Research

World Wrap

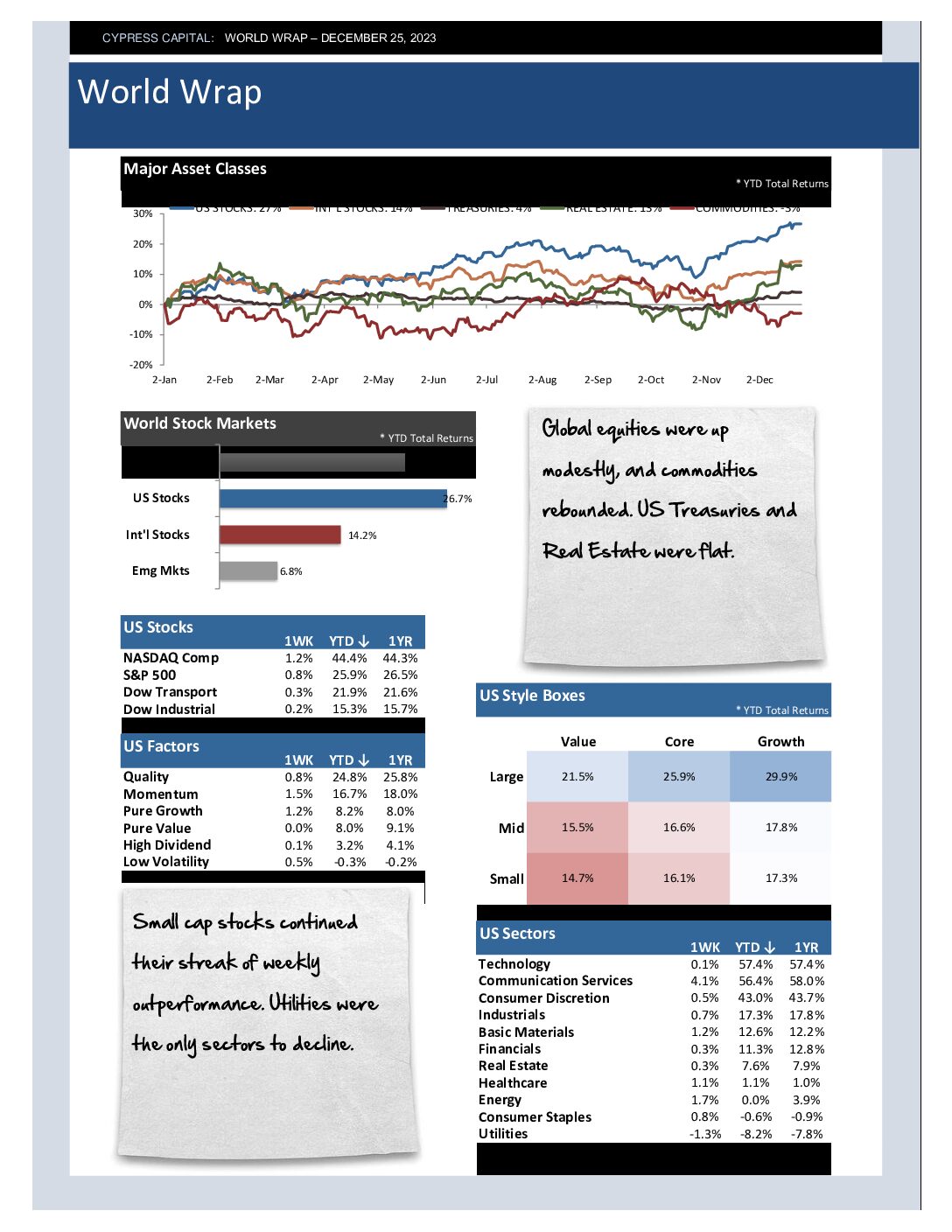

– Global equities were up modestly, and commodities rebounded. US Treasuries and Real Estate were flat.

– Small cap stocks continued their streak of weekly outperformance. Utilities were the only sectors to decline.

– Emerging markets closed lower on a 4% decline in China, making China is the second worst performing country in 2023.

– Gold prices closed the week at another new all-time high.

