Research

Market Outlook – Powell’s Pail of Cold Water

World Wrap

– US Equities led all major asset classes higher for the week.

– Communication Services was the only sector to decline for the week. All other sectors, styles and factors advanced.

– Intl developed market equities outperformed US equites on strength in Europe. Emerging markets declined on a 9% drop in China.

– The dollar sold off for the second week in a row. Economically sensitive commodities copper and lumber declined.

Market Outlook – Mid-Term November Bear Market Rally

World Wrap

– US Equities rallied strongly, while international equity gains were more muted. US Treasury yields went higher.

– US Equity gains were broad across every style, factor, and sector. Energy stocks were up 8.1% and are approaching June highs.

– Developed equities were up on strength in European stocks. Meanwhile Emerging markets were flat on a 2.7% decline in China.

– The dollar sold off, but so did US Treasuries. Yields on 30Yr Treasuries set a new 10 year high.

%

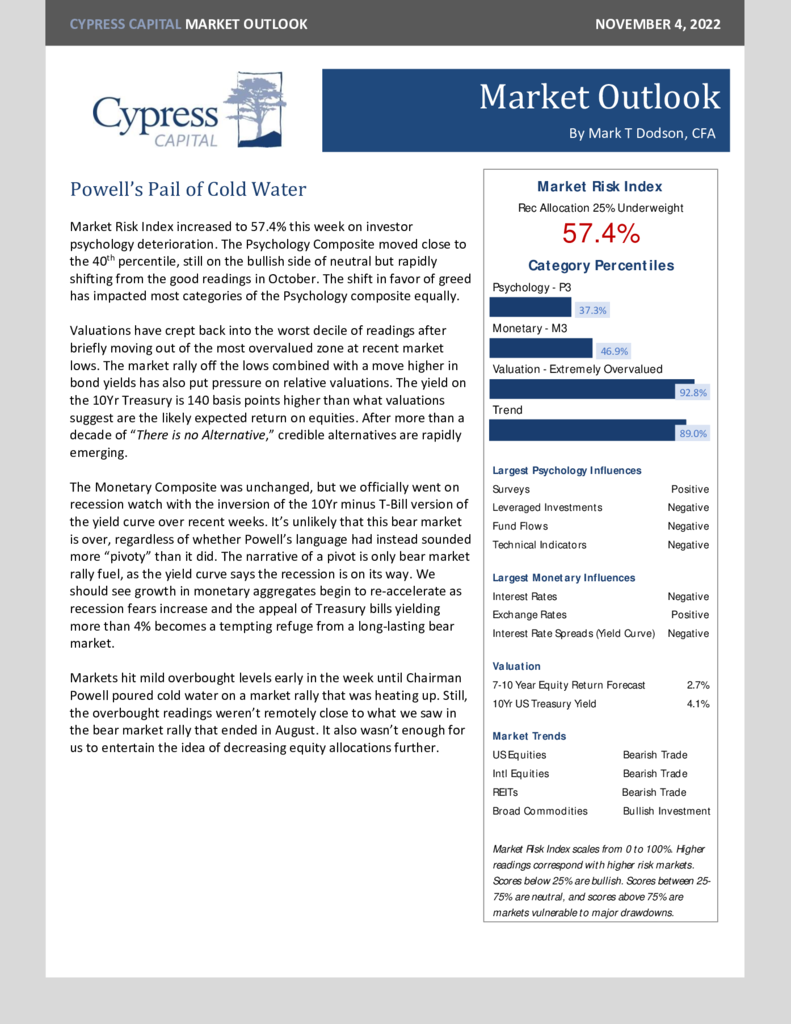

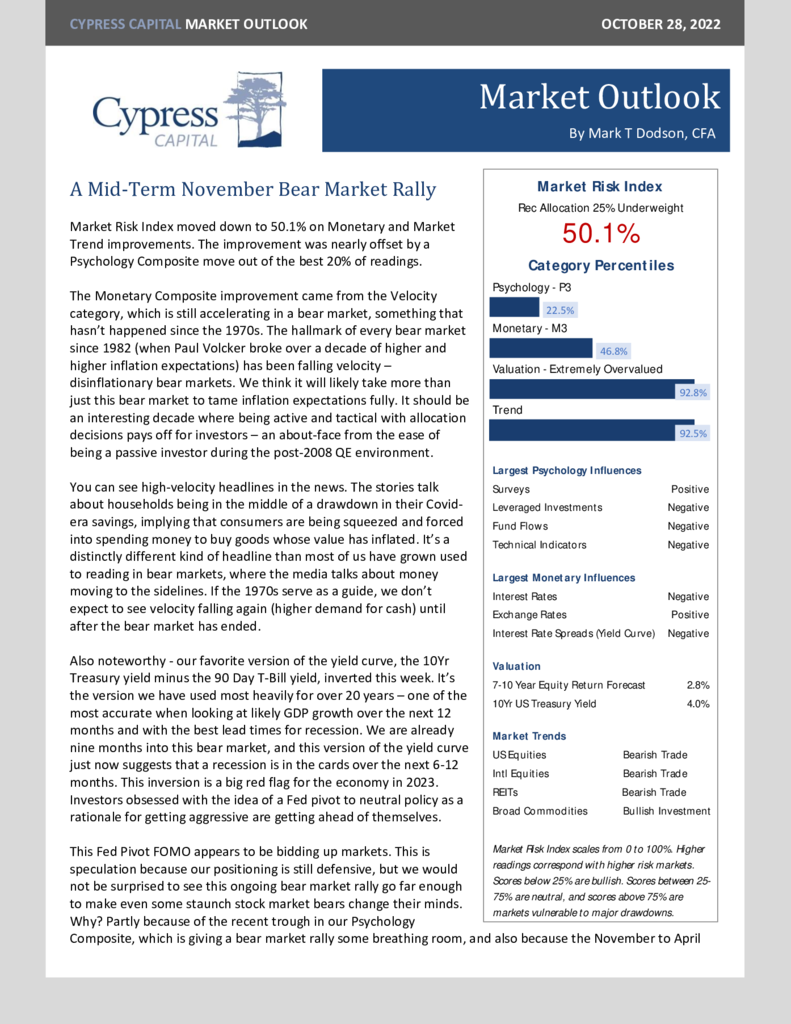

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%