Research

World Wrap

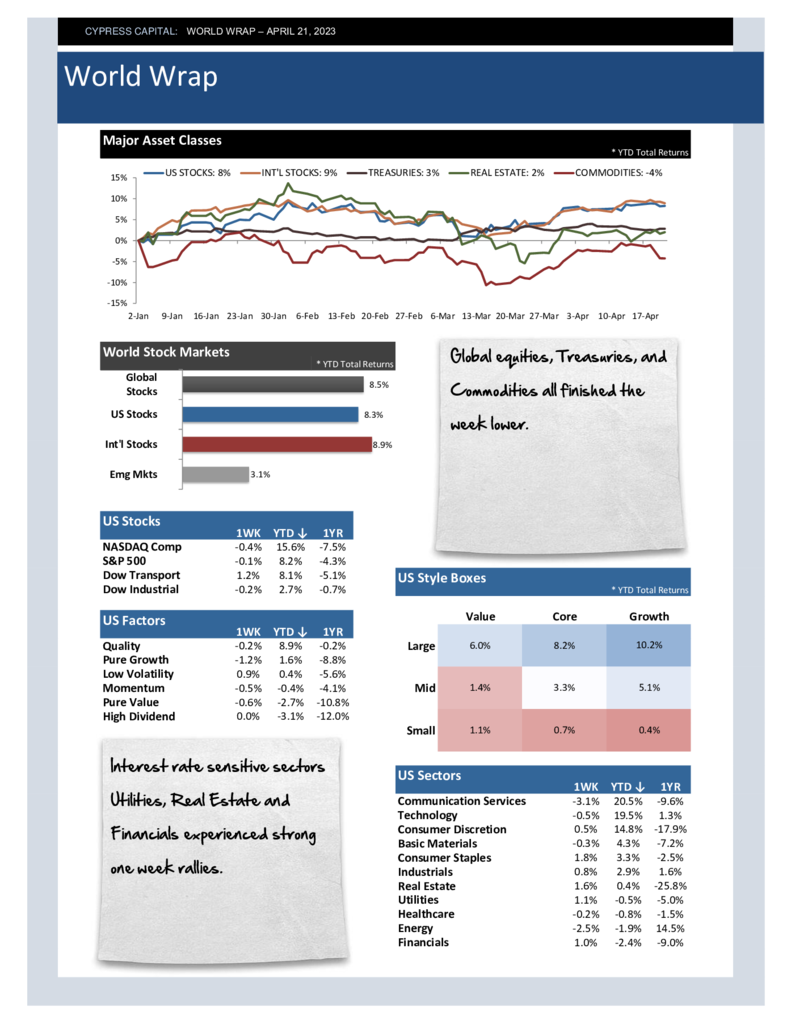

– Global equities, Treasuries, and Commodities all finished the week lower.

– Interest rate sensitive sectors Utilities, Real Estate and Financials experienced strong one week rallies.

– Emerging markets declined 2%, led by a 2.4% decline in Chinese equities.

– Bitcoin corrected more than 10% last week but is still up more than 60% year to date.