World Wrap

– A broad, global rally among all asset classes last week on Fed signaling possibility of three rate cuts in 2024.

– Small cap stocks are playing major catch up to finish the year. Small Cap value outperformed all sectors, styles, and factors.

– Peru’s stock market climbed a whopping 17.6% last week.

– Broad rally among fixed income sectors. The US dollar fell to the lowest level since late July.

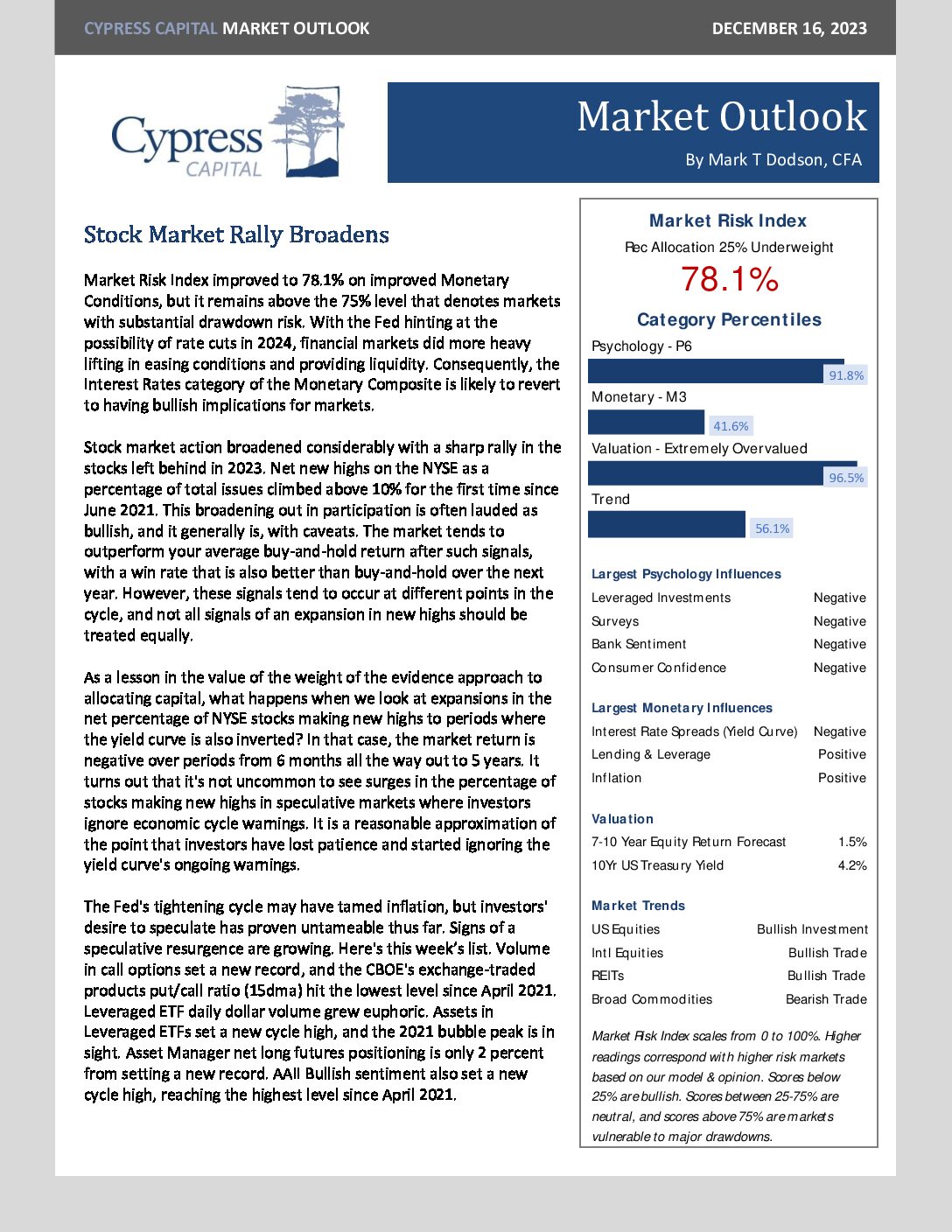

Market Outlook – Stock Market Rally Broadens

