Research

World Wrap

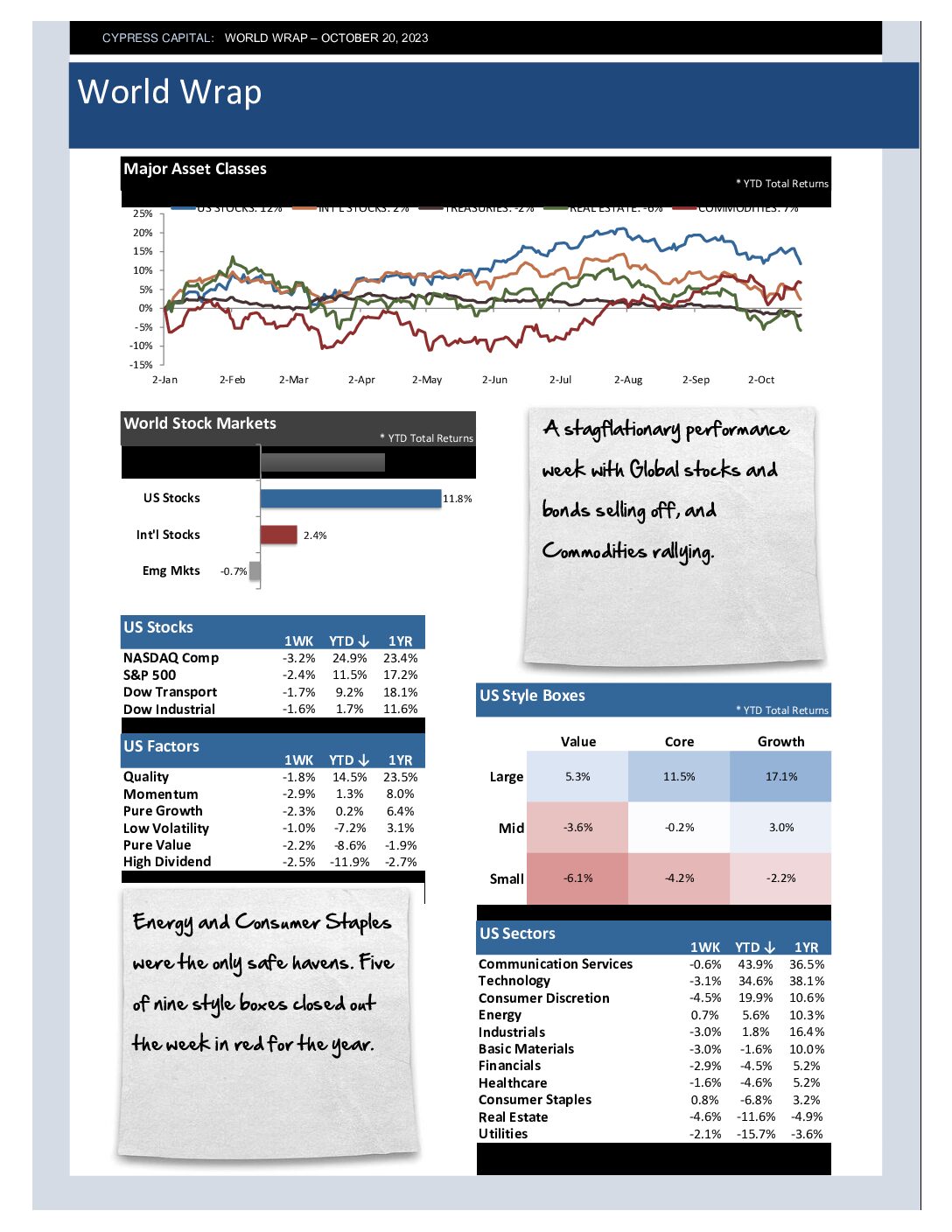

– A stagflationary performance week with Global stocks and bonds selling off, and Commodities rallying.

– Energy and Consumer Staples were the only safe havens. Five of nine style boxes closed out the week in red for the year.

– China sank to new bear market lows in US dollar terms. The country’s bear market is four months away from its third birthday.

– Yields on 10Yr Treasuries climbed to new highs, stopping just shy of 5%. It’s the highest level since the summer of 2007.

