Research

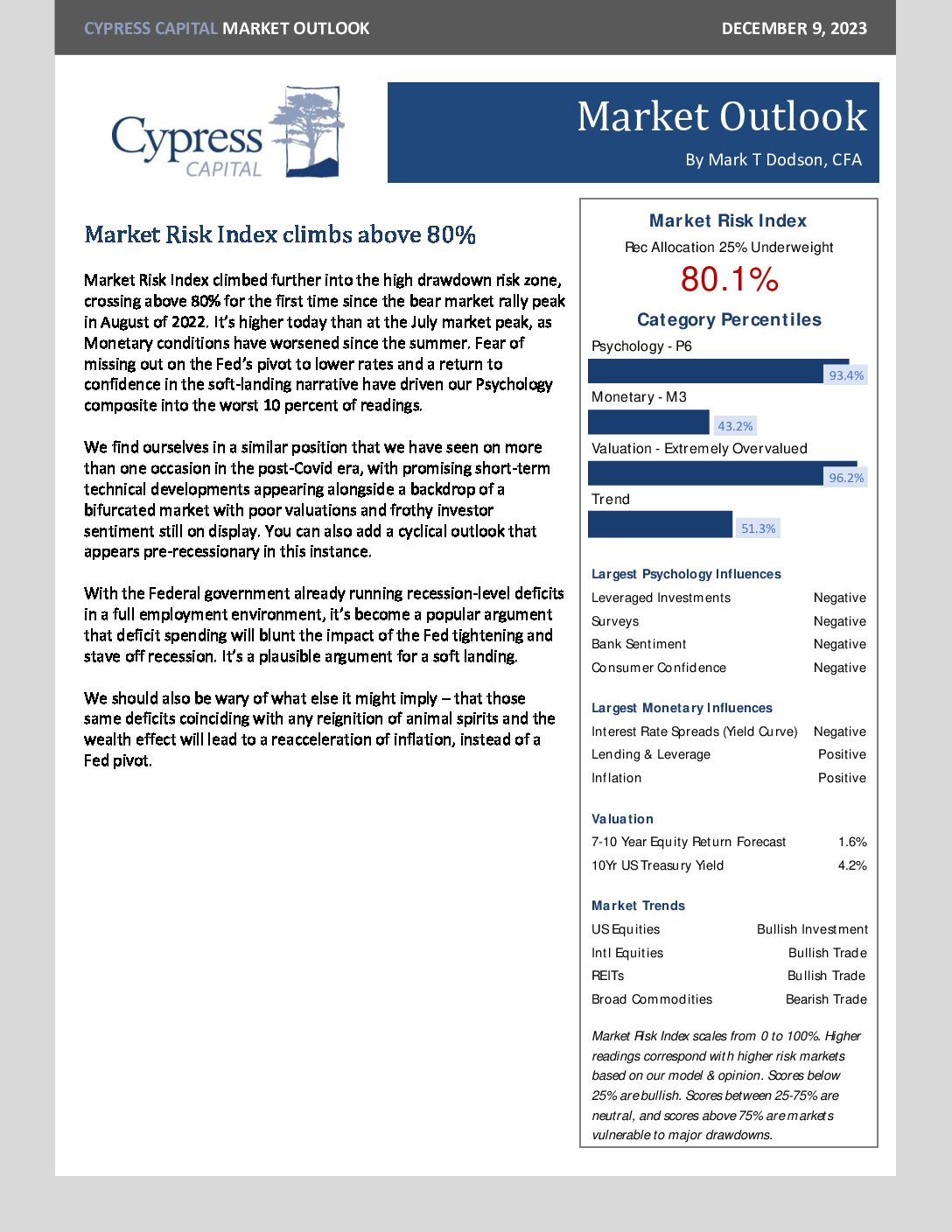

Market Outlook – Market Risk Index climbs above 80%

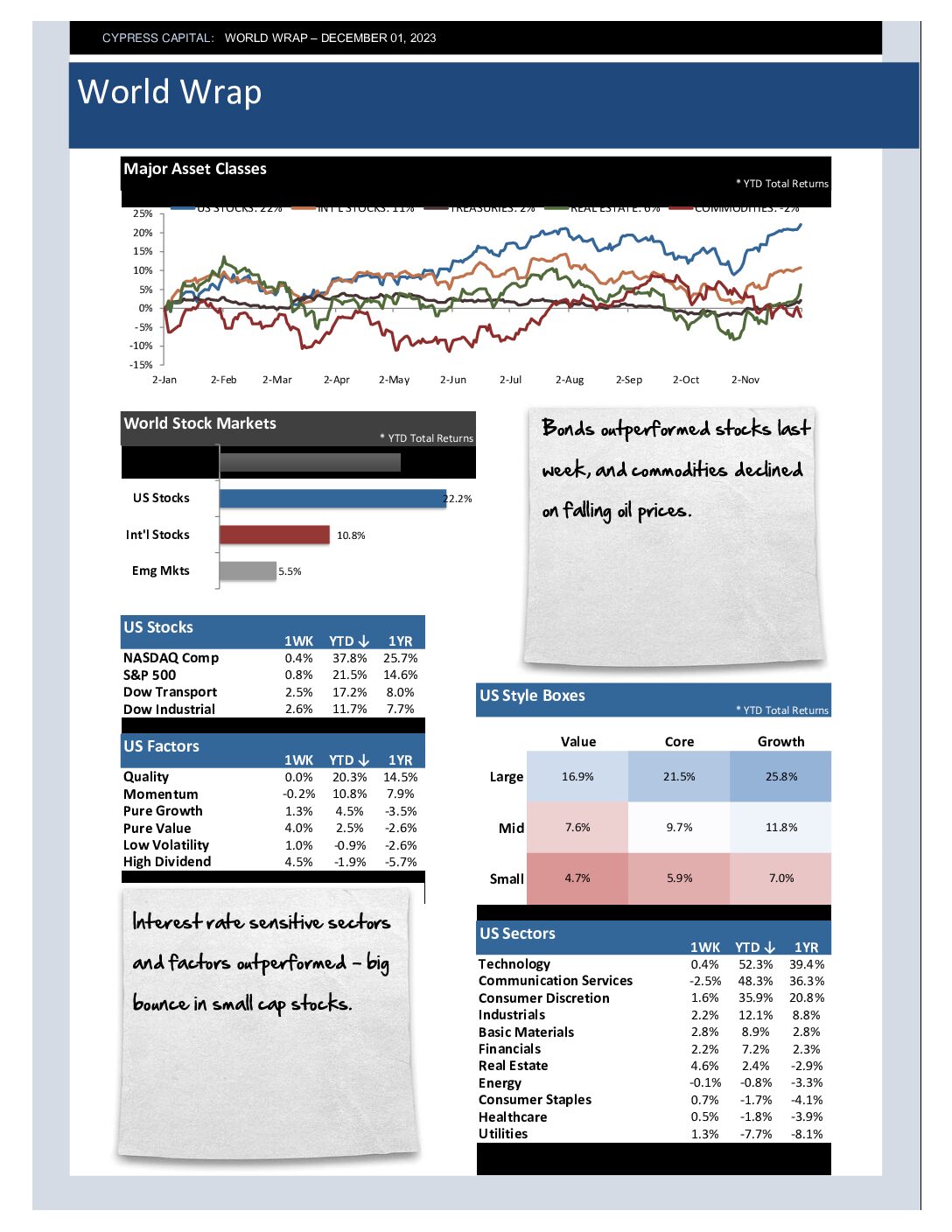

World Wrap

– Bonds outperformed stocks last week, and commodities declined on falling oil prices.

– Interest rate sensitive sectors and factors outperformed – big bounce in small cap stocks.

– The median country outperformed the cap-weighted international indices. China held back emerging market indices.

– Broad rally across fixed income sectors, and the price of Gold set a new all time high.

