Research

World Wrap

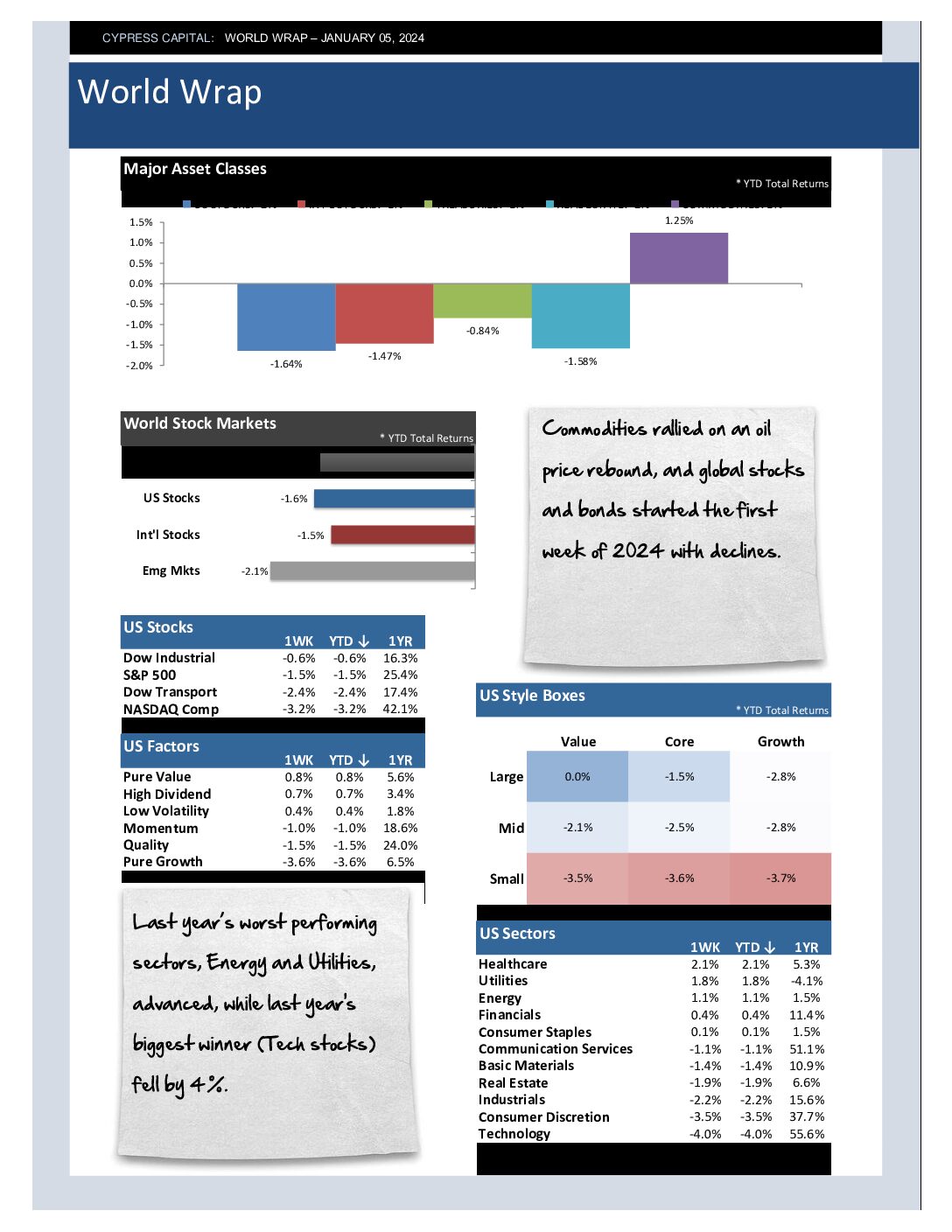

– Commodities rallied on an oil price rebound, and global stocks and bonds started the first week of 2024 with declines.

– Last year’s worst performing sectors, Energy and Utilities, advanced, while last year’s biggest winner (Tech stocks) fell by 4%.

