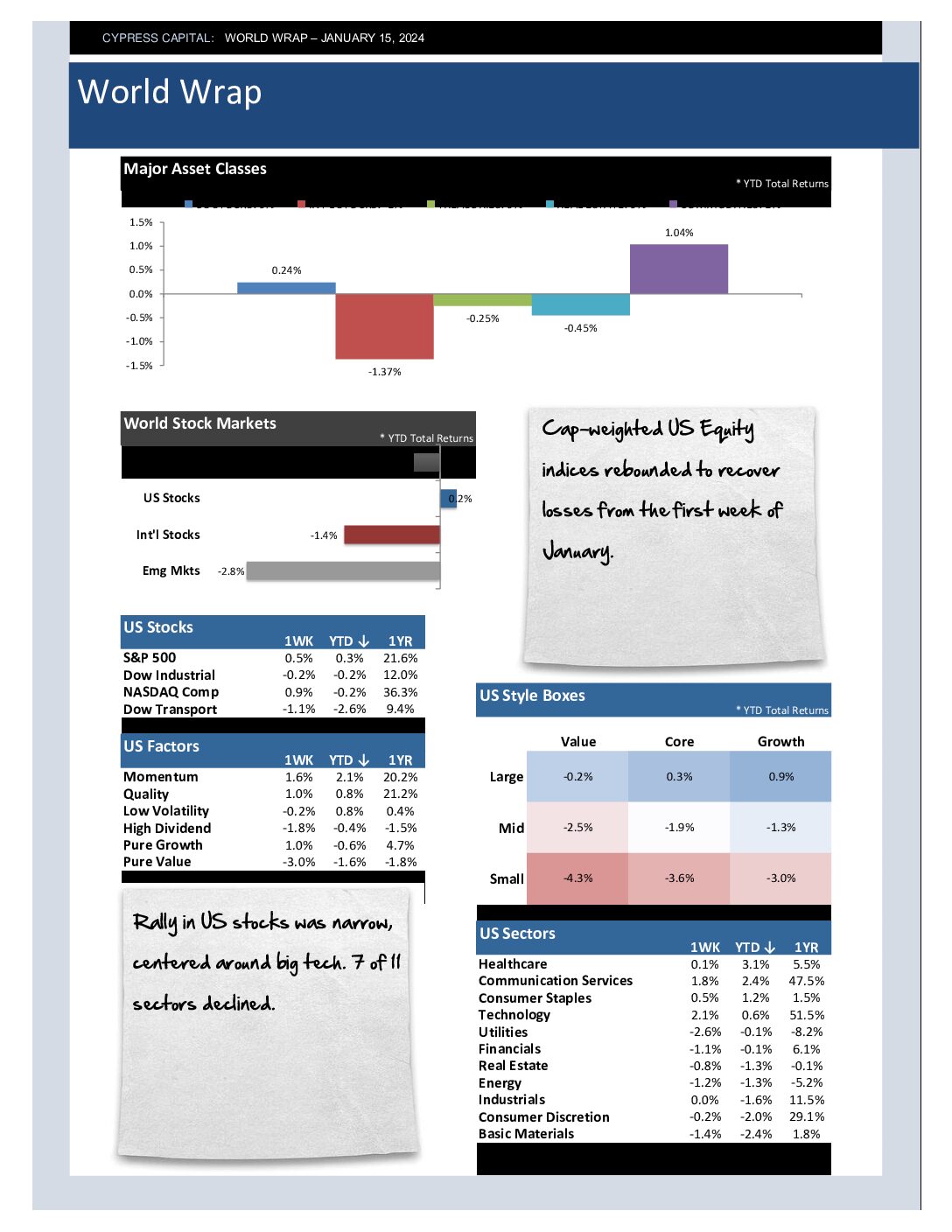

– Cap-weighted US Equity indices rebounded to recover losses from the first week of January.

– Rally in US stocks was narrow, centered around big tech. 7 of 11 sectors declined.

