Research

World Wrap

– Stocks were flat, while Commodities and Treasuries rallied.

– The market advance in 2023 isn’t a broad one – it’s Large Growth and Tech move. Four of six factors are down year-to-date.

– The yield curve inverted further matching levels only seen in 1973-74 and 1979-81.

– Oil prices rallied 6.7% on the announcement of a Saudi-led cut in oil production

Market Outlook – Zweig Breadth Thrusts when the Yield Curve is Inverted

Q1 2023 World Wrap

– Global Equities and Treasuries finished with a solid first quarter, while Commodities declined.

– Returns among sectors and factors were mixed, with the strongest sectors and styles being a throwback to the euphoric period from 2021.

– Strength in Developed European markets outperformed and buoyed both international and global equity indices.

– The yield curve (10Y-90D) ended the quarter with the most extreme inversion since 1981.

Market Outlook – In-Active Investing

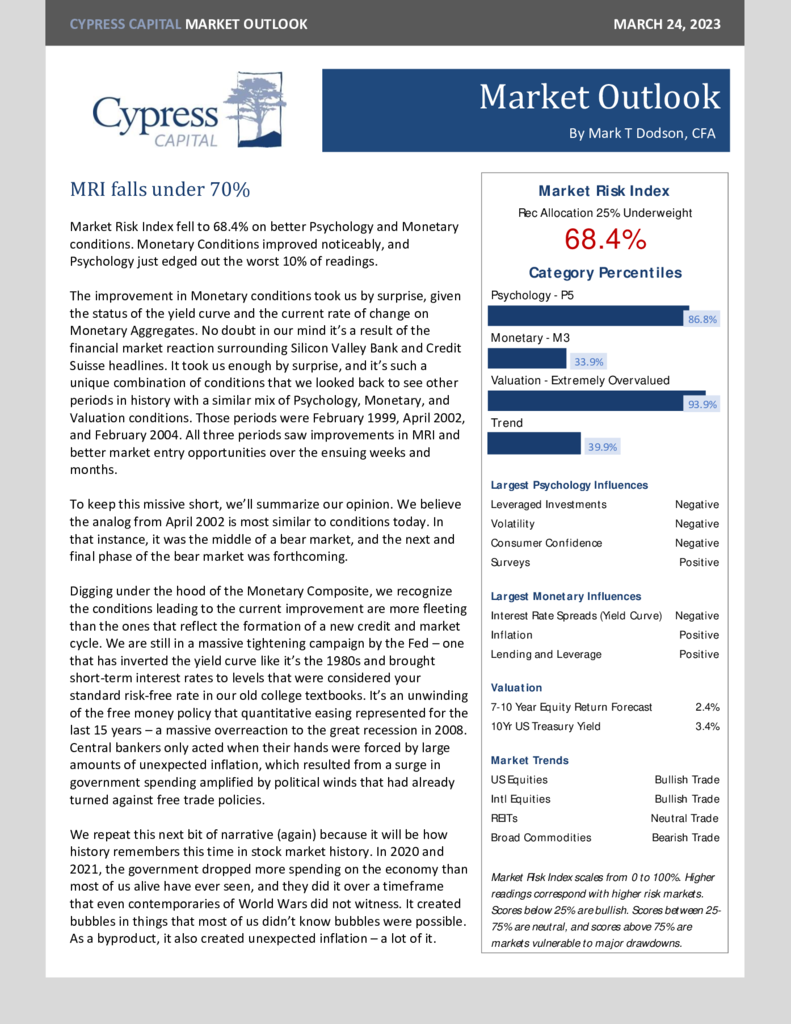

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%