Research

World Wrap

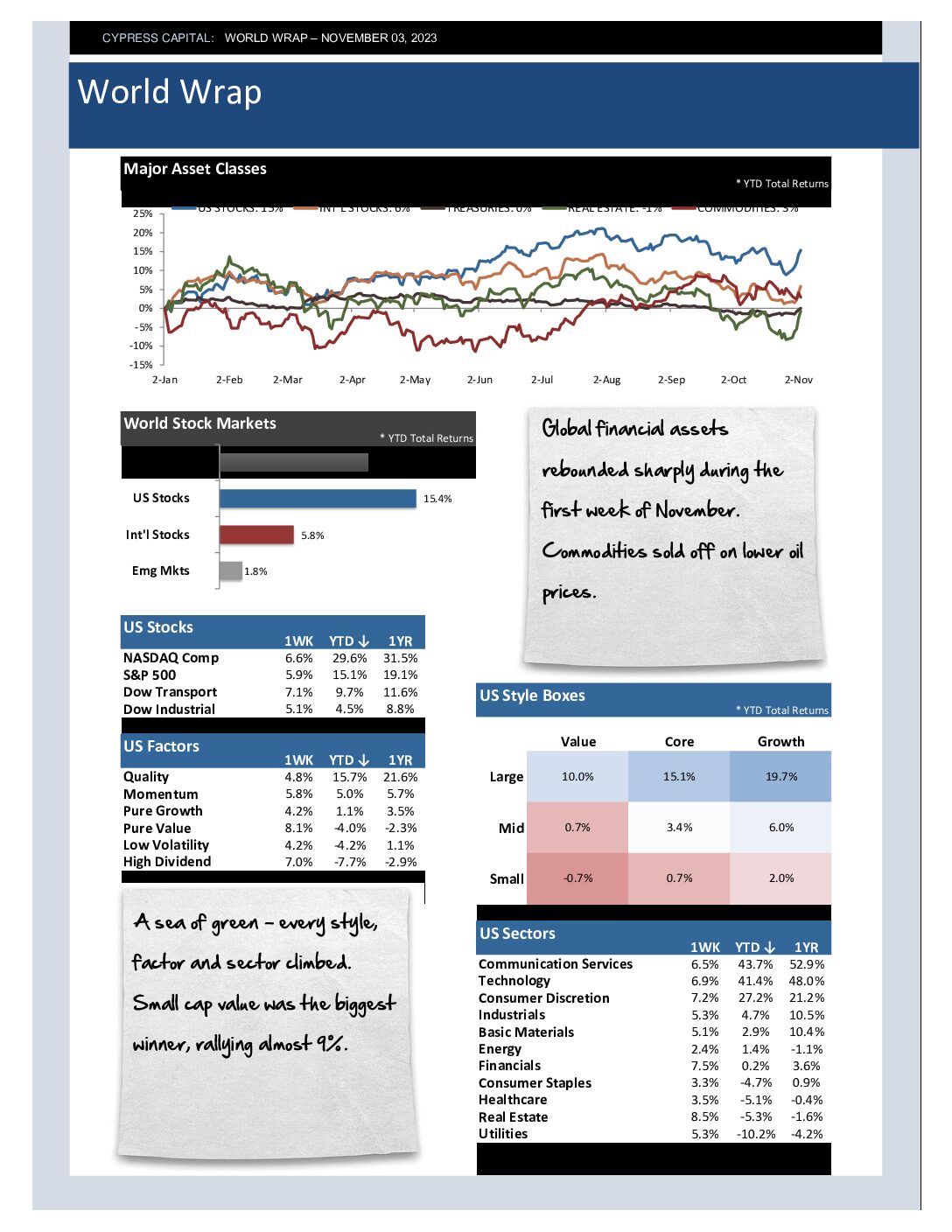

– Global financial assets rebounded sharply during the first week of November. Commodities sold off on lower oil prices.

– A sea of green – every style, factor and sector climbed. Small cap value was the biggest winner, rallying almost 9%.