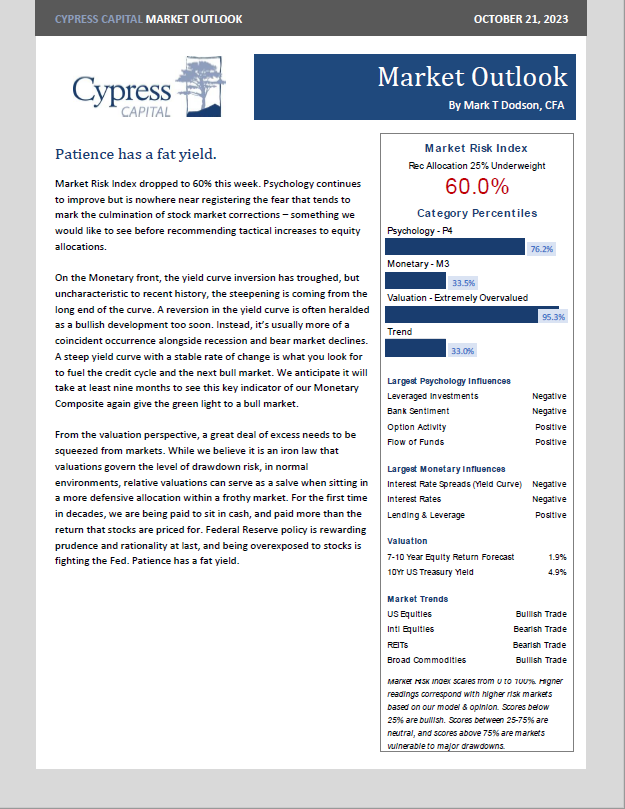

Market Outlook – Patience has a fat yield

World Wrap

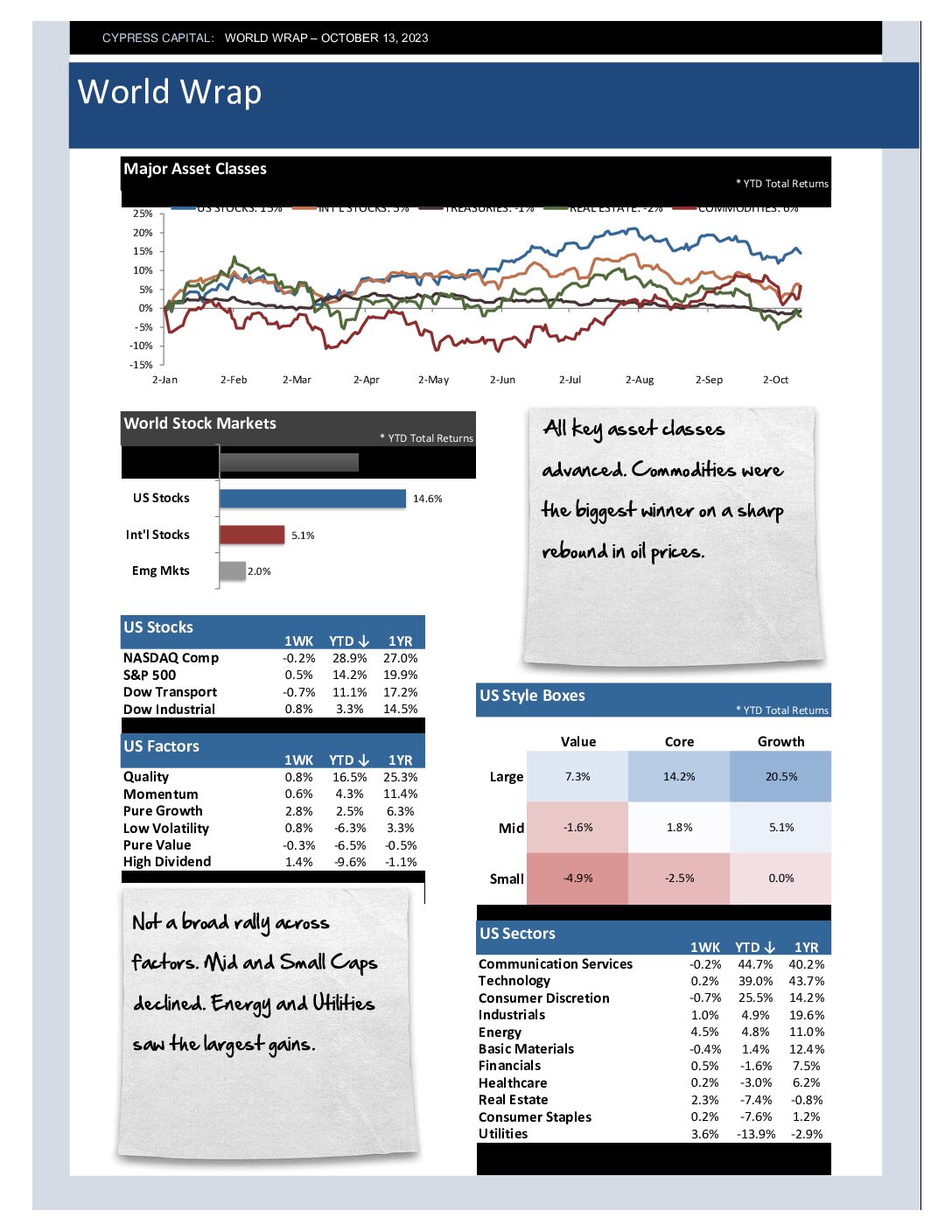

– All key asset classes advanced. Commodities were the biggest winner on a sharp rebound in oil prices.

