Research

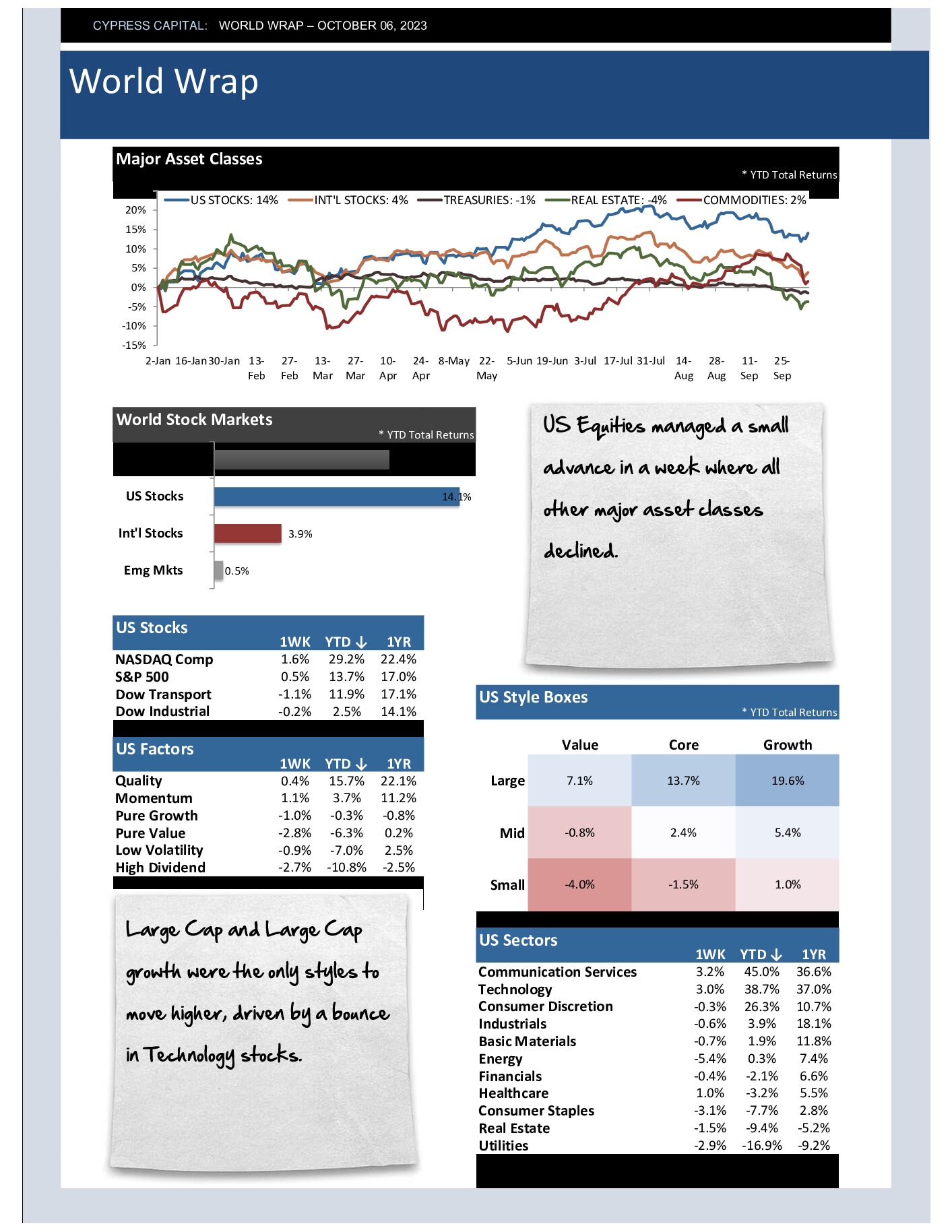

World Wrap

– US Equities managed a small advance in a week where all other major asset classes declined.

– Large Cap and Large Cap growth were the only styles to move higher, driven by a bounce in Technology stocks.

– Fairly broad declines across international markets with only seven of 44 countries we track moving higher, including the United States.