– Internationally, 43 of 44 countries that we monitor advanced. Mexico is having a good year – up 9.3% last week and up more than 21% year-to-date.

– Yields fell globally after Powell’s press conference and a weaker than expected jobs report as markets again bet that the Fed is done.

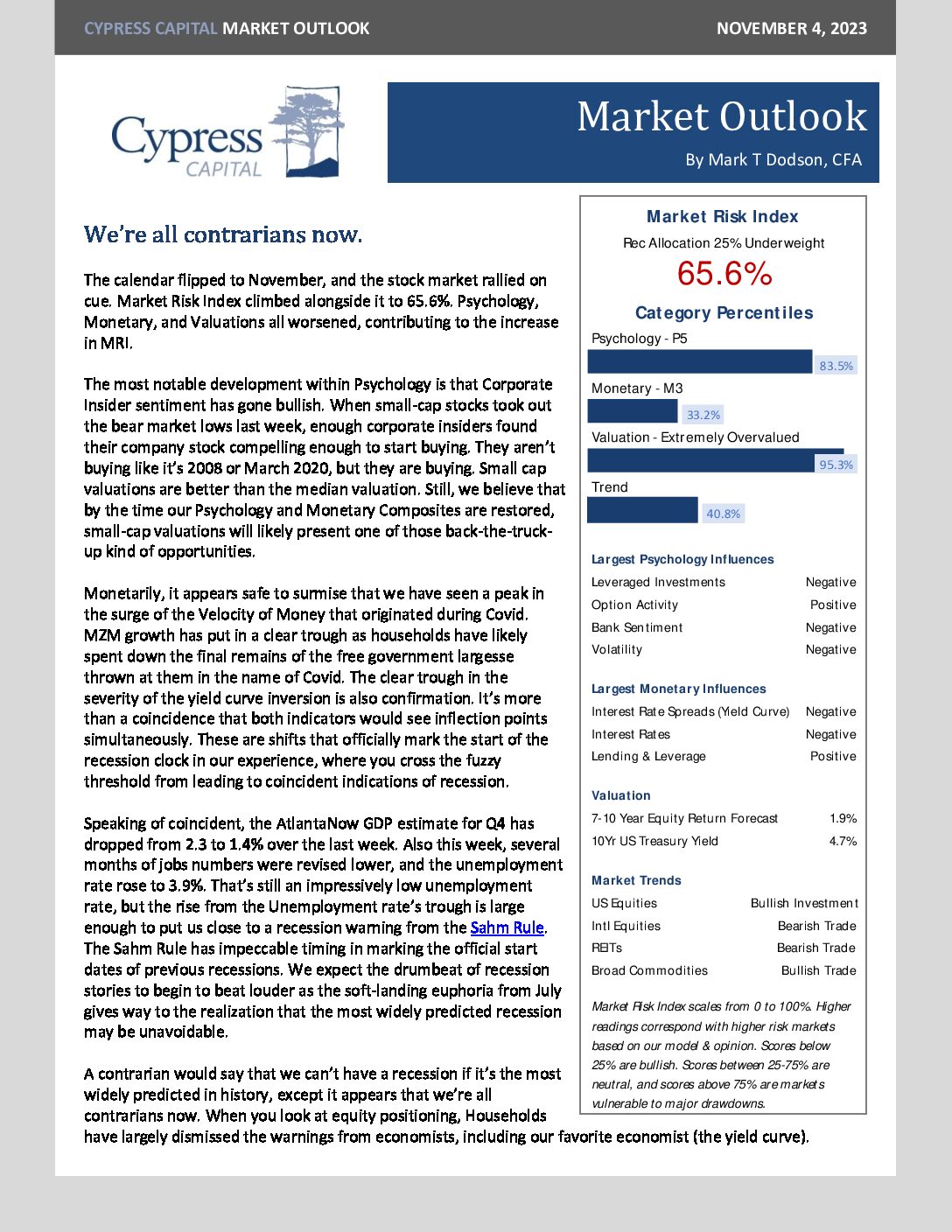

Market Outlook – We’re all contrarians now.