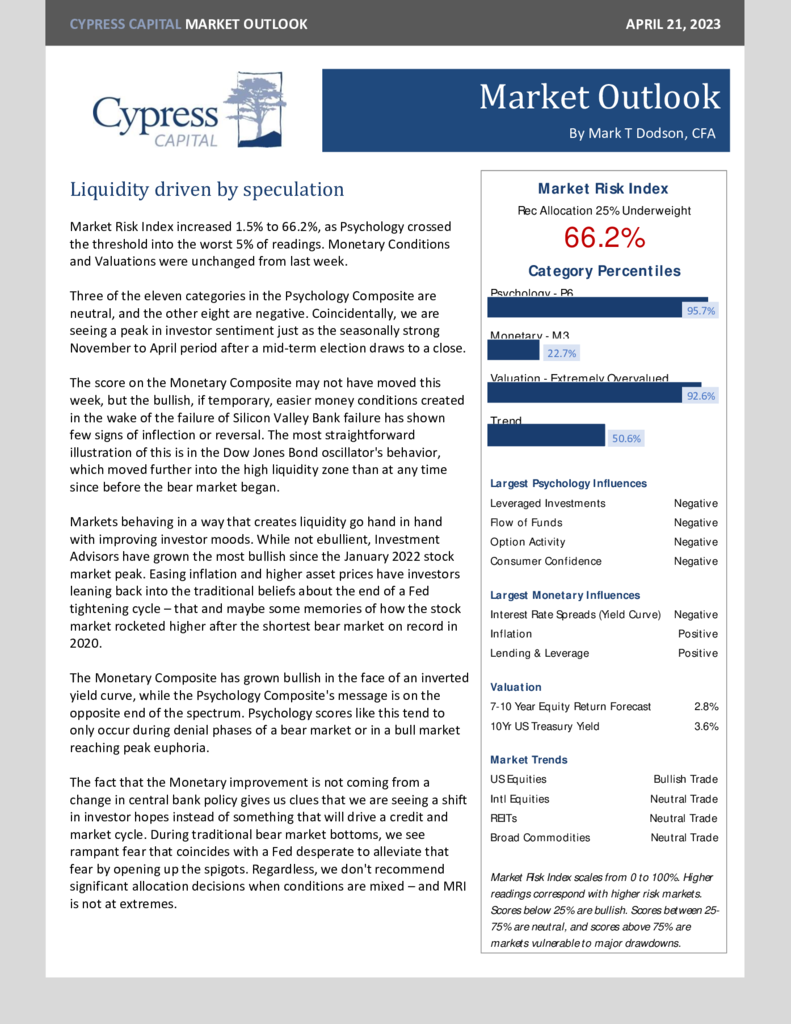

Market Outlook – Liquidity driven by speculation

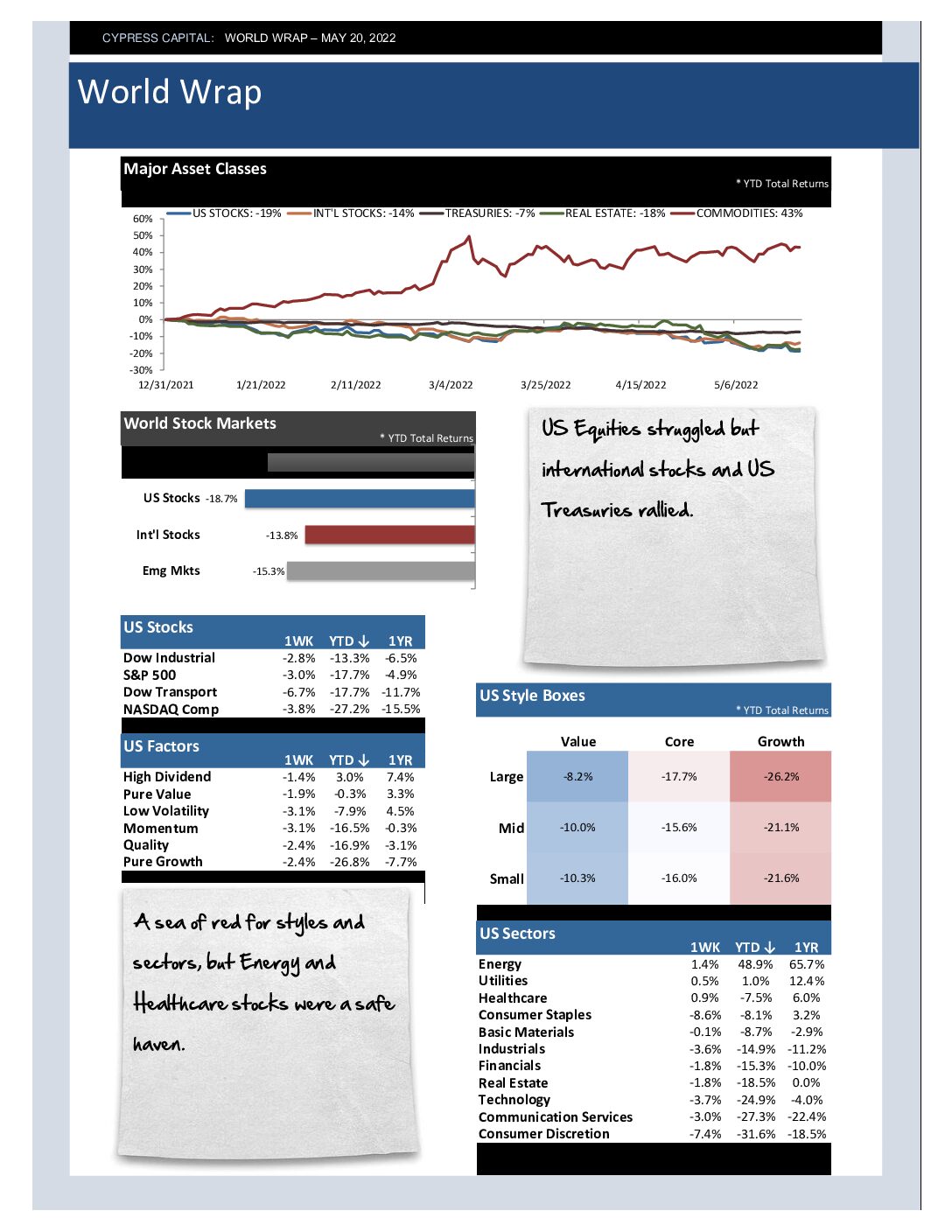

World Wrap

– International equities and Commodities outperformed. Commodities are on the cusp of positive returns for 2023.

– Sectors were mixed with declines in interest rate-sensitive sectors like Utilities and Real Estate. Technology stocks also declined.

– Developed Europe is the best-performing region in the world, driving international equities to outperformance.

– An inflationary week with strong performance from Commodities as US Treasuries and the US Dollar struggled.

Market Outlook – Psychology moves into the worst decile of readings.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%