– Frontier markets with heavy commodity exposure started the year with strong rallies.

– Natural gas and oil were strong, and the dollar rebounded, up more than 1% for the week.

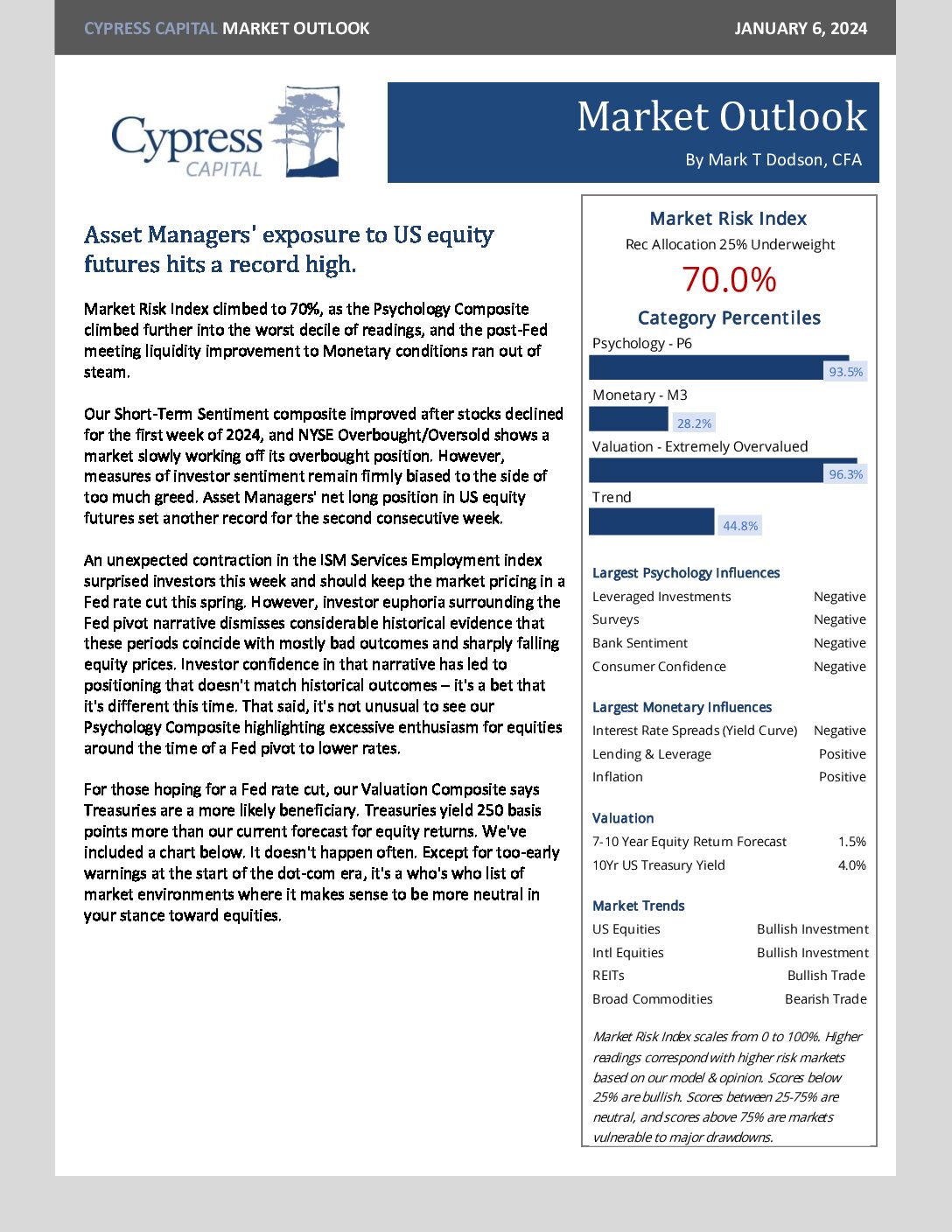

Market Outlook – Asset Managers’ exposure to US equity futures hits a record high.