– Emerging markets declined. China’s equity market continues to struggle – China is only 11% above its 2022 bear market low.

– Sell the news – Bitcoin sold off on ETF launch after months of excitement and anticipation.

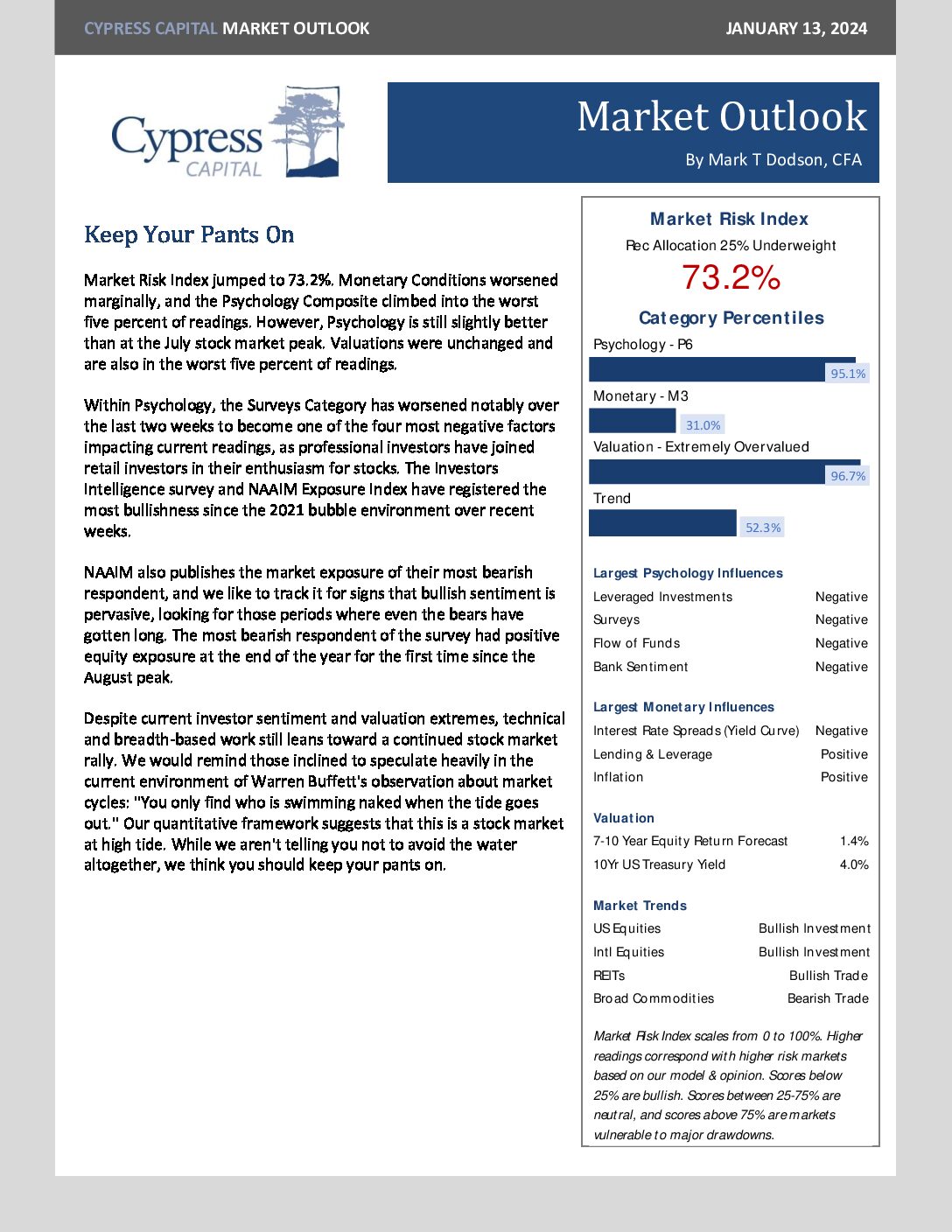

Market Outlook – Keep Your Pants On

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%