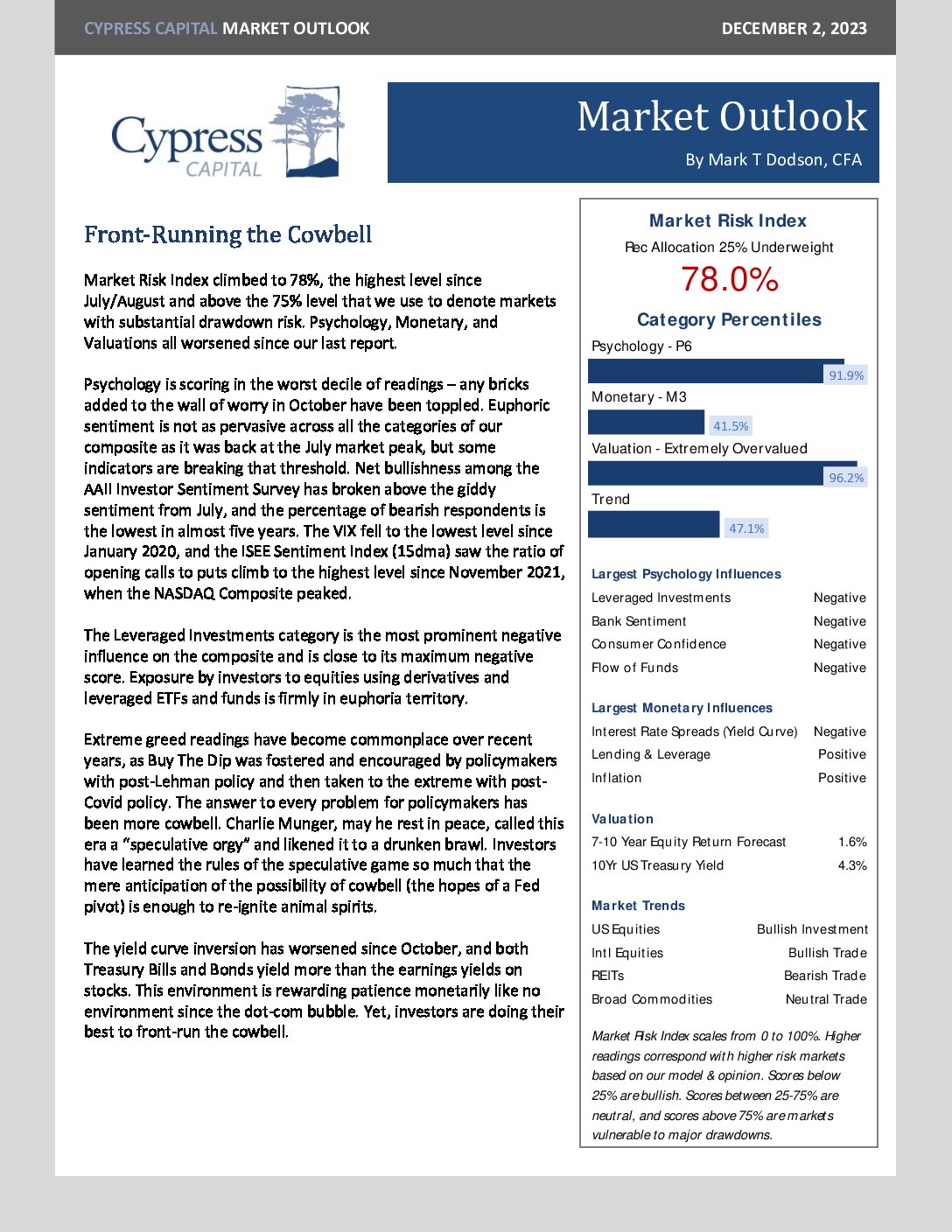

Market Outlook – Front-Running the Cowbell

World Wrap

– Global stocks advanced on the shortened holiday week. Commodities were off modestly on another weekly decline in crude oil prices.

– All sectors, styles, and factors moved higher. Unlike the prior week, small caps and value stocks lagged.

– Developed markets outperformed. China was up 1.3%, helping mask a challenging week for Emerging market equities.

– Precious Metals and Bitcoin experienced good performance. Prices on longer duration Treasuries were off slightly.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%