Research

World Wrap

– Global equities were flat, while Commodities advanced and prices on US Treasuries declined.

– Nine of eleven sectors moved higher, but declines in Technology and Consumer Discretion stocks were enough to hold back cap-weighted indices.

– Latin American stocks put in another strong performance, up more than 5% for the week.

– Crude Oil bounced more than 5% during the week, but prices are still down more than 25% from June highs.

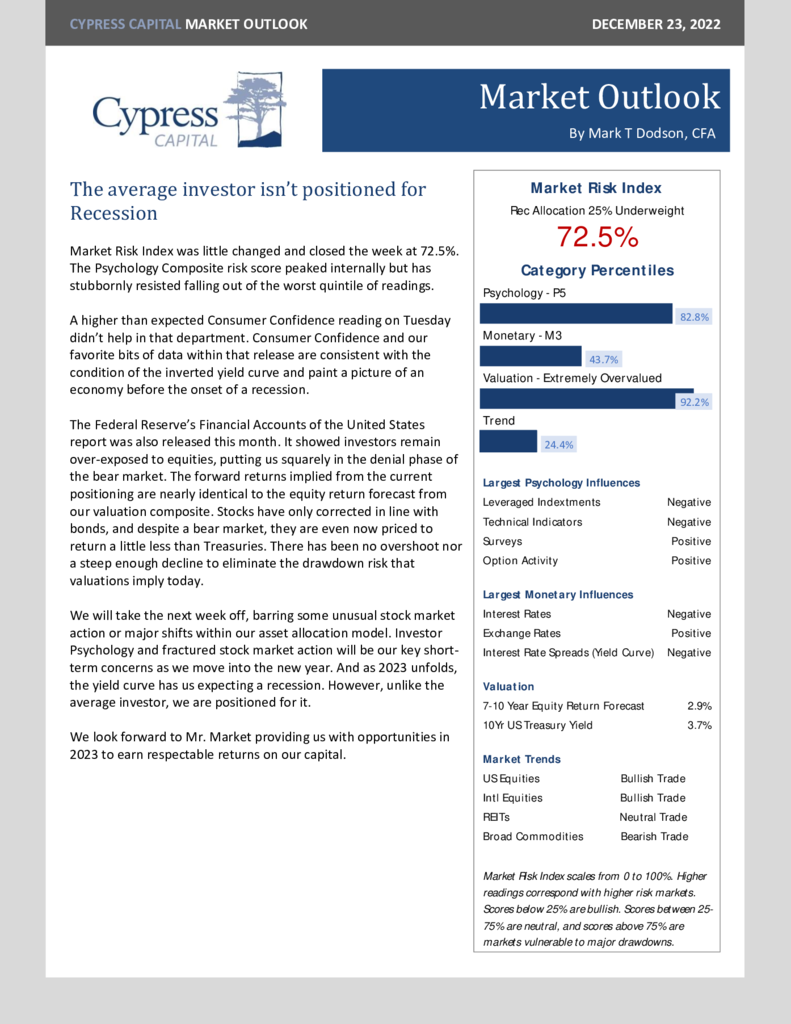

Market Outlook – The average investor isn’t positioned for Recession

World Wrap

– Jerome Powell’s hawkish comments sent global financial markets lower, while Treasuries rallied. Commodities also moved higher on a rebound in oil prices.

– Dow Transports finished the week flat, and Energy was the only sector to close in the green rebounding 1.8% after an 8% decline the week prior.

– While volatile, Latin American stocks have been a safe haven in 2023, with MSCI Latin America Index returning more than 5% ytd.

– The Federal Reserve raised the Fed Funds rate target to 4.5%, the highest rate in more than 15 years.

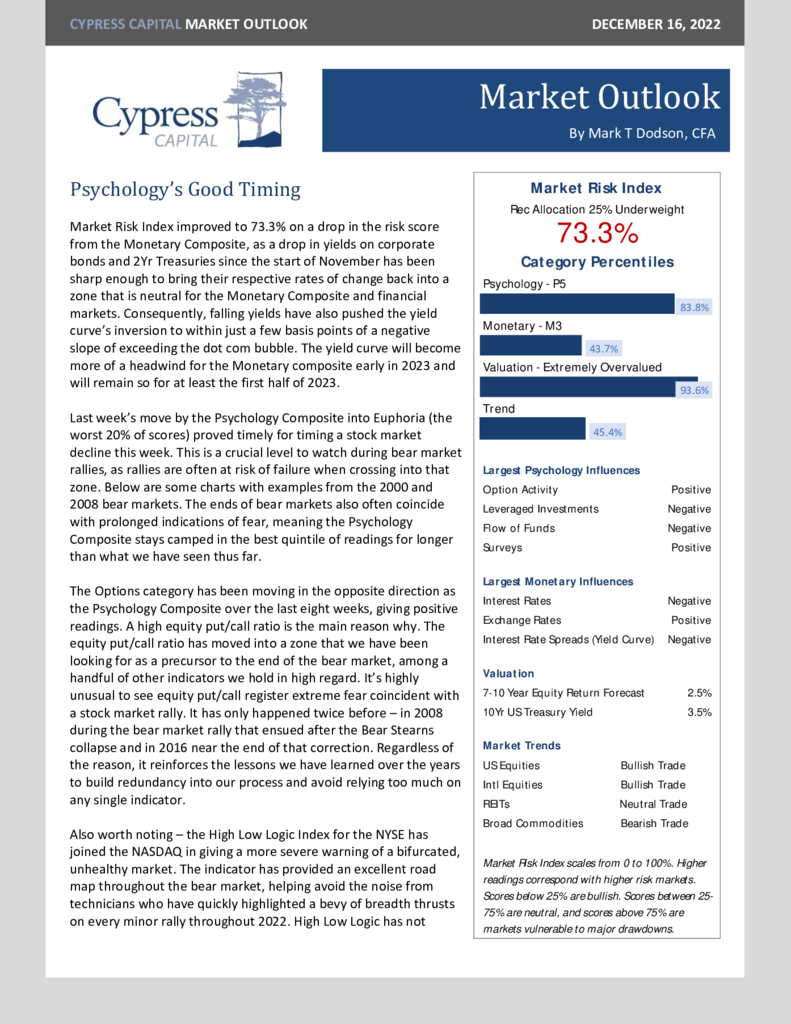

Market Outlook – Psychology’s Good Timing

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%