Q4 2023 World Wrap

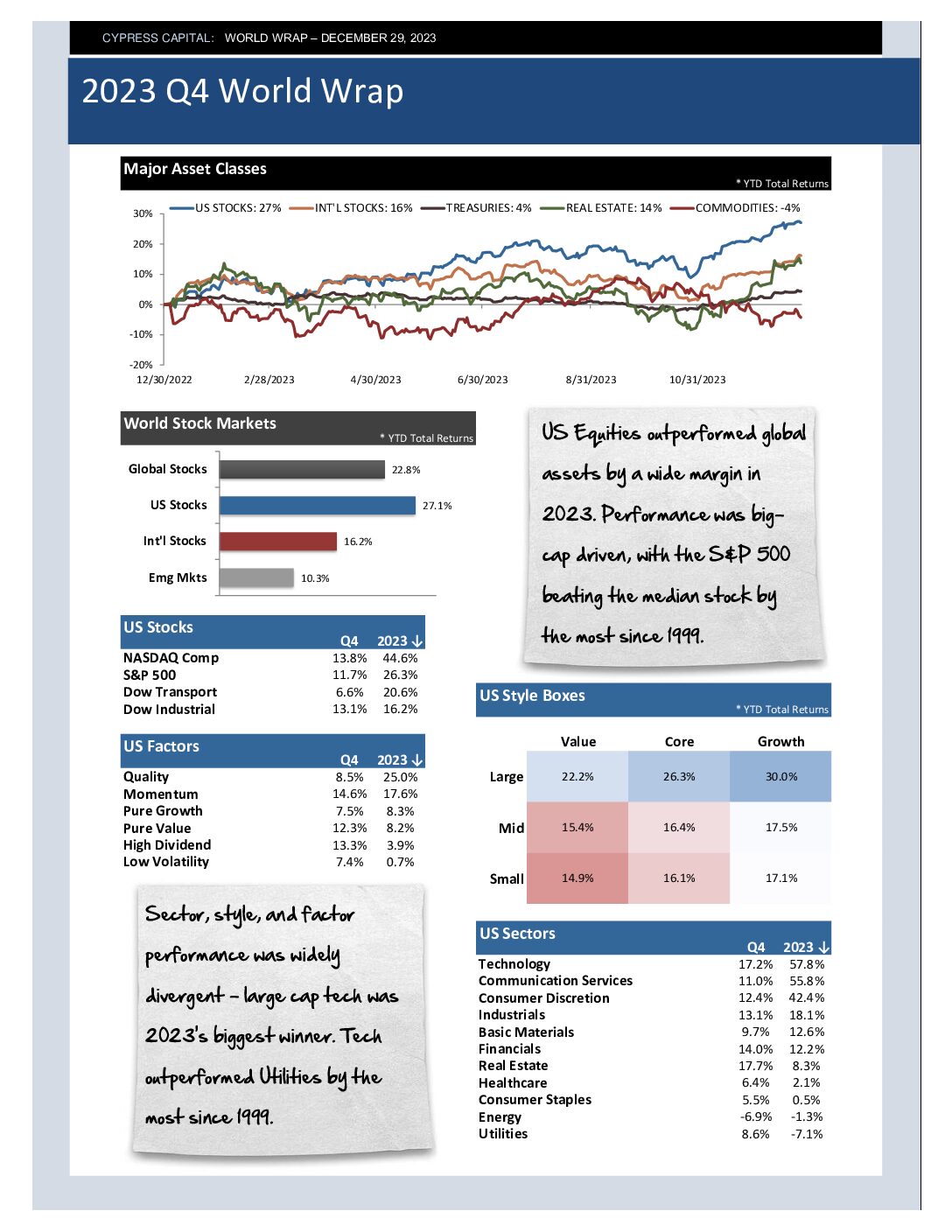

– US Equities outperformed global assets by a wide margin in 2023. Performance was big-cap driven, with the S&P 500 beating the median stock by the most since 1999.

– Sector, style, and factor performance was widely divergent – large cap tech was 2023’s biggest winner. Tech outperformed Utilities by the most since 1999.