– Yield Curve is beginning to steepen, but it’s coming from the long end of the curve. 30Yr Treasury yields are approaching 5% for the first time since 2007.

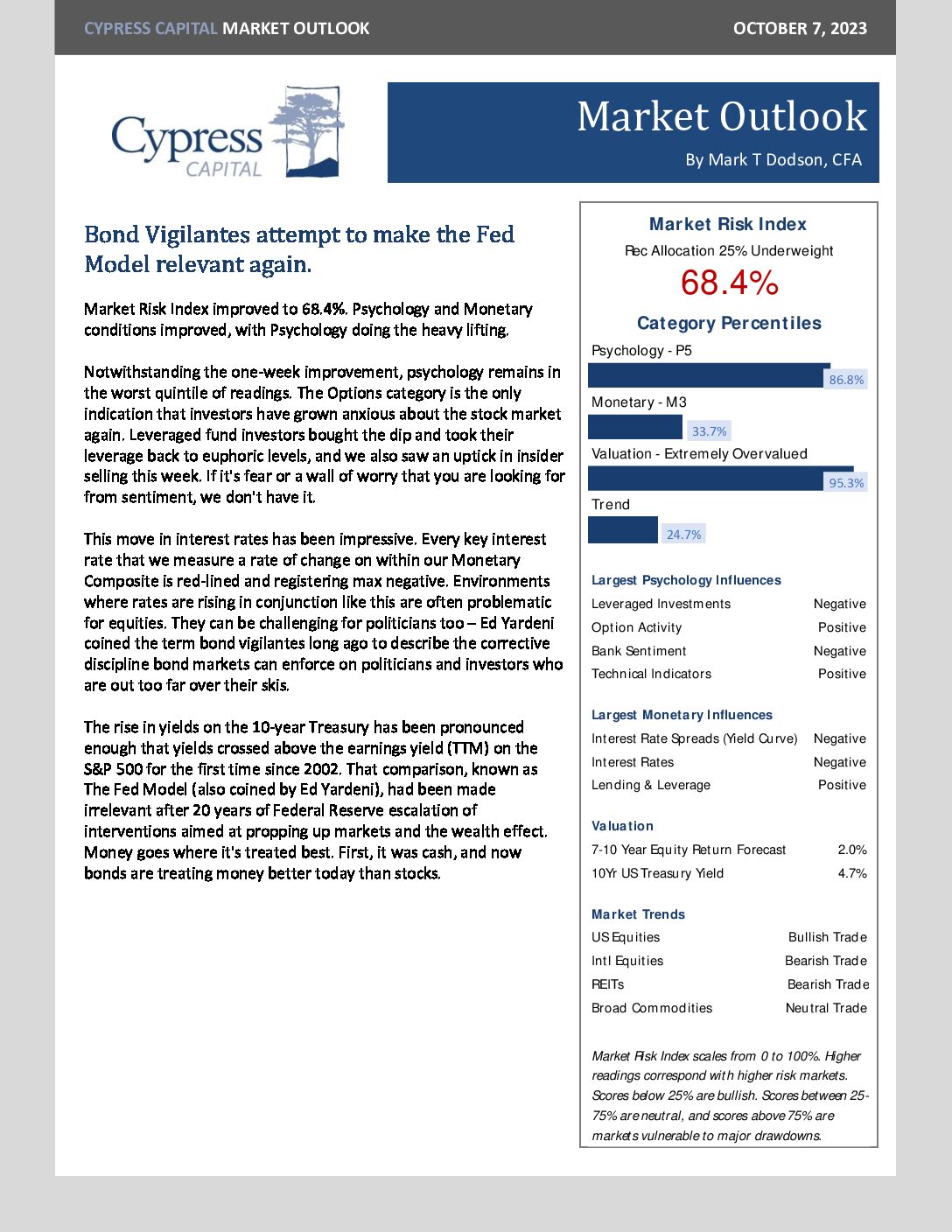

Market Outlook – Bond Vigilantes attempt to make the Fed Model relevant again.