World Wrap

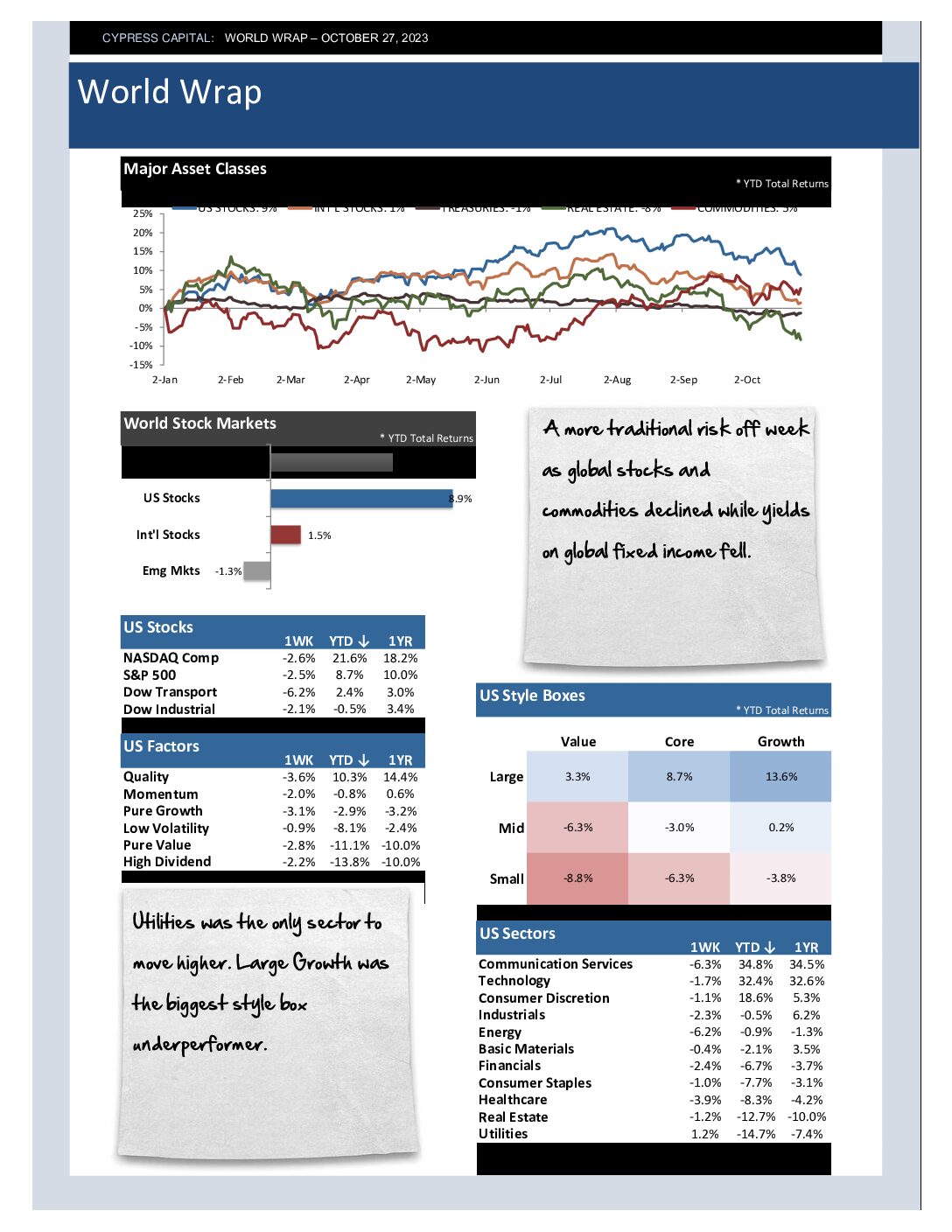

– A more traditional risk off week as global stocks and commodities declined while yields on global fixed income fell.

– Utilities was the only sector to move higher. Large Growth was the biggest style box underperformer.

