Research

Market Outlook – The Battle of Wits has Begun!

World Wrap

– While not severe, all major asset classes declined last week.

– Another advance by Large Growth stocks was insufficient to keep every other style and factor from dragging down cap-weighted indices.

– Latin America stood out, advancing 2.8% in a week when most equity markets declined.

– Spreads between different durations of short-term Treasury Bills have been volatile over the last six weeks as debt-ceiling talks continue.

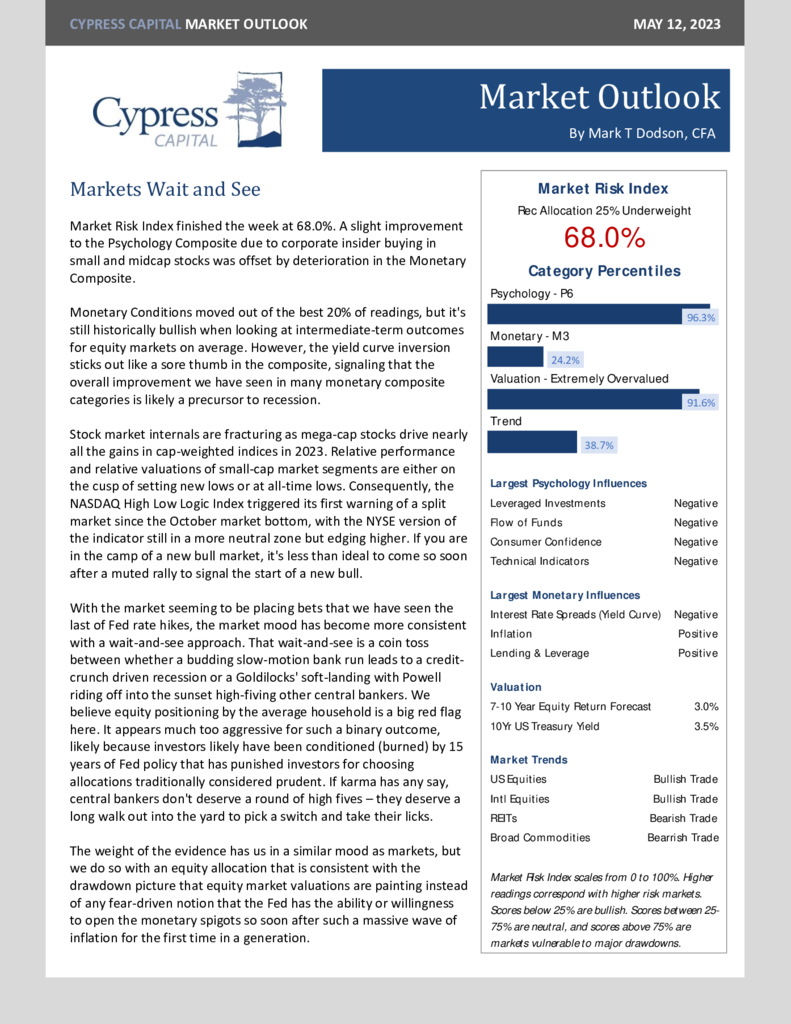

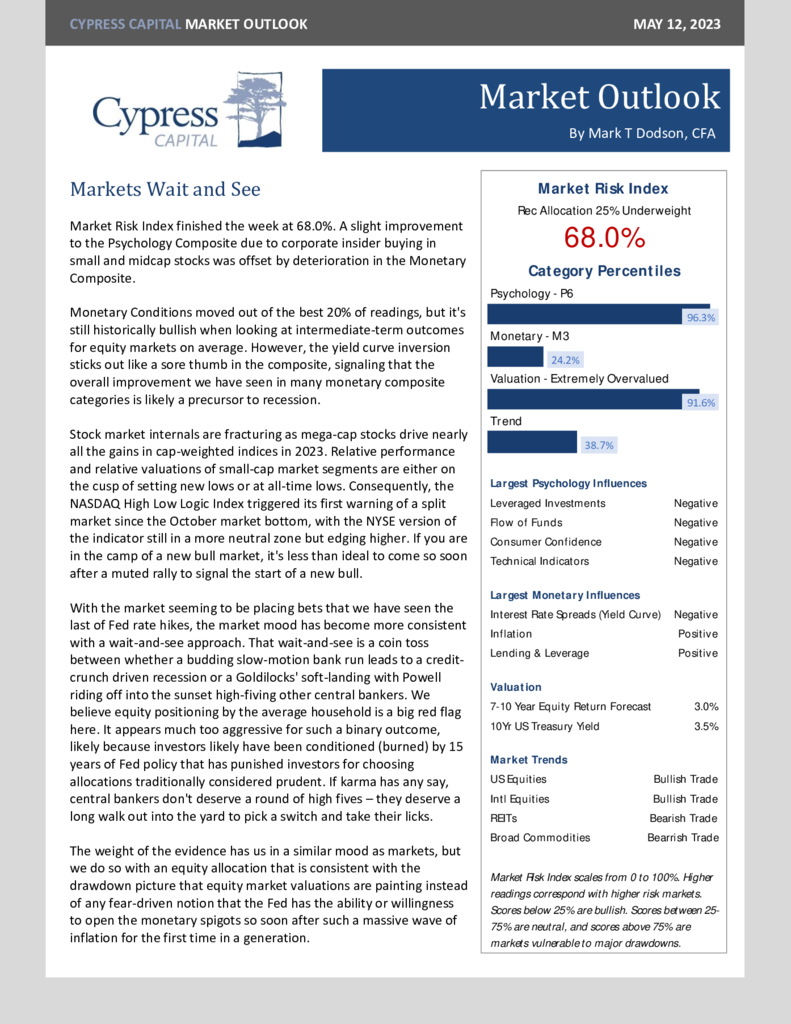

Market Outlook – Markets Wait and See

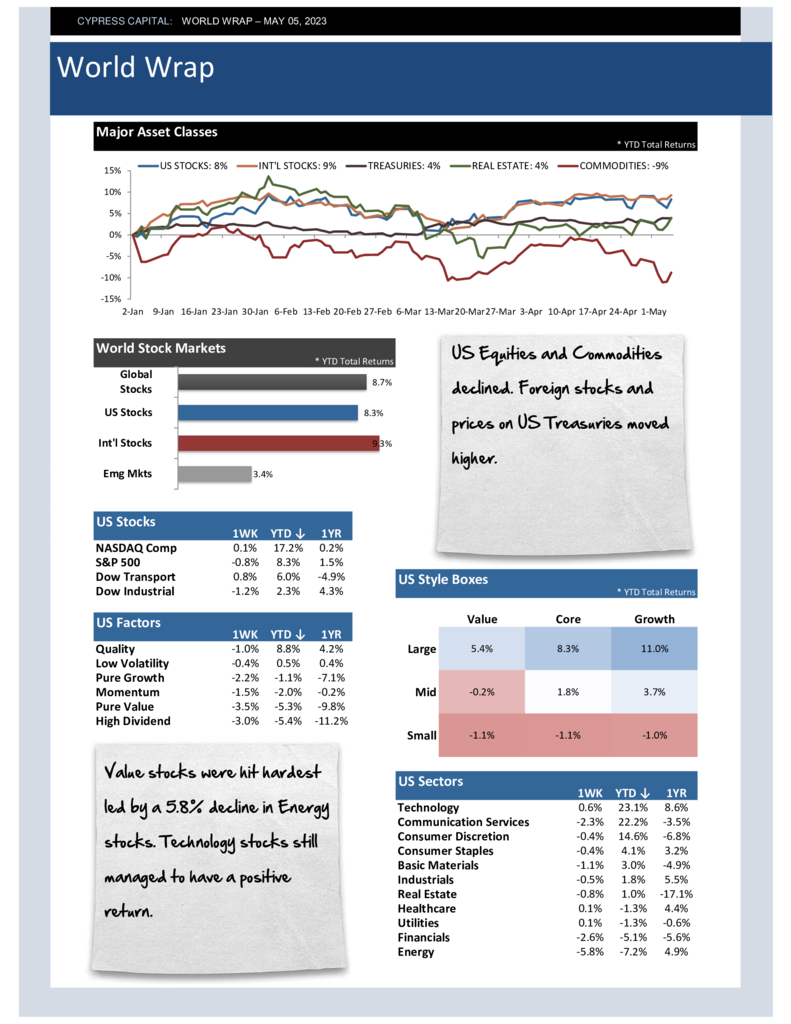

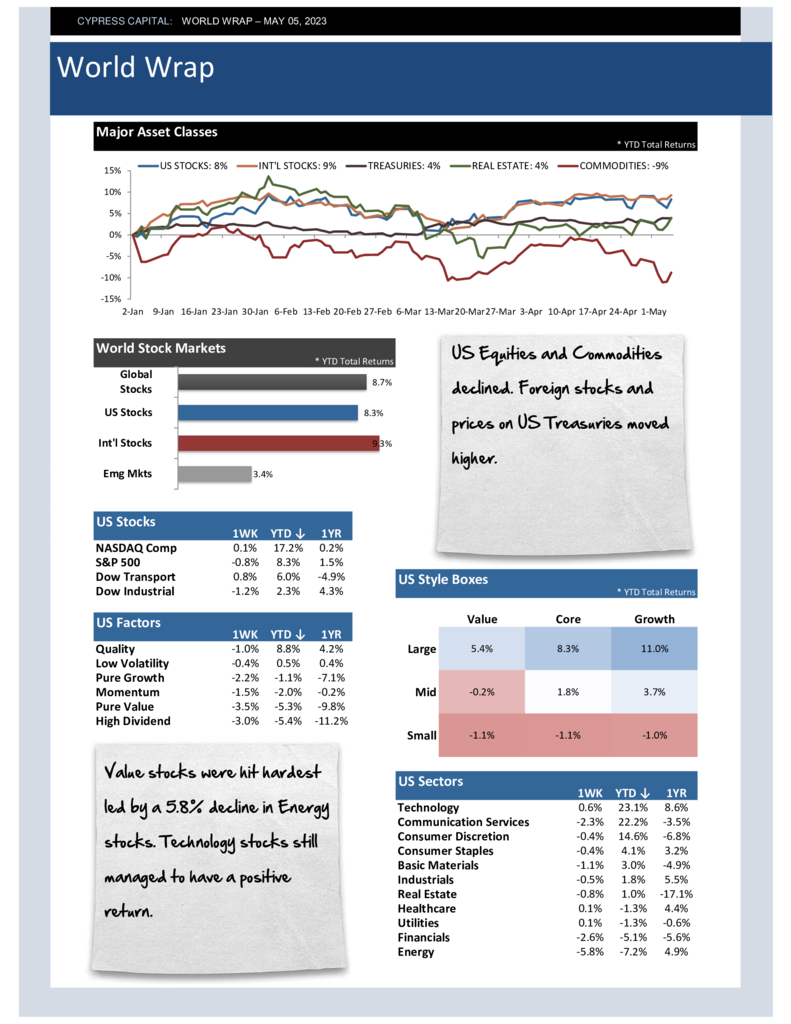

World Wrap

– US Equities and Commodities declined. Foreign stocks and prices on US Treasuries moved higher.

– Value stocks were hit hardest led by a 5.8% decline in Energy stocks. Technology stocks still managed to have a positive return.

– The Fed increased rates by 0.25 percent last week, it’s the 10th increase in the rate by the Fed in a little over a year.

– Yield Curve inversion worsened, becoming the second most severe inversion in over a century.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 96.8%

- Monetary 53.8%

- Valuation 99.9%

- Trend 47.0%