Research

Market Outlook – Psychology is approaching the best quintile of readings

Q3 2022 World Wrap

– All key asset classes declined, and stocks set new lows in the third quarter of 2022.

– Energy and Consumer Discretion stocks increased in Q3, but all other sectors, styles and factors saw lower prices.

– Latin American stocks advanced 3.7% in Q3 moving into positive territory for the year. Brazil is up 11.8% ytd.

– The US Dollar shot to 20 year highs, climbing by 7.1% in Q3. The dollar is up 16.8% ytd.

Market Outlook – Big Improvement in Psychology Offset by Shift to Bearish Market Trend

World Wrap

– A sea of red for all asset class returns for a second straight week after the Fed raised rates by another 75bps.

– All sectors, styles, and factors declined. Energy stocks were the worst performing sector, declining 9%.

– Brazil and Egypt were the only two countries with stock markets advancing.

– Bull market in the US Dollar continues – the dollar was up whopping 3% for the week and has climbed more than 20% in the last 12 months.

%

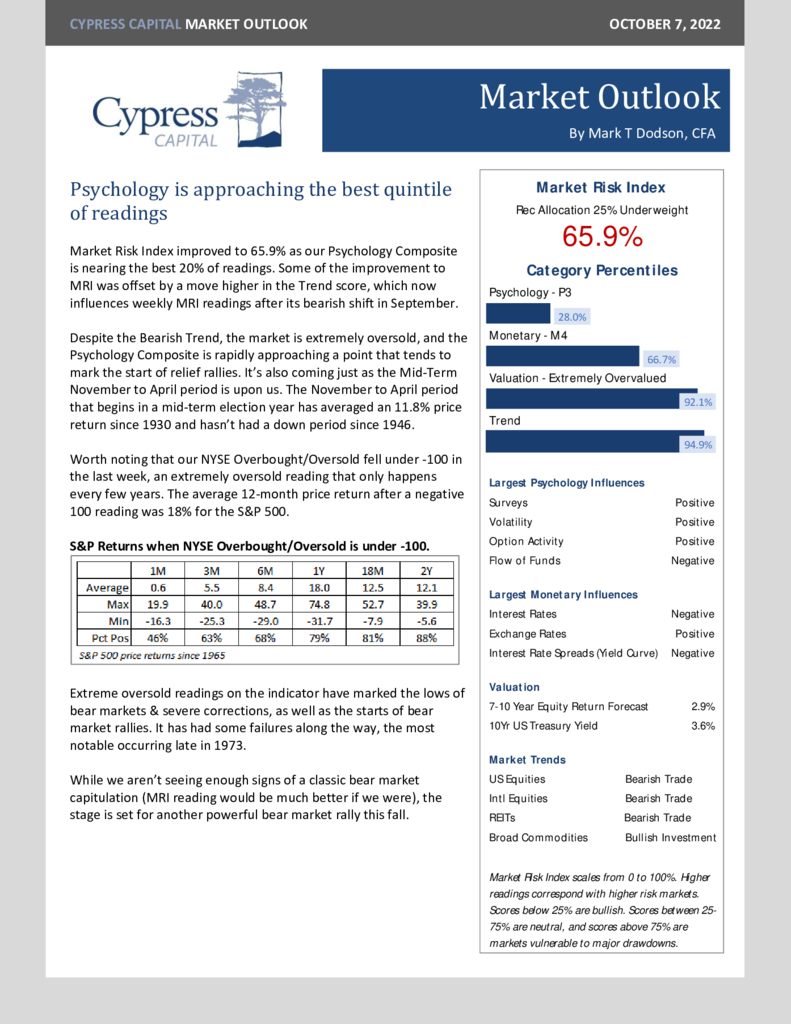

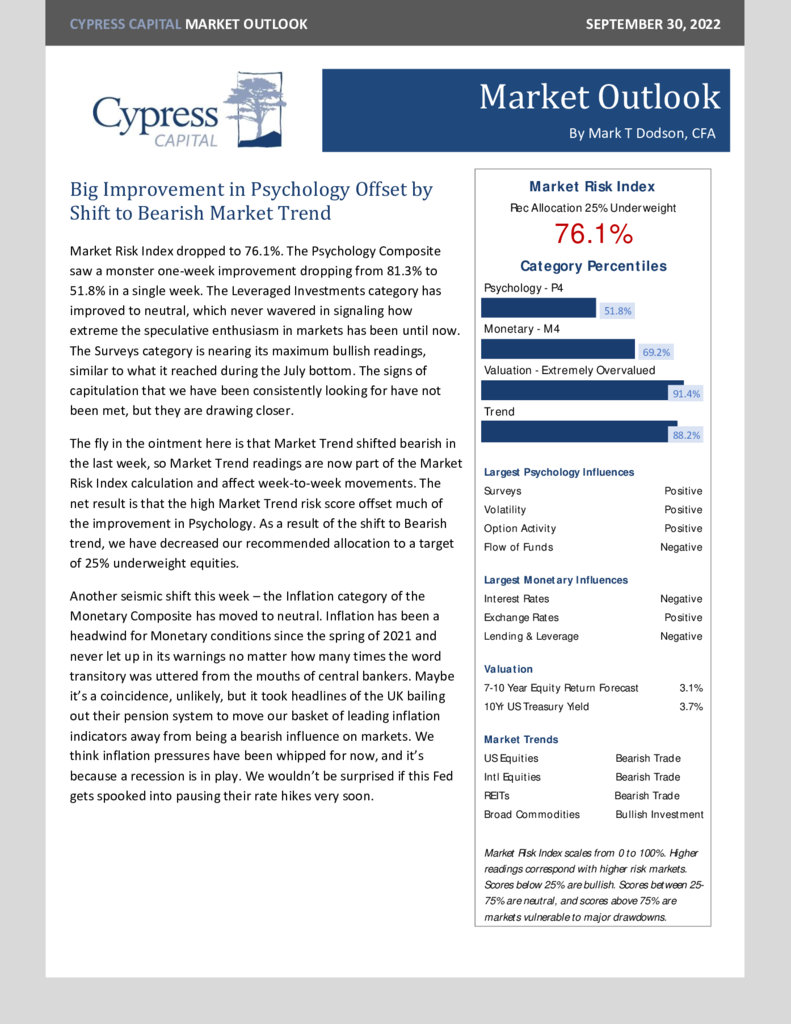

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%