World Wrap

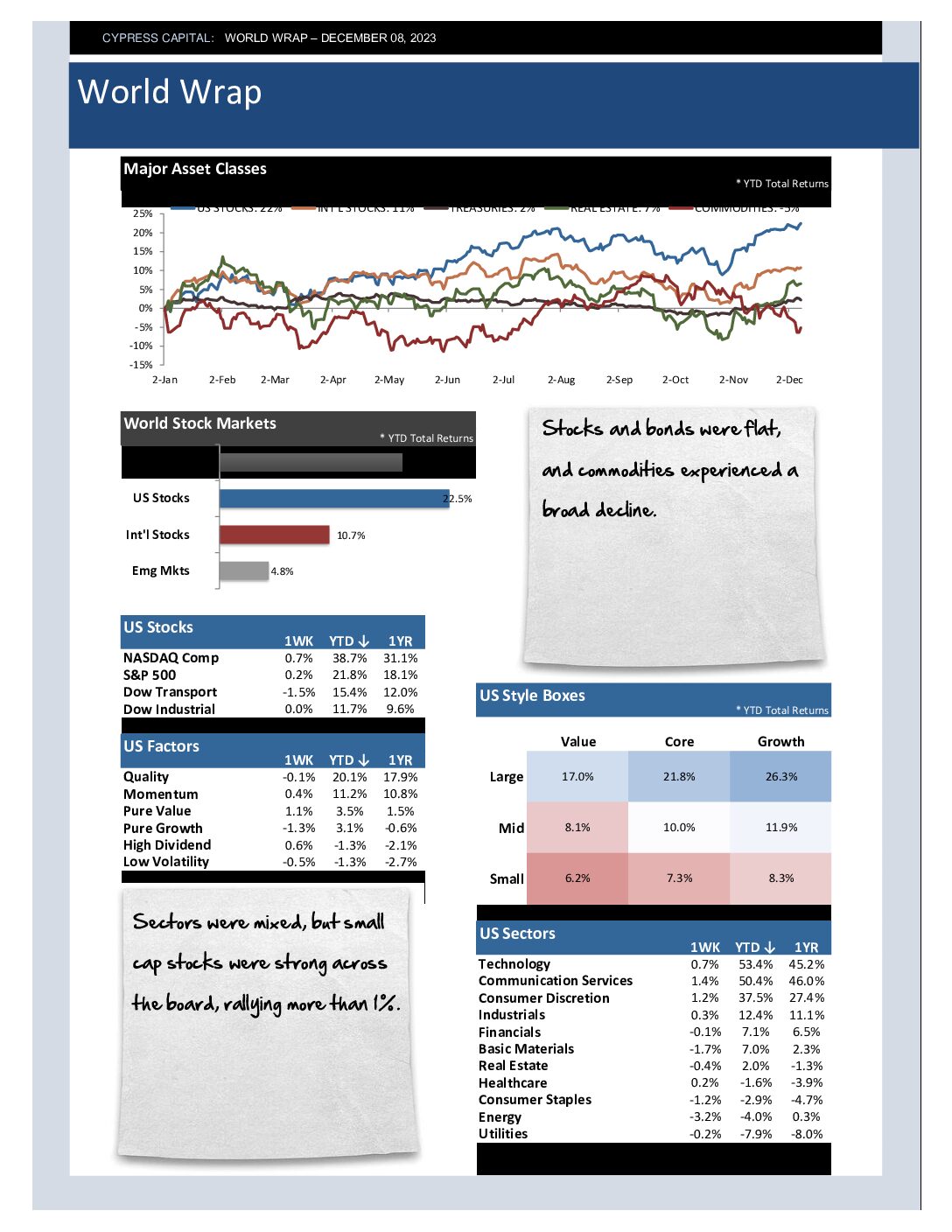

– Stocks and bonds were flat, and commodities experienced a broad decline.

– Sectors were mixed, but small cap stocks were strong across the board, rallying more than 1%.

– China fell more than 3.5% setting a new 52 week low. This coming February will mark three years since the bull market peak in China.

– Crude oil is down more than 25% off its September peak, falling below $70bbl last week.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%