– Emerging markets lagged developed markets, driven by weakness in China. China was the 3rd worst performing country in 2023 and has declined three years in a row.

– Global fixed income finished the year with respectable returns, with all of the gains coming in Q4. In a sign that animal spirits have returned, Bitcoin closed the year up 150%.

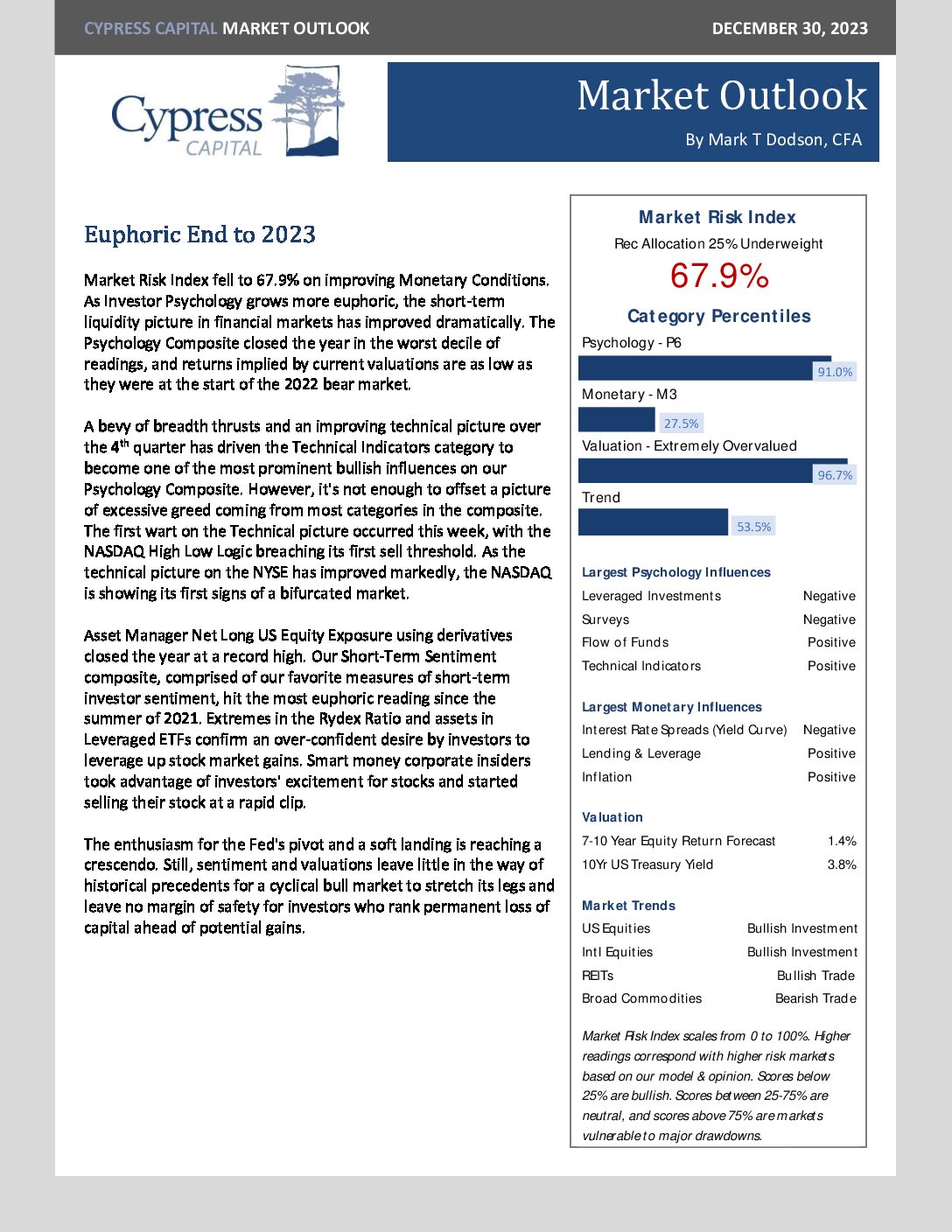

Market Outlook – Euphoric End to 2023

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%