– Emerging markets outperformed Developed markets with declines being mitigated by a 2.5% rebound in Chinese equities.

– Bitcoin rallied 14% amid continued speculation surrounding a possible Bitcoin spot ETF.

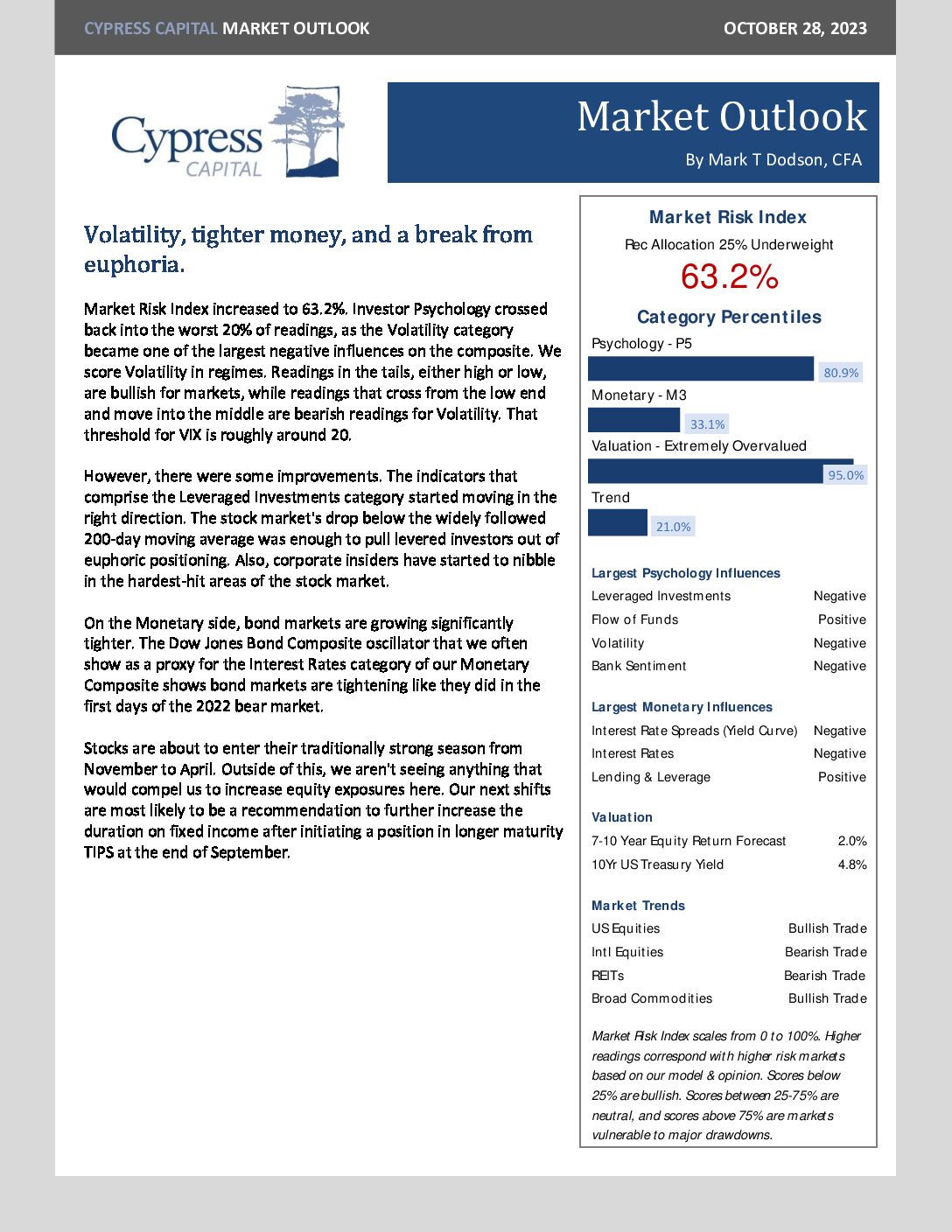

Market Outlook – Volatility, tighter money, and a break from euphoria.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%