– Not a broad rally across factors. Mid and Small Caps declined. Energy and Utilities saw the largest gains.

– International equities rallied. Israel’s equity market declined 8.8% after the Hamas attack.

– Fixed income markets advanced, and yields fell. Gold prices also rebounded by more than 5%.

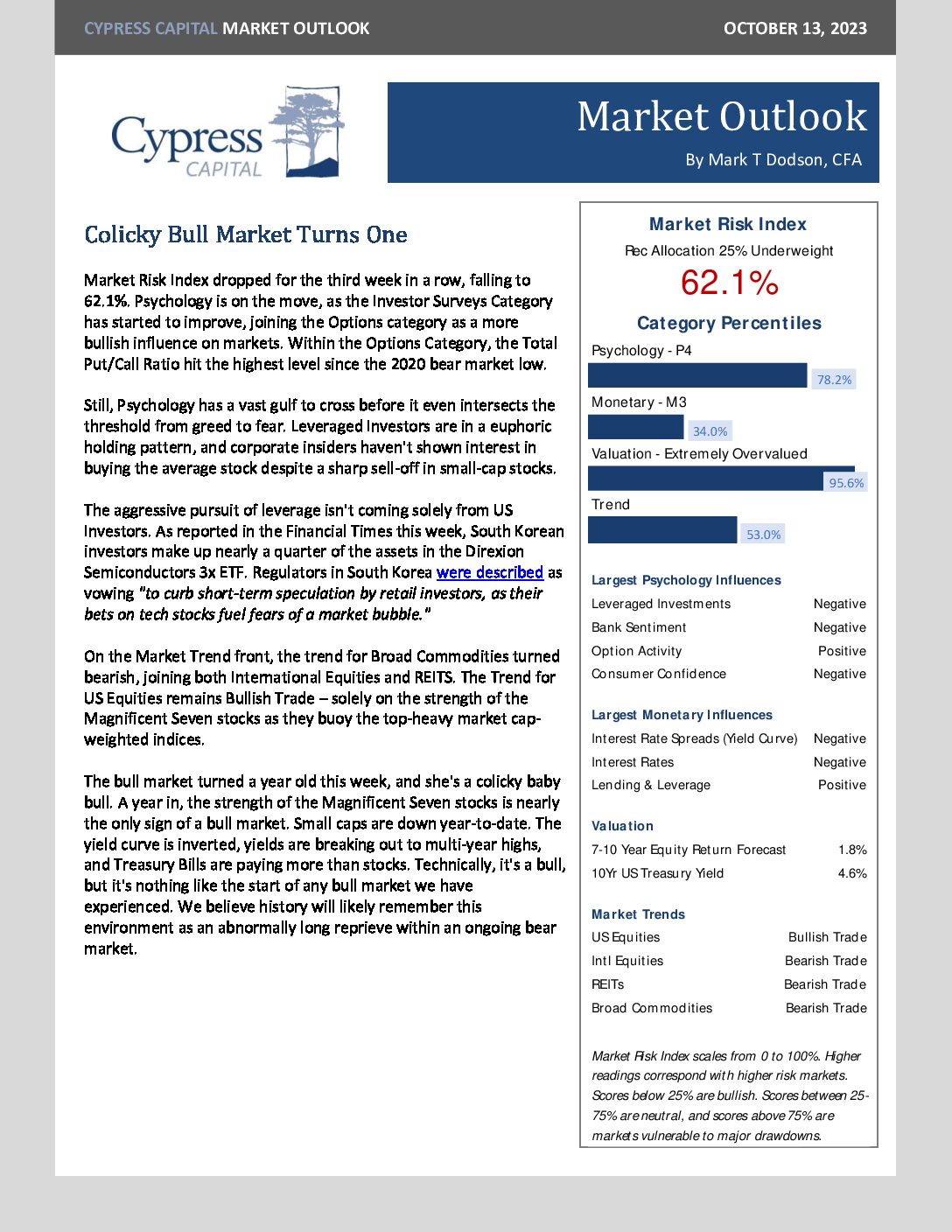

Market Outlook – Colicky Bull Market Turns One

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%