Research

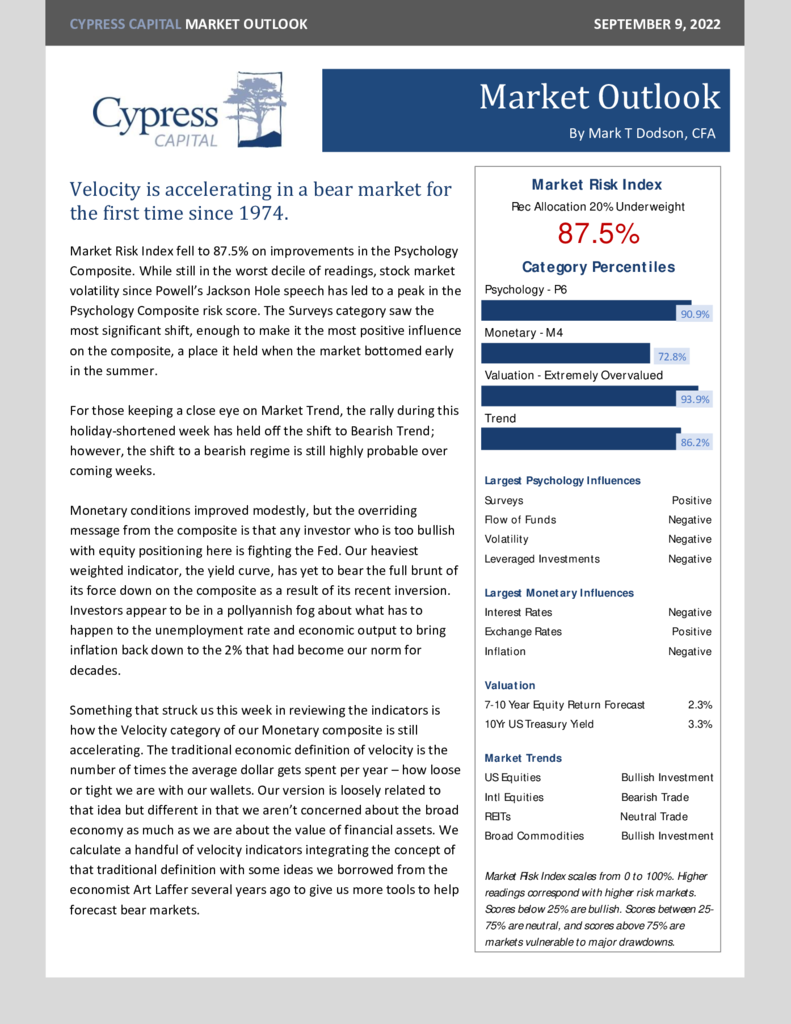

Market Outlook – Velocity is accelerating in a bear market for the first time since 1974.

World Wrap

– All major asset classes declined for the week. Commodities were hit hardest on a 6.6% decline in oil.

– No safe havens as every style, sector, and factor struggled.

– International declines were broad with only 5 of 44 countries moving higher. Germany was one of the five.

– Another strong week for the US Dollar as it rallied to a new 20 year high. The Euro closed below parity with the dollar again, falling to a new 15yr low.

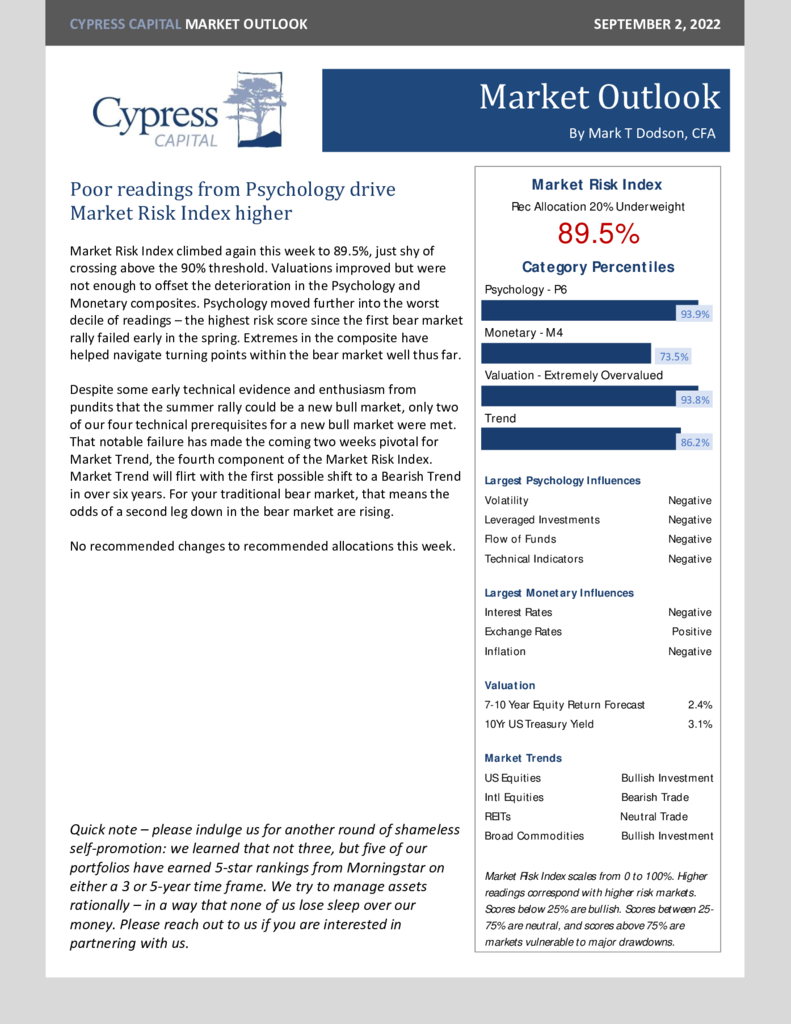

Market Outlook – Poor readings from Psychology drive Market Risk Index higher

World Wrap

– Commodities rallied, but financial assets declined for the week after Jerome Powell’s hawkish speech on Friday at Jackson Hole

– Energy stocks stood out – advancing 4.3% as all other factors, sectors, and styles struggled.

– Emerging markets climbed 0.5% on strong performance from China and Latin America.

– The US Dollar climbed to a 20-year high last week, and the Euro fell below parity with the dollar for the first time since November 2002.

%

Market Risk Index

Market Risk Index scales from 0 to 100%. Higher readings correspond with higher risk markets. Scores below 25% are bullish. Scores between 25-75% are neutral, and scores above 75% are markets vulnerable to major drawdowns.

Model Category Readings (Percentiles)

- Psychology 97.5%

- Monetary 55.3%

- Valuation 100%

- Trend 34.9%