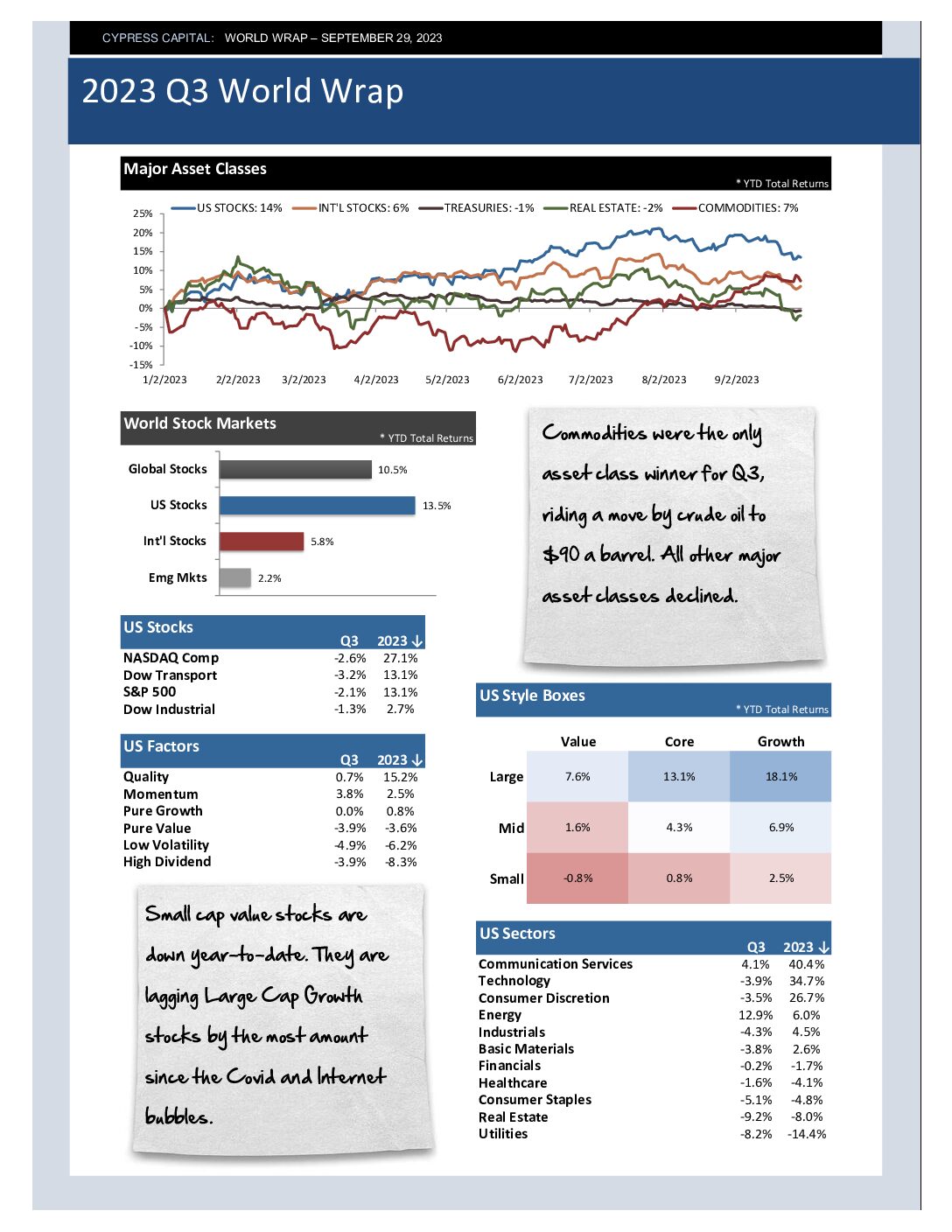

Q3 2023 World Wrap

– Commodities were the only asset class winner for Q3, riding a move by crude oil to $90 a barrel. All other major asset classes declined.

– Small cap value stocks are down year-to-date. They are lagging Large Cap Growth stocks by the most amount since the Covid and Internet bubbles.

– Emerging markets finished the quarter 2.5% lower, just holding on to a positive 2.2% year-to-date return.

– Fixed income struggled as Treasury yields broke to 10 year highs. Crude oil futures were up more than 30% in Q3.

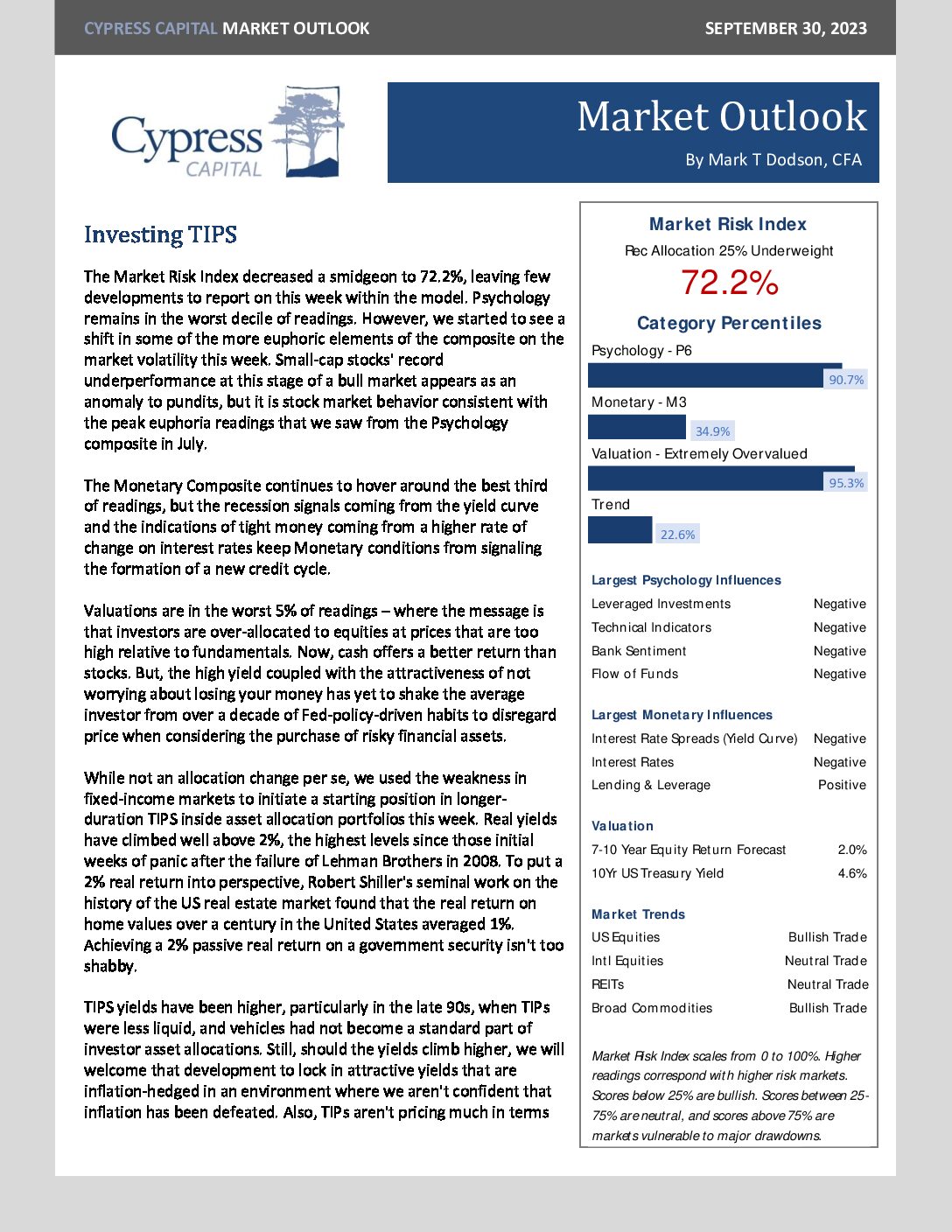

Market Outlook – Investing TIPS

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%